UK foreign enrolment takes another leap, driven by students from China, India, and Nigeria

- The number of international students in UK universities continues to grow thanks to many more students coming from outside the EU

- There are now almost 5x as many non-EU students as EU students enrolled in UK higher education

- China, India, and Nigeria are the main drivers of growth

- The UK welcomed close to 680,000 international students in 2021/22 – a record high helped along by 12% overall growth year-over-year

Foreign enrolment in the UK increased by 12.4% in 2021/22 over the previous year – with 679,970 international students attending UK universities. The growth was driven entirely by students coming from non-EU countries – especially from China, India, and Nigeria. Non-EU enrolments surged by 23.8% year-over-year, with new, first-year enrolments growing by 32%.

By contrast, the total number of EU students in UK universities fell by 21.4% – and 53% fewer first-year students came from the EU compared with the previous academic year.

Currently, there are more than 5x as many non-EU students in UK universities as EU students (559,825 versus 120,140, respectively).

The data are contained in Higher Education Student Statistics (HESA) for 2021/22, a resource based on UK higher education providers’ reports of student enrolments.

The overall growth in international student numbers follows 9% growth in 2020/21 and represents the further internationalisation of UK education, an ongoing pattern over the past six years.

Full fees for EU students a factor

As HESA notes, the decline in EU student numbers reflects a larger structural development: “The 2021/22 academic year was the first for which EU students were required to pay full international fees.”

As context, until this past academic year, EU students were able to pay the same fees as UK students for higher education – but now they must pay the same fees as international students from other world regions as a result of the UK leaving the European Union.

HESA notes that EU students would have been aware last year that it was their final chance to pay “home fees” in the UK – a factor that led to an increase in EU students in 2020/21. But now that home fees are off the table, EU student numbers declined sharply in 2021/22.

Between 2017/18 and 2021/22, there has been a noticeable decline in first-year enrolments within the top ten EU countries, with the exception of Ireland. Of all EU countries, Ireland accounted for the highest number of first-year enrolments in 2021/22. That said, France remains the top EU sending market, overall, for UK universities, followed closely by Italy.

Top 10 EU markets for UK 2021/22

France: 11,870

Italy: 11,320

Spain: 10,330

Germany: 9,915

Ireland: 9,855

Romania: 8,915

Poland: 7,910

Greece: 7,110

Cyprus: 6,330

Portugal: 6,170

Chinese outbound seems focused on the UK

While many destinations – such as Canada, the US, and Australia – are coping with slowing outbound student mobility from China – the UK is not yet grappling with that trend. China still sends more students to the UK than any other country – and more than a quarter (27%) of all non-EU students in UK universities are Chinese. UK universities welcomed 44,475 more Chinese students in 2021/22 than in 2017/18 – a 41% increase over five years.

India is also growing quickly for the UK – UK universities welcomed 106,200 more Indian students in the five-year period from 2017/18 to 2021/22. Indian students represent 23% of all non-EU enrolments in 2021/22 and are the second largest international student group in the UK, growing by 50% since last year.

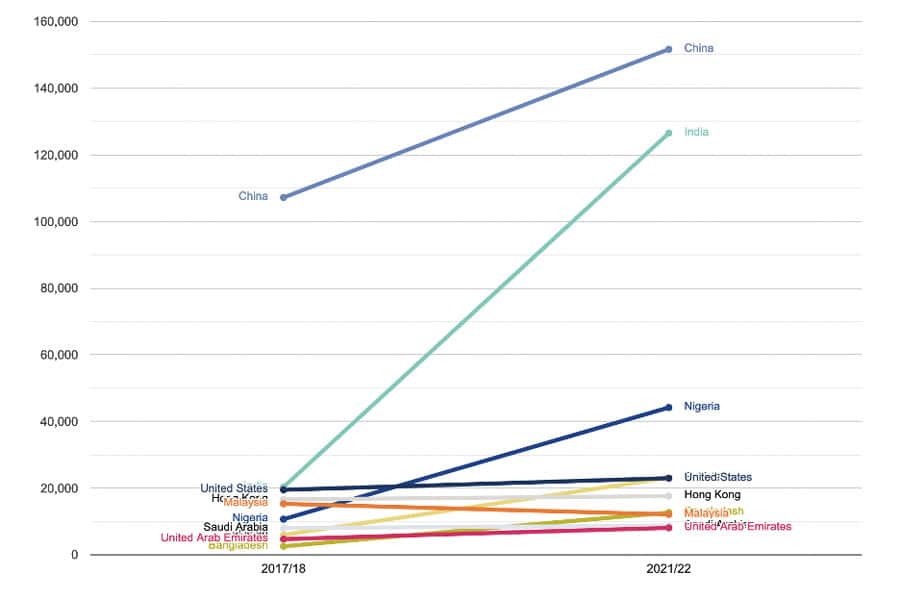

The following chart shows just how important Chinese and Indian enrolments are for UK universities, as well as the steeper growth trajectory of late for India. The Nigerian student market is also very significant.

In 2021/22, UAE and Bangladesh moved into the top ten non-EU sending markets for UK higher education in 2021/22 for the first time. In contrast, 21% fewer Malaysian students are studying in the UK than five years ago and are now outnumbered by students from Nigeria, the US, Hong Kong, and Pakistan.

In general, UK universities have seen their ability to recruit in non-EU markets boosted since the introduction of the Graduate Route in 2021, which allows all international students who graduate with a bachelor’s degree or higher from a recognised UK university to stay on in the country to work for two years (three for postgraduates).

Top 10 Non-EU markets for UK 2021/22

China: 151,690

India: 126,535

Nigeria: 44,195

Pakistan: 23,075

US: 22,990

Hong Kong: 17,630

Bangladesh: 12,700

Malaysia: 12,135

Saudi Arabia: 8,750

UAE: 8,085

For additional background, please see: