Study recommends that the UK invest more in European student recruitment

- A new study indicates that the UK is losing share in the European student market, largely as a result of Brexit and/or a lag in adapting policies and strategies for European student recruitment post-Brexit

- Germany, the Netherlands, and Canada are increasingly attractive destinations for European students

- The UK remains the top destination for students in most European countries, but the report suggests that without more investment in the region, this position could be in jeopardy

A new study from Universities UK International (UUKi) and Studyportals finds that the UK’s exit from the EU in early 2020 has lessened UK universities’ ability to recruit students from 10 important European countries. The study, “International student recruitment from Europe: the road to recovery,” compiles numerous data sources including from HESA, UCAS, and UNESCO, alongside data from Studyportals websites and their 52 million student users around the world.

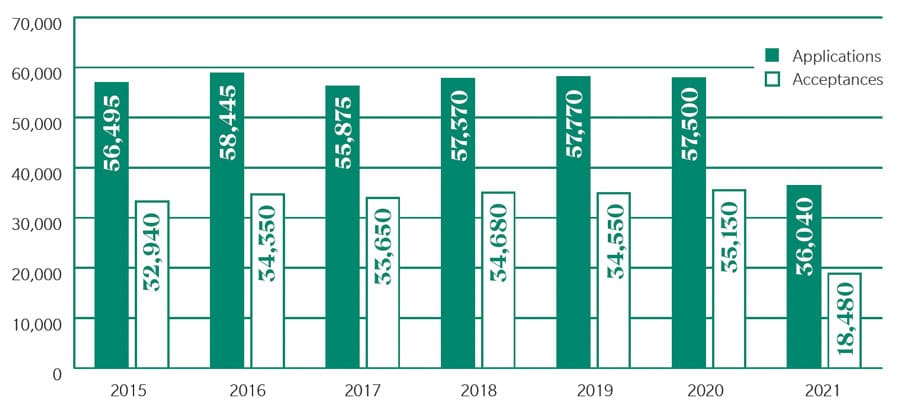

Fewer EU applications and first-year enrolments

UCAS data show that between 2020 and 2021, there was:

- A 37% decrease in the number of EU undergraduate applications to UK universities;

- A 47% drop in the number of EU students accepted to UK universities (linked to fewer EU students applying in the first place).

Those decreases help to explain why there were 50% fewer first-year EU students enrolled with UK universities in 2021/22 compared with 2020/21.

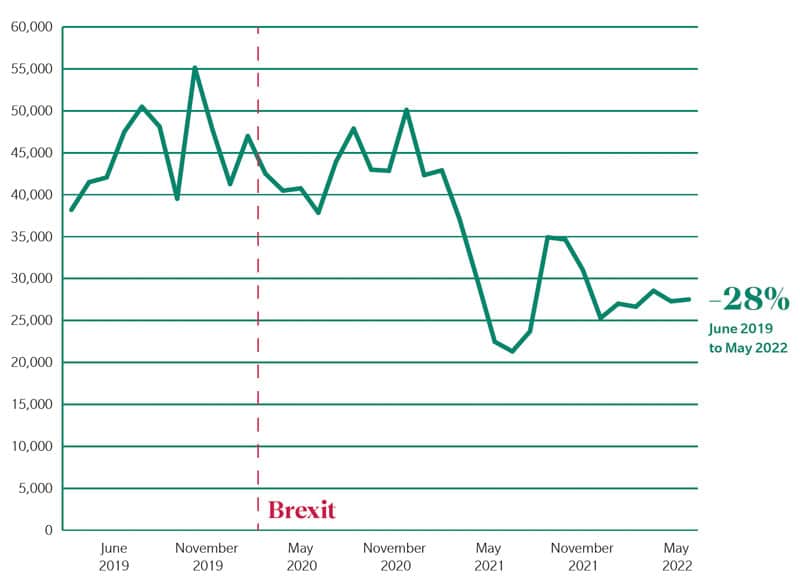

Declining share of European student interest

Studyportals data show a 28% decline from 2019 to 2021 in the number of pageviews of UK courses on the Studyportals platform, equating to a 5.9% loss of share of total European student interest for the UK. This loss of share stems from the fact that total search activity by European students on Studyportals webpages increased by 31% from 2019 to 2021, indicating “the UK’s market share is now a smaller slice of a larger pie.”

Further losses look likely

Given that students’ search behaviour on Studyportals indicates demand for programmes whose start dates are months into the future, the report authors believe that a further drop in first-year European enrolments is imminent:

“Studyportals research finds that students typically start researching their programme options 6–24 months before enrolment, with an average of 15 months before enrolment. With that in mind, we could extrapolate that the low point for European enrolments is likely to manifest in either the 2022–23 or 2023–24 academic years.”

Brexit at the root of the issue

The decline in European student interest in the UK is largely attributed to the consequences of Brexit: EU students now require visas and must pay the same tuition fees as other international students to study in the UK. In short, Brexit made it more cumbersome and expensive for European students to pursue degrees in the UK.

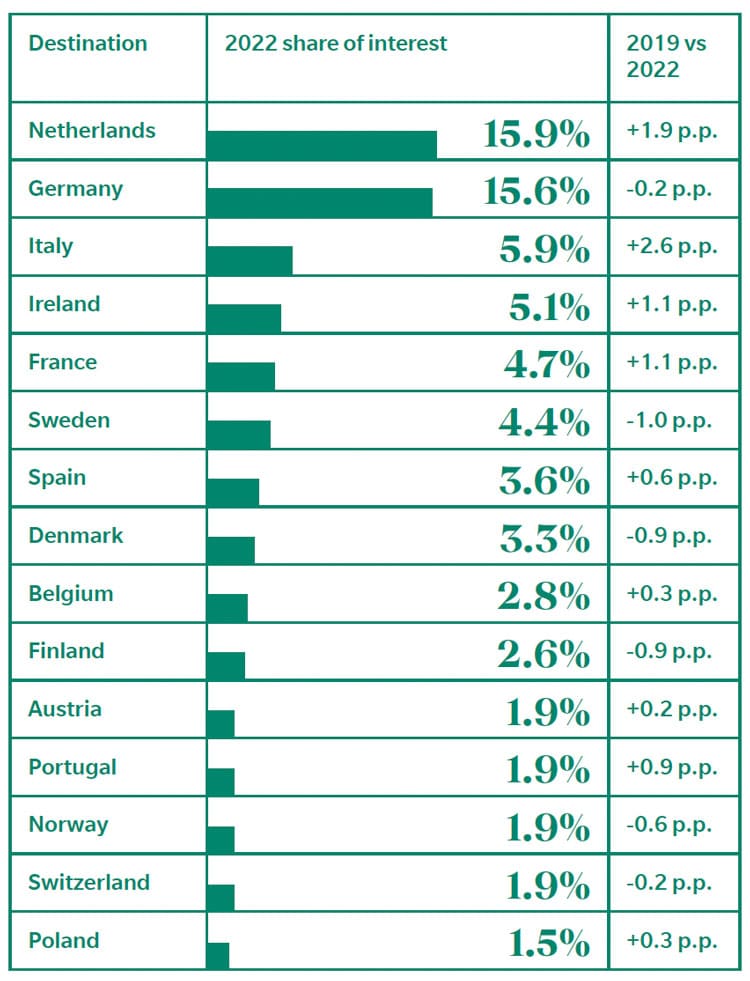

Many students who, before Brexit, would have chosen the UK for studies, are exploring European destinations such as the Netherlands, Germany, Italy, Ireland and France when on the Studyportals platform. These countries offer a growing number of English-taught courses and are increasingly competitive with Canada, the UK, the US, and Australia.

Germany and the Netherlands, in particular, seem to be claiming more share of the European student market lately, as shown in the following screen shot.

Another beneficiary of declining European student applications to the UK appears to be Canada:

“The data show that [Canadian study] permits issued to students from the European Union grew by 50% (to 37,075), between the years 2019 (which represents the pre-pandemic market position) and 2021, compared with 11% growth in the total number of Canadian study permits issued over the same period.”

The trajectory could be reversed

While the UK has lost share of student interest in Europe, the report also suggests that further decline is not inevitable:

“In spite of a sharp drop in market share, the UK retains a lead over other anglophone competitor destinations and has a very strong brand in Europe for online provision, advantages that the UK should now seek to secure and build on.”

The UK’s international education sector has rebounded more quickly from pandemic losses than equivalent sectors in Australia, Canada, and the US – but this is largely due to enrolment increases from non-EU markets. UUKi and Studyportals are urging the UK government to commit to rebuilding the UK’s position in the key European markets of Italy, France, Spain, Germany and Ireland, and to investing more seriously in developing “high potential markets” including the Netherlands, Belgium, and Switzerland and “speculative markets” such as Romania, Portugal, Poland, and Greece.

The UUKI/Studyportals report points out that Europe is “right on the doorstep” for UK educators and that it continues to represent a major opportunity for the UK in terms of talent and enrolments. As it stands, 39.5% of the UK’s international student population is from Europe.

Beyond Brexit

The report suggests that the UK has not yet recalibrated its approach to recruiting European students despite the far-reaching implications of Brexit:

“Institutions and government were previously able to treat European Union countries as effectively an extension of the domestic student market, requiring little resource investment to maintain strong and consistent flows of high-quality students. That is now firmly no longer the case …

We must not settle for inertia, watching numbers decline and waiting for the ‘bottom.’ A generation of students whose expectations were not shaped by the pre-Brexit status quo is coming through the pipeline and they are making decisions now.”

Don’t count on non-EU enrolments

As important as the UK’s increasing diversification of its campuses has been in recent years – i.e., with more non-EU students enrolled – there is a danger, says the report, in relying too heavily on non-EU markets as a growth strategy. The report notes that “[recent] growth has been largely driven by historically dynamic markets [i.e., non-EU countries] and we cannot be certain that growth from these markets will be sustained.”

UUKi and Studyportals therefore recommend that UK universities devote more thought to including the EU in their recruitment goals, in part to mitigate risk factors:

“The EU should form a key part of a diverse recruitment portfolio for UK institutions … once stabilised, European student recruitment flows may be less susceptible to short-term shocks than other sending regions.”

Leverage online courses

Another opportunity for UK universities is online education, says the report:

“Studyportals data shows that EU/EEA student demand for UK online programmes is comparable to, and often larger than, the total combined demand for online programmes from all EU/EEA countries put together. Interest in online programmes at the postgraduate level is particularly strong.”

For additional background please see: