Special report: Chinese students are turning to Asian destinations in greater numbers

- The nature of student demand for study abroad is changing in China

- Asian destinations such as Singapore, Hong Kong, Malaysia, Japan, and Thailand are becoming more popular

- Demand is especially high at the K-12 and postgraduate levels

- Proximity and affordability are major concerns for many Chinese parents

In 2023, the shape of Chinese outbound student mobility is notably different than it was in 2019. Geo-politics, concerns about safety, notoriously difficult entrance exams, and a weaker Chinese economy are changing the way that Chinese students are making decisions about study abroad.

A 2023 report from New Oriental Vision Overseas Consulting Company reveals that while the US and UK remain top study destinations for Chinese students, Asian countries are increasingly popular and being considered alongside Australia, Canada, and Europe. Further, it appears that Asian countries are gaining share from the US of the overall Chinese student market.

New Oriental’s 2023 Report on Chinese Students’ Overseas Study is based on an online survey that was active from December 2022–February 2023. In all, there were 9,551 respondents from all over China, 78% of whom were students and 22% of whom were parents. Students ranged in age and were considering foreign programmes at the high school, undergraduate, graduate, and postgraduate levels.

The US still leads but has lost share to Asian competitors

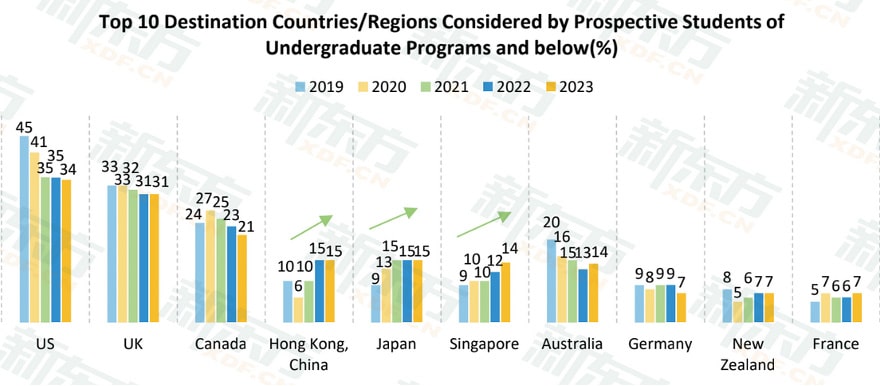

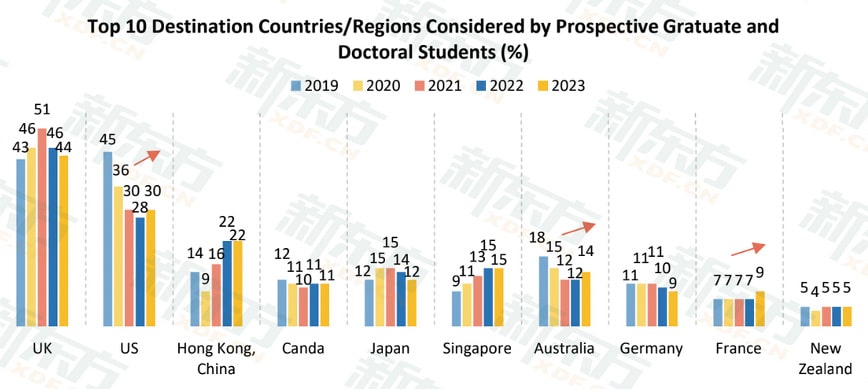

The following chart depicts the consideration set of Chinese high-school and undergraduate-level students thinking about where they will study. While the US, UK, and Canada still hold the top three spots in terms of how many students are considering them, mentions of the US fell from 45% in 2019 to 34% in 2023. In that same timeframe, Hong Kong, Japan, and Singapore became more attractive, and Australia lost some appeal.

At the graduate/postgraduate level, the UK remains stable in the top spot in 2023 in terms of how many students are considering it. The US remains #2, but the proportion considering the US fell from 45% in 2019 to 30% in 2023. Hong Kong (#3) increased in popularity and so did Singapore. The 15% who are considering Singapore in 2023 is higher than the 11% considering Canada. Japan (12%) also has a slight edge on Canada in 2023.

Who’s number one? Top preferences of Chinese students

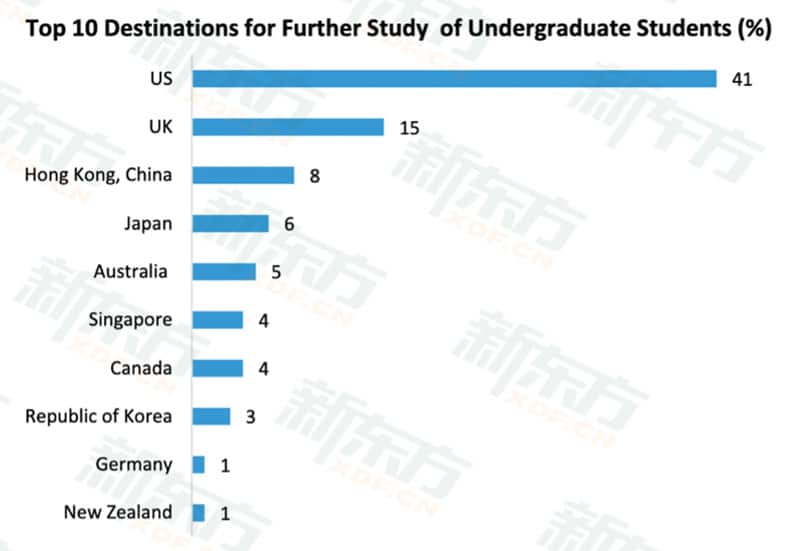

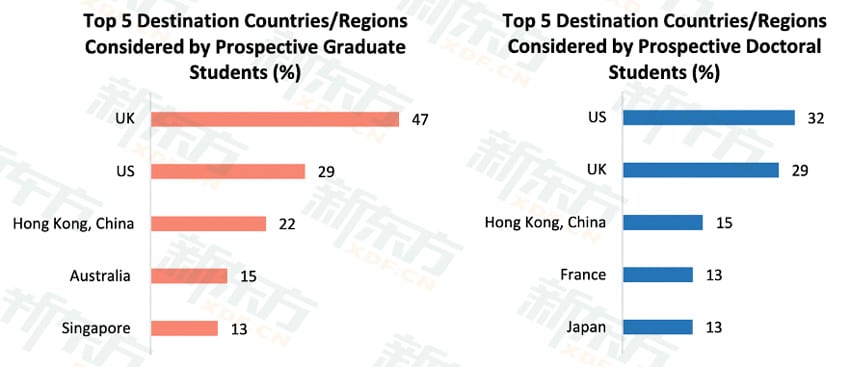

While it’s common to consider a few options for study abroad, most students have a country in mind that they would choose above all others. In this respect, at the undergraduate level, the US is far ahead with 41% of undergraduate students saying it’s their first choice in 2023. The UK follows at 15%. After that, Hong Kong and Japan edge out Australia, Singapore, and Canada at the undergraduate level in 2023.

At the graduate level, the UK nabs top spot with the US in second. Hong Kong follows, followed by Australia, then by Singapore. Canada is absent from the top five at this level.

At the postgraduate (doctoral) level, it’s the US in first place, followed closely by the UK. Hong Kong takes third spot, followed by France and Japan. Australia and Canada do not feature in the top five at this level.

Why has Asia become more popular for Chinese students?

Asian countries’ proximity to China – and greater reputation for safety than the US – is helping them to attract Chinese students.

Throughout the pandemic, the Chinese government imposed stringent virus containment measures on the population, measures that included a border closure shutting China off from the rest of the world from March 2020–January 2023. This pandemic response stoked an apprehension about travel abroad that remains difficult to shake for many families in China.

In October 2022, for example, more than half of 4,000 consumers responding to a survey conducted by the consultancy Oliver Wyman said they planned to put off travel abroad “even if the borders reopen tomorrow,” with fear of infection cited as the top concern.

When borders did open, Ctrip, China’s largest travel agency, found that three countries absorbed an outsized proportion of an increase in Chinese travelling abroad: Singapore, Thailand, and Malaysia. Ctrip CEO Jane Sun noted a change in her customers’ priorities: “More and more customers really want to be very well protected when they’re travelling.”

To that point, the US’s position has weakened among Chinese families worried about safety. The Chinese state media extensively covered anti-Asian discrimination in the US in the years of the pandemic, and this has convinced many families that the US is more dangerous than it used to be. Gary Bowerman, director of Check-in Asia, a tourism intelligence and strategic marketing firm, told Time Magazine in February 2023 that, “Chinese tourists are incredibly risk averse. They don’t want to be near anything that puts their own personal security in danger.”

Keeping family close to home appears to be linked to a need for security among Chinese families still adjusting to a post-pandemic environment. They remember the trauma of Chinese students being trapped abroad when borders closed, many far away in Western destinations, and how difficult it was for those students to return home.

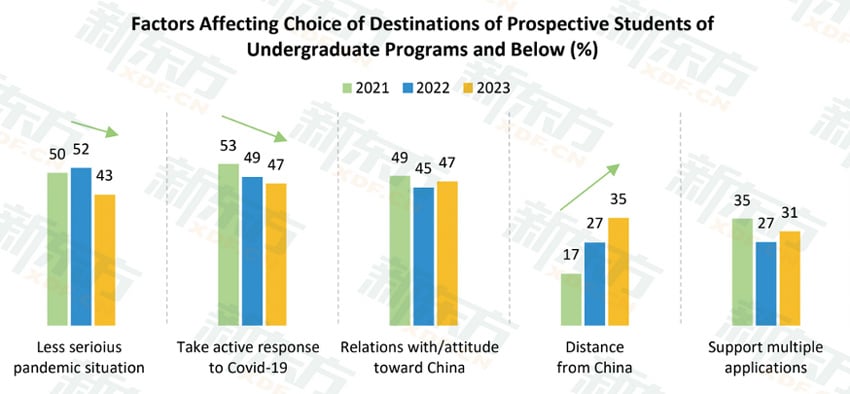

The responses of surveyed parents and students looking at study abroad options at the undergraduate level show that while families’ nervousness about COVID has abated, their interest in destinations close to China jumped from 17% in 2021 to 35% in 2023.

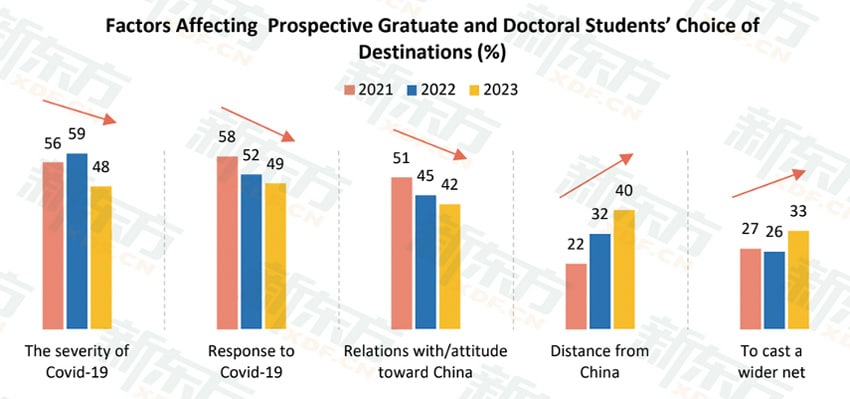

That emphasis on proximity also emerged in the responses from prospective graduate and postgraduate students, with “distance from China” jumping from 22% to 40% between 2021 and 2023.

Cost matters

Chinese families also appear to be looking for more budget-friendly study abroad options in 2023. More affordable options resonate especially in rural areas characterised by lower average household income. (Study abroad used to be an option primarily for urban Chinese families, but this has changed, and smaller cities and towns are now very much on the radar of international student recruiters.)

Between 2021 and 2023, “budget problems” rose as a concern for surveyed prospective students (from 13% to 20% for undergrads and highschoolers) and it did for graduate/postgraduate students as well (from 16% to 23%).

Interviewed this month by the Toronto Star, Shaun Rein, founder and managing director of the China Market Research Group in Shanghai, said:

“Chinese consumer confidence remains weak due to a mix of geopolitics, continued weakness from COVID-19 and domestic Chinese politics. For months, Chinese consumers have been price-conscious, looking for deals and trading down across most product categories.”

Many Asian destinations are more affordable than Western ones for students. According to the "affordability" filter on the QS Best Student Cities 2023 rankings, cities such as Singapore, Tokyo, Hong Kong, Seoul, and Kuala Lumpur are much more attractive from a cost perspective than many major student cities in the West.

Student cities ranked by QS according to affordability (higher numbers = more expensive) in 2023

- New York, US: 139

- Dublin, Ireland: 136

- London, UK: 127

- Sydney, Australia: 115

- Toronto, Canada: 109

- Singapore: 95

- Tokyo, Japan: 74

- Paris, France: 74

- Hong Kong: 61

- Seoul, South Korea: 51

- Berlin, Germany: 44

- Kuala Lumpur: 3

Beyond affordability, Asian cities also rank well on the overall QS’s Top 20 Student Cities in 2023. Singapore (#13), Tokyo, (#7), Hong Kong (#12), and Seoul (#2) all make the top 20 and Kuala Lumpur also places well at #28. Along with affordability, QS uses university rankings, “student mix,” desirability, employer activity, and “student voice” to determine the top student city rankings.

Chinese families are famously reliant on world university rankings to make study abroad decisions and the Best Student Cities list will be familiar to many of them.

Domestic education issues push Chinese students abroad

Also driving Chinese students to Asia are the tough entrance exams required for advanced degree programmes at a Chinese university. According to the Ministry of Education, out of 4.57 million test-takers for the 2023 academic cycle, only 1.1 million got a place in a postgraduate programme in China. That means 3 million test-takers did not get a place.

Chen Zhiwen, editor-in-chief of the online education portal Education OnLine (EOL), said the intense competition in postgraduate exams is contributing to:

- A smaller yearly increase in the number of test-takers signing up for the exam. The annual increase in test-takers for the 2023 exam was 3.7%, much lower than the 21% recorded the year before.

- A growing propensity among test-takers to apply to less prestigious universities.

An EOL report notes:

“While well-known universities have seen slight increases or even drops in applicants this year, less famous ones have witnessed big jumps in test-takers, showing that more students are willing to settle for less famous universities to avoid fierce exam competition.”

Applicants’ mindset in 2023 is evident in the following survey findings underlying the EOL report:

- 60% said they care about whether the university has high entrance scores;

- 41% said they pay the most attention to how many students the school plans to accept.

At the same time, demand for postgraduate programmes is strong because of high unemployment among students graduating from any level in China. More than half (55%) of those surveyed by EOL said their decision to pursue postgraduate studies stemmed from “the difficulty in finding employment.”

High rates of failure to get into postgraduate programmes coupled with dim employment prospects is pushing many students abroad – especially to Asian universities. For example, New Oriental notes that the number of Chinese students in Thai universities has doubled in the past five years.

The appeal of Thailand

Nation Thailand reported on the excitement among Thai university staff when China’s borders reopened, noting that 102 Thai universities enrol students from China. As many as 70% of Chinese students in Thailand study at private universities.

The Chinese embassy in Thailand estimates that 50,000 Chinese were studying at all levels in Thailand before the pandemic and have cited a survey illuminating why Chinese students choose Thailand. Reasons include:

- “China’s universities have limited seats for students;

- The cost of studying in Thailand is affordable;

- There are plenty of courses in Thai universities that Chinese students want to study;

- Chinese students love Thai food, culture, and tourist destinations;

- It is not hard for them to obtain visas;

- Cooperation between Thai and Chinese universities enhances opportunities for graduates to find jobs.”

Nation Thailand adds that, “the trend of Chinese students studying in Thailand has prompted several Thai universities to adjust courses for them.” We reported in 2019 on the massive effort Thai universities were making to attract Chinese students; clearly that effort is just as intense now as in 2019.

Rural Chinese going abroad

Interestingly, the Chinese embassy in Thailand told Nation Thailand that most Chinese students in Thailand “came from southern parts of China, including Yunnan and Guangxi provinces.” Those provinces have some of the highest poverty rates in the country (especially Yunnan).

Sunrise Education summarises the predicament of rural Chinese families trying to secure a good education for their children – a predicament that illuminates the appeal of study abroad for Chinese in poorer regions:

“While top-ranked C-9 League universities have begun to gain worldwide recognition, admission to them is still governed by an exam that largely benefits wealthier urban citizens with better access to more resources. While measures to decrease the urban-rural divide in both the quality of education as well as equity in opportunity have made the gaokao a bit more competitive, China’s household registration, or hukou, system continues to hamper the prospects of rural students; recent data indicate that the percentage of rural students at China’s most prestigious universities has actually shrunk to 0.3%, compared to 2.8% for urban students. Because of the hukou system, the children of economic migrants in larger cities are unable to attend local schools; they are therefore forced to either pay to attend lackluster private schools or simply return to their families’ home regions to receive a free but often bare-bones education there.”

Demand for K-12 education in Southeast Asia

A 2022 article the South China Morning Post (SCMP) indicates that another trend in the Chinese student market is the draw of K-12 education in Southeast Asia. Chinese families are sending their children to Malaysia, Thailand, and Singapore to attend international schools affiliated with well-known Western universities.

Like Thailand, Malaysia is seeing record numbers of Chinese students. Government data show that in 2021 “19,202 Chinese students applied to study in Malaysia, a sharp rise of more than 150% from only 8,876 applicants the year before.”

Vision Education's Jenson Zhang illuminates the profile of the families the firm is working with when recommending Southeast Asian destinations:

“We’re targeting families whose disposable income varies from 200,000 to 300,000 yuan per year. Comparatively speaking, international education in the US or UK would entail a bracket above 600,000 yuan per year.”

SCMP compares tuition fees at a top international school in Malaysia to those in China to underline why K-12 education in Malaysia is so attractive to Chinese families:

“BSKL is considered among Malaysia’s top private international schools. Yet, its annual tuition – 49,250 ringgit (US$10,620) for Kindergarten 1, to 100,700 ringgit for grade 12 students – is more affordable compared to the 250,000 yuan (US$35,080) to 300,000 yuan per year for grades 10-12 in China.”

An increasingly complex market

The rising popularity of Asian destinations is prompted by important shifts in the factors Chinese parents now prioritise when choosing where to send their children for education abroad. Proximity and cost are clearly major concerns for a large segment of prospective Chinese students – and those students now have a much larger range of highly ranked Asian schools and universities to consider enrolling in.

Western institutions would be well advised to double down on market research, engagement with top Chinese agents and other partners, and segmentation-based recruitment (e.g., by student persona, income bracket, or Chinese city/region) to understand how best to compete in the context of increased Asian competition for Chinese students.

In addition, it will be interesting to see if post-study work rights become more important to Chinese families given the sluggish Chinese economy and high youth unemployment rates in China. In May 2023, the urban youth unemployment rate hit a record high of 20.8%.

University graduates are among those most likely to be unemployed; a June 2023 Guardian article notes:

“Nearly 11.6 million students are set to graduate in June, facing a labour market that looks increasingly hostile.”

For additional background: