Malta ELT enrolment down slightly in 2015

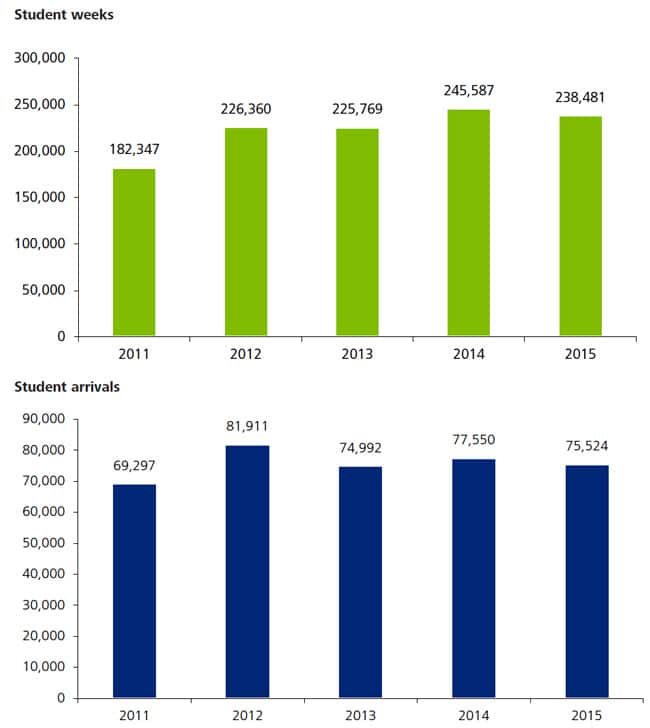

An annual survey of Malta’s English Language Teaching (ELT) sector finds a modest decrease in enrolment for 2015. The 2015 FELTOM ELT Industry Survey Report, prepared by Deloitte and drawing on data from the National Statistics Office, indicates the number of student weeks fell by 2.9% from 2014 to 2015, while student arrivals decreased by 2.6%.

The following graphs reflect a longer-term trend of fluctuating student numbers - which, at 75,524 for 2015, remain off the recent-year peak of 81,911 in 2012. They illustrate as well a general upward trend in total student weeks, with some marginal year-over-year declines, as is the case this year, which offset years of more substantial growth.

Outlook for summer 2016 and beyond

Malta’s ELT sector generally positions against the UK as its primary competitor, and Maltese providers are watching currency rates and political developments closely this year in the lead-up to the key summer season. Summer bookings accounted for nearly half (48.7%) of all student arrivals in Malta in 2015. This year, ELT providers are noting a recent weakening in the British pound and the upcoming Brexit vote as factors that could shift some demand to the UK. In a recent interview with the Times of Malta a FELTOM spokesperson said there was concern that a depreciation in the pound relative to the Euro could "encourage agents to send students to the UK as opposed to Malta". "At the moment this shift is not yet being felt for the simple reason that sterling started taking a downward turn only recently," he added. "However, we are sure that if this pattern persists, especially if a Brexit occurs, tour operators and agents will be even more inclined to opt to send students to the UK as they have always done every time sterling weakened." Aside from relative exchange rates, applicable sales, or value-added taxes (VAT), are another aspect of competitive position for Maltese providers this year. Students are required to pay a 7% VAT in Malta on courses and accommodation, and up to 18% on other good and services purchased during their stay. In the UK, meanwhile, there is no VAT on course fees. This sharp discrepancy has led FELTOM, the peak ELT body in Malta, to recently renew its calls for VAT exemptions on ELT tuitions and related services. "More favourable VAT exemptions as exist in other destinations on tuition and services as well as simplified and more efficient procedures when it comes to issuing of visas can give the sector a much needed competitive boost," said FELTOM CEO Genevieve Abela at a recent press conference. More broadly, FELTOM has also called for greater collaboration between the ELT sector and government in order to strengthen the country’s competitive position as a study destination. As it stands, Malta remains the seventh most-popular destination for ELT students (after the US, UK, Australia, Canada, Ireland, and New Zealand). As the 2015 figures illustrate, however, the sector is well established and stands as a significant export sector in Malta. Deloitte puts total 2015 spending by ELT students in Malta at approximately €161 million (US$184 million), which equates to roughly 9.8% of total tourism spending in Malta for the year.