Canada’s foreign enrolment grew by more than 30% in 2022

- Canada’s foreign enrolment reached a record high of nearly 808,000 at the end of 2022

- India remains the leading sending market and a major driver of that overall growth

- However, several other emerging markets are also showing real strength this year as well

Newly released data from Immigration, Refugees and Citizenship Canada (IRCC) tells the story of a record year of growth for Canadian institutions and schools. IRCC reports that, as of 31 December 2022, there were 807,750 foreign students with active study permits (study visas) for Canada. This compares to just over 617,000 the year prior and represents an astonishing 31% year-over-year growth rate.

That enrolment is also 27% higher than before the onset of the COVID-19 pandemic, and reflects overall growth of 43% over the previous five years and nearly 170% over the last decade.

As in 2021, India remains far and away the largest sending market for Canadian educators. There were just under 320,000 Indian students with active study permits at the end of December 2022. This represents year-over-year growth of just over 47%, and Indian students accounted for nearly four out of every ten foreign students in Canada as of the end of 2022.

In contrast, China, which for decades was the leading sending market for Canada, now accounts for roughly 12.5% of Canada's foreign enrolment. The 100,075 Chinese students with active study permits as of 31 December 2022 reflects a -4.3% decrease from 2021 levels.

In separate reporting on study permit processing, IRCC explains that, "Canada is on pace to set a new record this year. As of [30 November 2022], IRCC had processed over 670,000 study permits, compared to more than 500,000 during the same time period last year."

Processing times, however, remain a significant issue with average turnaround times reportedly running up to 10 weeks for new applications lodged from outside of Canada. IRCC's reporting in this respect revolves around an established service standard of 60 days, which, while processing times will vary by country, continues to suggest that students should file study permit applications well ahead of their planned programme starts.

Leading senders and notable growth markets

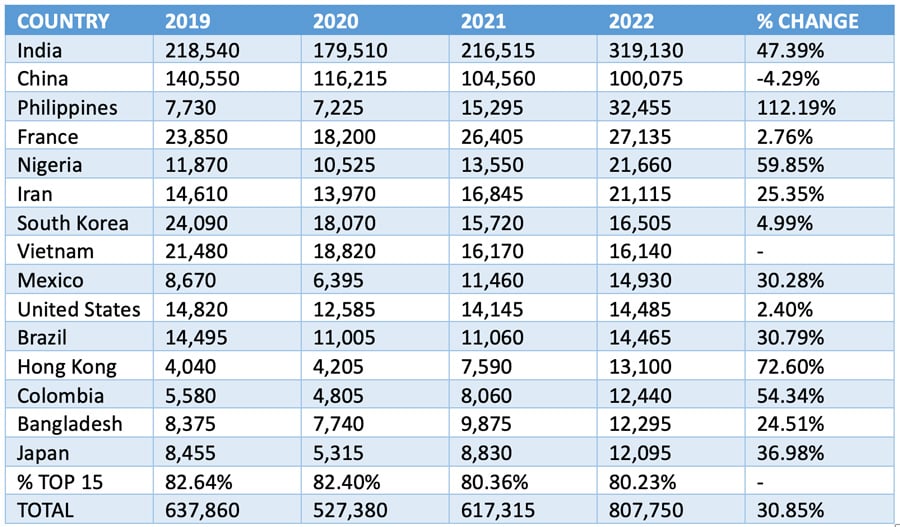

The following table summarises the top 15 sending markets for Canada for the period from 2019 through 2022.

Along with India, notable gainers within this field of top sending markets include Philippines (+112.19%), Nigeria (+59.85%), Hong Kong (+72.60%), and Colombia (+54.34%). Those latest numbers also see Philippines surging into the top three sending markets for the first time.

Other notable growth markets just outside that top tier include Nepal (with 7,745 students for end of 2022 and +257.74% year-over-year growth); Algeria (7,510; +44.42%); Ukraine (7,150; +268.56%); Sri Lanka (5,205; +93.85%); Cameroon (4,075; +59.49%); and Peru (4,025; +114.67%).

Needless, this dramatic growth for 2022 represents a record-high level of foreign enrolment that places Canada squarely among the top study destinations worldwide.

For additional background, please see: