A data-based case for diversification: Study finds that only 14 countries account for half of all international student enrolments

- A new report maps the major sending markets for study destinations around the world, examines past enrolment patterns and compares them to emerging student demand drivers as indicated by current student search activity

- It finds that enrolments remain highly concentrated for most destinations but that new growth markets are opening the door to more diverse foreign student populations

A new analysis from Studyportals draws on the platform’s own search data as well as mobility statistics from UNESCO and the OECD to map both historical and emerging patterns of international student demand.

We should note that the usual cautions around UNESCO/OECD numbers apply here: those statistics are primarily concerned with higher education studies abroad and the quality (and currency) of estimates varies somewhat from country to country.

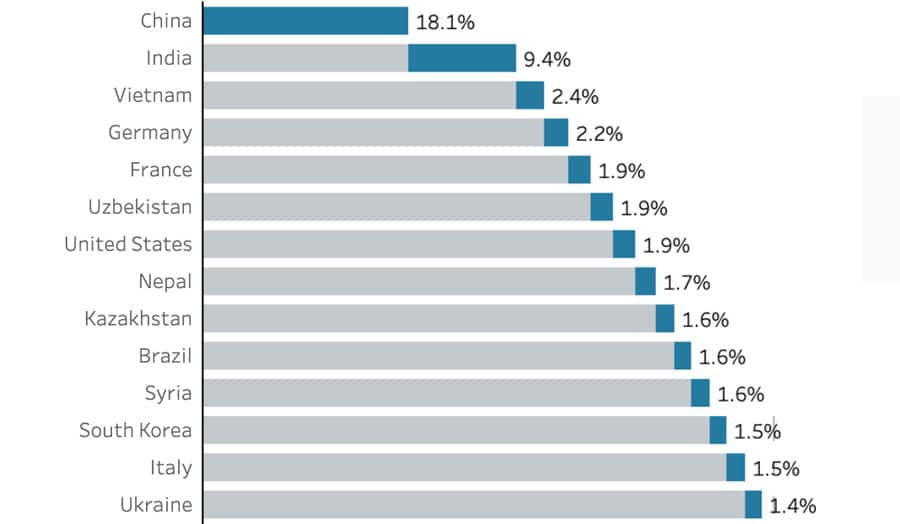

With those points firmly in mind, the headline finding from the Studyportals report is that global student flows are concentrated within a relatively small number of sending markets. In fact, the UNESCO and OECD estimates indicate that only 14 countries contribute just under half of all internationally mobile students. China and India, not surprisingly, are and continue to be the primary drivers of growth with the two accounting for nearly 30% of all students abroad all by themselves.

The report adds, "Global student mobility for the past thirty years relied on one country – China, which has been for decades the world’s largest sending country of international students, and – more recently – a recipient. In a shorter timespan, however, the economic and demographic weight of India also reflected a on international students numbers: Indian student visas already outnumber Chinese in Canada, and for the first time, in the UK, and growing fast in the US and Australia."

The report notes as well that, of the world’s 209 countries, only 54 account for 80% – or four out of five – of all higher education students abroad. When we look at that band of markets between the 14th and 54th largest sending countries, we see a number of important growth markets for student recruitment, including Nigeria, Pakistan, Iran, Morocco, Saudi Arabia, Colombia, Indonesia, Malaysia, Turkey, Bangladesh, Egypt, Sri Lanka, and Philippines.

The relative weight of those source countries varies by destination and Studyportals does a nice job of using interactive tools to illustrate that student mix for a wide range of destinations. This tells us, for example, that 80% of Australia's students come from only 12 countries, notably China, India, Nepal, Vietnam, and Malaysia. Meanwhile, four out of five foreign students in Ireland come from one of 15 countries, which, along with India and China, include the United States, Canada, and the United Kingdom. And the bulk of South Africa's foreign enrolment comes from just 13 sending markets, mostly within Africa and including Zimbabwe, Congo, Nigeria, Lesotho, and Namibia.

Relating historical demand to future interest

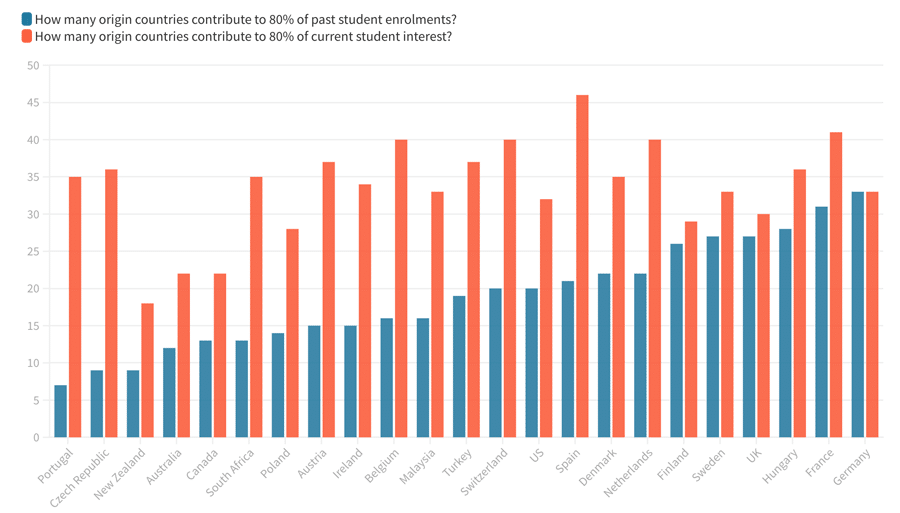

The Studyportals analysis extends to consider the relationship – and notably the gaps – between historical demand and emerging patterns of student interest. The report relies on search data from 52 million users on Studyportals sites for the latter, noting that, "Because student behavior on Studyportals is forward-looking, this can give us insights into what the future holds." In broad terms, patterns of search activity on Studyportals sites can be understood as "top of the funnel" indicators of enrolment patterns in the next 12-24 months.

Perhaps not surprisingly, given the number of strong growth market outside of the top 14 senders in the Studyportals analysis, those current patterns of student interest suggest a trend toward a more diversified enrolment for many destinations going forward.

The following chart relates the number of source markets that make up 80% of past enrolment for a number of destinations; and then relates that to the number of countries that account for 80% of current student interest.

"While traditional recruitment grounds are still represented, developing countries [are driving] student demand for higher education," adds Studyportals. "Many of the origin countries with rising student interest share a common profile: young and mobile populations, and an appetite for high-quality higher education not yet matched by local institutions. While historically, more enrolments have come from a select group of countries, access to student loans, shifting demographics and broadening economies in emerging markets [are creating new] opportunities."

For additional background, please see: