UK ELT student weeks down 13% in 2015

On the heels of data from The 2015 ALTO-Deloitte Language Travel Industry Survey, which suggests a softening in global demand for English-language courses, English UK has also released statistics revealing that ELT student numbers in the UK were down 8% in 2015 and that student weeks fell by 13% compared to the year before.

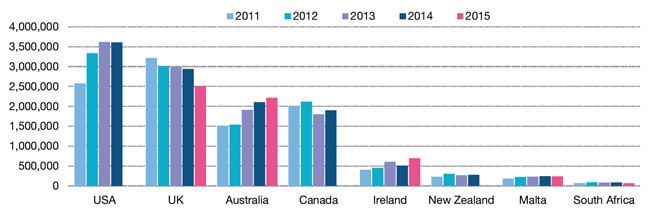

In 2015, approximately 535,485 students attended English UK’s 465 member schools (the majority of which are private sector) for a total of 2,047,033 student weeks. The UK remains the second most-popular English-speaking destination globally in terms of student weeks, after only the US. But Australia, the third-rated destination, continues to close the gap and pending 2015 results for Canada and the US will soon round out the global picture.

Many source markets are sending fewer students

According to English UK, and considering only private English UK schools that reported data in both 2014 and 2015, student numbers fell nearly 7% from 449,961 in 2014 to 419,286 in 2015. Student weeks fell 12.6% from 1,840,574 in 2014 to 1,608,833 in 2015.

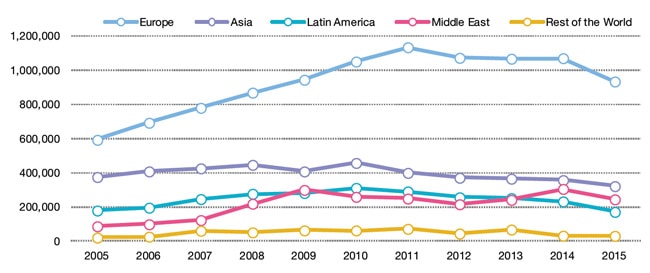

English UK analysed 114 markets sending students to its private ELT school members, and found declines in 75 of them, compared to only 39 showing growth. Some of the most alarming declines came from the traditionally strong markets of Italy, Russia, and Libya (where student numbers fell by 13.4%, 58.4%, and 51.6%, respectively). Looking at these markets, English UK noted “the absence of the PON scholarship in Italy, the security situation in Libya, and the fall of the rouble in Russia” as major contributing factors to the fall-off in student enrolments.

While countries in Europe still send the greatest numbers of ELT students to the UK (accounting for roughly three-quarters of all students in private English UK schools), significant enrolment drop-offs came from both Eastern Europe (-11.9%) and Western Europe (-8.8%). Moreover, Europeans stayed for fewer weeks in 2015 than 2014 (-19.7% for Western Europeans and -27.5% for Eastern Europeans).

Students are spending less time in London-based ELT schools

ELT schools in London, which account for the largest proportion of student weeks spent in the UK, saw a significant drop-off in student weeks (-18%). ELT schools in South and South Eastern England, which command almost as large a proportion of student weeks as London-based schools, experienced a milder decline in student weeks (-6%). But all UK regions experienced declines with the exception of Wales, which saw a 3% uptick.

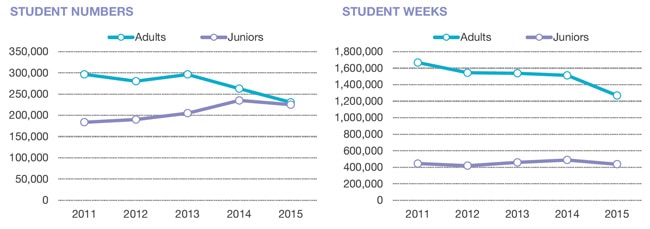

Enrolments fall among adults, and for the first time, juniors as well

In 2015, 230,599 adults studied in English UK private schools, down by 32,340 students, or 13%. But while the decline was less dramatic among junior students (-4%), 2015 marks the first year that the junior enrolments have fallen off. English UK adds that, “Due to the adult segment suffering a steeper decline, the adult vs junior student ratio in private sector membership is now closer to 1:1 (in terms of student numbers, with juniors now accounting for 49% of arrivals.”

The association also notes a decline in student weeks for both segments, despite the number of schools focusing on juniors increasing from 239 to 258 schools: “Adults stayed an average of 5.6 weeks, while juniors stayed for 2.9 weeks, which compares to 5.7 and 3.3 student weeks respectively in 2014.”

The competitive context

The UK is not the only major ELT destination market that experienced a tough 2015. Schools in a number of key destinations have been adjusting to a decline in student bookings. The latest data from Malta, for example, indicates that student weeks were down by 2.9% between 2014 and 2015. South Africa’s ELT sector, trying to cope with a badly tangled immigration policy, saw student numbers fall off by 37% in 2015. Buoyed in part by the relative weakness of the Euro against the British pound, ELT providers in Ireland, meanwhile, had a strong year, with enrolment up by 10% over 2014. With Ireland the exception, ELT providers across the board are facing more challenging times in maintaining enrolments and also student weeks. When asked what market factors most impacted their businesses in 2015, nine in ten school operators responding to the The 2015 ALTO-Deloitte Language Travel Industry Survey cited "economic issues in source countries" as the most prominent issue. A related factor - "currency exchange rates" - was noted for its negative impact by 62% of respondents, while 65% cited “competitor school activity” and 64% “my country’s visa policies” as key pressures on enrolment. Responding to the findings reported by its member English-language schools, English UK says its strategy will be to "arrest the decline of the UK ELT’s market volume and value, and return to a position of overall growth." But it cautions: "This cannot be achieved by English UK alone…We are working with government agencies and commercial partners to enable the UK sector to compete in an increasingly competitive global market."

Most Recent

-

How have changes in policy settings impacted international student recruitment at Australian universities? Read More

-

ICEF Podcast: Together for transparency – Building global standards for ethical international student recruitment Read More

-

New analysis sounds a note of caution for UK immigration reforms Read More