Five international education trends that will extend into 2024

Here we are at the end of another fascinating year in international education, and as always, we like to look back over the past months and reflect on the trends and events that most affected educators, agents, students, and other stakeholders. We have no doubt that these trends will carry over into 2024 and influence the way our readers think about business plans, institutional branding, international student support, and recruitment strategies.

One: AI moves into the mainstream

Once a futuristic possibility that we mostly read about in books and magazines, artificial intelligence (AI) became a real-life opportunity for a growing number of educators and agents in 2023. Two ways in which AI tools can make recruitment faster, easier, and better are:

- Reducing response times for queries and admissions applications

If an institution is relying on traditional ways of identifying, processing, and following up with leads, the time interval from “student makes an enquiry” to “student gets a reply” can be 10–15 days. Not so with a technology-led process that uses AI tools. Student enquiries are passed automatically from the institutional website (or via a mobile app used by recruitment staff at education fairs or other events) to a CRM system. The system provides an immediate response to the student, and then automatically triggers a series of scheduled follow-up messages over the following weeks. That all-important interval between enquiry and first response shrinks from 10+ days to 10–15 minutes.

2. Personalising communications for individual students

AI also provides a competitive edge in terms of personalisation. AI-boosted chat tools can reach a wider range of global students, and their families, in their first languages, for example. Research has shown that more than three-quarters of consumers prefer to be addressed in their own language, and that a significant portion “will never buy” from a website that isn’t in their language or offer translation. Removing language barriers also helps students to understand complex information related to their applications and is thus a very good way to reduce friction in the conversion process.

With benefits such as these, we expect AI adoption to expand quickly in the international industry – and most industries – in 2024. A March/April 2023 Forbes Advisor survey of 600 business owners found that 97% believe that ChatGPT will benefit their operations; many plan to use ChatGPT to create website content and 44% intend to generate content in multiple languages.

Read on for a deeper dive into the world of AI.

Two: Students expect faster responses

As educators became more dedicated to diversifying their student markets this year, competition became more intense in a greater number of countries. As it did, it became clear that many students – e.g., faced with two similar offers – would choose the one that offered them faster acceptance and visa application processing. Those same students, when conducting their own research on the web, also expected to find information and answers immediately from institutional websites.

Research echoes the stories we heard from the field from recruiters. In 2023, Keystone Education Group asked 23,800 students across 195+ countries how a university could improve its communications. “Speed of response” was a top three recommendation (24%), along with “availability of information” and “quality of response.” The research firm found that 62% of students expect a response from a university within 24 hours or less, an increase of 21% over 2022.

Students’ expectation for speedy responses is one of the reasons that incorporating AI tools is becoming more common across destinations and types of institutions.

Check out the latest research and fast facts on responsiveness here.

Three: Study abroad becomes less affordable

The rising cost of living and studying in major destinations became a struggle for many in 2023. The affordability crisis was widespread:

- In Australia, the cost of living in the September 2023 quarter was 9% higher than the same quarter in 2022.

- In Canada, 2023 marked the fastest rental cost increase in over 40 years.

- In the US, 67% of Americans polled in September 2023 said the cost of living is outpacing their salary/wages, up from 58% in 2022.

- In the UK, more than half of consumers polled this fall said their cost of living increased over the previous month.

- In New Zealand, 90% of those surveyed by The Guardian in September 2023 rated “reducing living costs” more highly than any other issue for the government to tackle and over half said they were “struggling” or “in serious difficulty” financially.

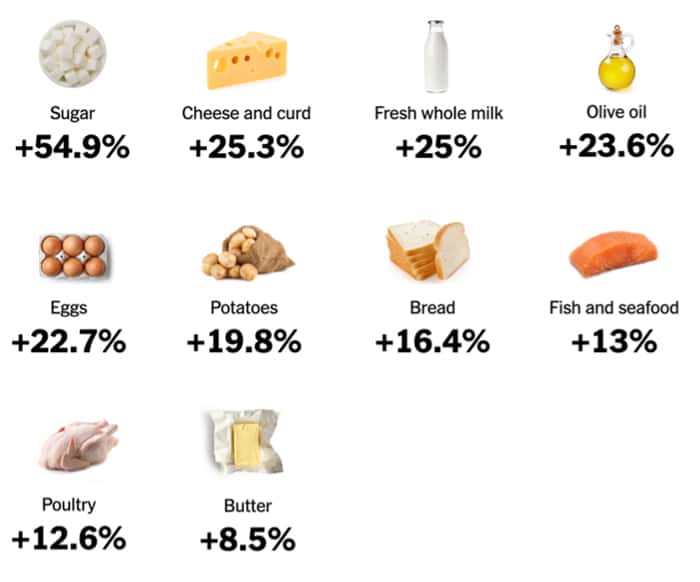

- And across the EU, rising food prices are straining households’ ability to pay the bills and squeezing out extra income that they might otherwise spend in the wider economy.

Affordability was already top-of-mind in international students’ decision-making in 2022, but in 2023 it became clear that only a top segment of the overall prospective student population – or those on generous scholarships – could afford to travel to and study in coveted metropolitan cities. The problem was still more intense for some nationalities, such as Nigerians, who travelled abroad with what they thought were adequate funds for study and living but who then experienced a massive crash in their currency.

Even if students had adequate budgets, finding suitable accommodation was also often a challenge this year. In Australia and Canada, governments became sufficiently alarmed about the cost-of-living and accommodation problems faced by newly arrived international students that they raised the savings threshold for incoming international students (now more than $20,000 in Australia and Canada) and are considering ways to compel institutions to take an active role in increasing on-campus housing or finding students off-campus accommodation.

In 2024, we should see relatively affordable destinations become more popular as a result of the high cost of living paired with more restrictive governmental policies in Australia, Canada, and the UK. Similarly, we expect more intra-regional mobility as students find ways to reduce the overall cost of study abroad, including not having to pay for expensive flights. Our 2023 coverage included spotlights on alternate, more affordable destinations (e.g., Egypt, UAE, and several Asian countries). And finally, students' interest in studying at a branch campus is higher than last year according to recent IDP research, and "paying lower tuition fees compared to overseas study" emerged as the top motivation for branch campus study.

Read more about the accommodation crunch here.

Four: A sudden move away from an unrestricted growth mindset

At the end of summer 2023, the governments of Australia, Canada, and the UK announced various policies that took them clearly away from an open embrace of international students to a far more cautious stance. Going into 2024, we are seeing a much more explicit link between international education policies and responses to public unease about record-high migration.

The extension of this is that we expect to see institutions reimagine their international education strategies as they face pressure to manage enrolments down, or at least to slow growth as they bump up against capacity limits. Quality and student satisfaction will increase as priorities, not least because of new governmental scrutiny in these areas. In both Canada and the UK, for example, institutions that demonstrate a high level of support for international students – especially when it comes to providing housing – are to be rewarded in 2024 with preferential visa processing treatment by immigration authorities. Crucial in this new environment will be working with trusted agents with impressive qualifications, reputations, and track records and with other well-respected in-country partners.

Read more about new international education policies here, and check out ICEF's Code of Conduct for the Ethical Recruitment of International Students here.

Five: India is now driving global growth in student mobility

This was the year in which India displaced China in the minds of many educators when it came to the #1 target market – if it hadn’t already done so. Consider:

Australia

India has been key to the post-pandemic recovery of the international education sector, with 122,391 Indian students in Australia on a student visa in the January-September 2023 period (+22% year-over-year). Indians are the second largest international student group after Chinese (159,485). Where Indian student numbers grew by 22% between 2022 and 2023, Chinese increased only slightly by 2%.

Context: Australia signed a major trade deal with India in December 2022, the Australia-India Economic Cooperation and Trade Agreement (ECTA), the terms of which will pave the way for even more student mobility between the two countries. At the same time, the Australian government and some universities are increasing their scrutiny of Indian applicants and of the Australian vocational sector (VET is a very popular option for Indian students). Rejection rates for Indian applications soared in 2023, and as reported in India’s The Print, some universities elected to stop processing applications coming from Punjab, Haryana, Uttarakhand, UP, Gujarat and J&K. They cited “fraudulent documents and high dropout rates as reasons.”

Canada

There were 320,000 Indian students with active study permits at the end of December 2022, and these students made up 39.5% of Canada’s total foreign enrolment. The Indian student market for Canadian institutions has grown by 46% since 2019, in contrast to the Chinese market, which contracted by 29% between 2019 and 2022.

Many Canadian institutions' heavy reliance on Indian students is worrisome going into 2023. Diplomatic tension characterised the Canada/India relationship for the latter half of this year after Prime Minister Trudeau publicly announced that there was “credible evidence” of an Indian-state-involved assassination on Canadian soil in June 2023. Canadian diplomats were expelled and IRCC’s ability to process Indian applications has been seriously weakened. Some experts believe as well that the Canadian education brand is losing its appeal among some Indian families. We should see an even stronger effort on the part of Canadian colleges and universities to diversify beyond China and India in the coming year.

United Kingdom

Indian students represented 23% of all non-EU enrolments in UK universities in 2021/22 for a total of 126,535 (+50% y-o-y). They were outnumbered only by Chinese students (151,690). In contrast to trends in other leading destinations, however, Chinese enrolments in UK universities grew (+5.5%) between 2020/21 and 2021/22.

Growth in Indian student numbers will very likely slow for UK educators in 2024. The UK government's ban on student dependants comes into force in less than a month, and also in the works is a review of post-study work rights. Both will present challenges for UK educators in India in the next few months.

United States

In 2022/23, India was the main driver of growth in international enrolments for US colleges and universities, sending 35% more students (268,923) than in the previous year. China remains the top market (289,526), but by the slimmest of margins, and was flat in terms of growth (-0.2%).

The US, and US institutions, are ramping up their recruitment in India. Research conducted by IIE in spring 2023 revealed that US institutions are prioritising India as a recruitment focus, which can only be helping to boost Indian numbers. India was the top focus for institutions recruiting for both undergraduate (57%) and graduate (77%) programmes. There is also a national strategy at play. The US government had a target of processing more than 1 million non-immigrant visas from India in 2023. In September, the US Mission to India reported that it had already surpassed that goal and “processing almost 20% more applications than in pre-pandemic 2019.”

And the overarching trend in 2023? A maturing industry

The pandemic spotlighted just how much international students contribute to the overall economies of leading destination. It did so by interrupting and disrupting international student mobility, which equated to billions and billions of dollars lost across multiple sectors.

The losses encouraged many institutions to take an almost-panicked approach to recruiting overseas when the pandemic subsided – exemplified in monumental growth in international student numbers in leading destinations. But the pace of growth we saw in 2022/2023 is unsustainable, and many campuses and communities do not have the capacity required to provide the experience that international students deserve. This has caught the attention of governments, which are now taking a much more active role in regulating their international education sectors.

Closer government scrutiny and new rules around recruiting will initially feel like a shock. But overall, we are also looking forward to a new year filled with reports of happy students and thriving campuses, innovative approaches to recruitment, and new models of international education that serve both institutions and students well.

For additional background, please see: