Latest language travel data points to slowing growth in 2015

This time last year, the general impression in language travel was that some important market shifts were afoot. The UK was losing market share and seeing some weakening in student numbers while the US continued to grow. Meanwhile, other more affordable destinations - including Canada, Ireland, and Malta - were also still recording stronger growth. Broader market studies, most recently IALC’s Study Travel Research Report 2016: Trends in the Demand for Foreign Languages, continue to track steady growth through 2014 with 2.28 million students abroad for language travel that year, and nearly two-thirds of those pursuing English studies. More recent reports, however, point to a slowdown in growth in 2015, with a number of key destinations adjusting to a decline in student bookings. The latest data from Malta, for example, indicates student weeks were down by 2.9% between 2014 and 2015. New statistics presented at the English UK Annual Conference and AGM earlier this month reveal that ELT student numbers in the UK were down 8% in 2015 (and student weeks by 13%). And South Africa’s ELT sector, after two years under a badly tangled immigration policy, reports a dramatic 37% fall-off in student numbers for 2015. ELT providers in Ireland, meanwhile, had a strong year, with enrolment up by 10% over the year before and helped in part by the relative weakness of the Euro against the British pound. We have not yet seen 2015 data for Canada or the US but early indicators are of softening enrolment in some English language centres in the US, largely due to a significant decline in Saudi enrolment. Stepping back to look at global trends, the latest indicators come via The 2015 ALTO-Deloitte Language Travel Industry Survey. It gathers responses from both schools and agents in markets around the world, and, while conducted annually, the results are best interpreted with a couple of important points in mind.

- The survey sample is not scientifically drawn but relies instead on the voluntary participation of respondents. There are, as a result, some issues with validity of the sample size, particularly at the level of national markets. "We would like to emphasise that although the data collected in this survey is representative of the industry, it would be more accurate with a higher response rate," notes the survey report. "This is especially true for the [individual] country analysis."

- Similarly, the survey sample varies from year to year. The first annual survey was conducted in 2014 but the respondent pool varies to at least some degree and so year-over-year comparisons should be made cautiously as well. (That said, the 2015 survey drew a larger field of responses [122 this year compared to 108 in 2014] and the 228 individual schools represented in the respondent pool had a combined turnover of US$587 million.)

With those two caveats firmly in place, the ALTO findings can be read as broad directional indicators for the global language travel market. And, as such, the survey reinforces the point that the language travel industry has entered a more mature phase marked by increased competition and slower growth. It also highlights the challenging economic conditions in a number of important sending markets as a key factor in the overall enrolment trends for 2015.

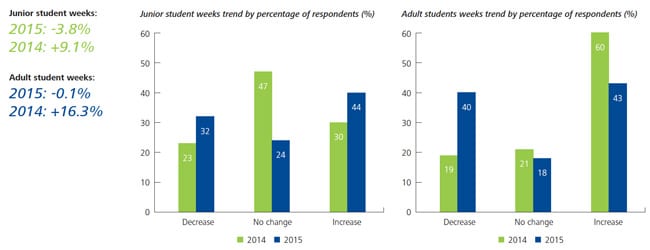

Language schools reported a 3.8% decline in junior student weeks for 2015, with adult bookings virtually flat (-0.1% year-over-year). This follows reports of strong growth overall for both segments in 2014, as reflected in the summary graphics below.