Report reveals continued recovery for ELT sector in 2023, but also policy headwinds in 2024

- Globally, the English Language Teaching sector recovered to 84% of pre-pandemic levels in 2023

- The major growth drivers during the year were key sending markets in Latin America, and continued strength in junior enrolments

- The sector’s progress to recovery, however, has been blunted in the first half of 2024 by new policy settings in a number of top destinations

The Global ELT Annual Report for 2024 was released this week by industry research specialist firm BONARD. It paints a picture of continued recovery for the English Language Teaching (ELT) sector last year, albeit one that has been more recently buffeted by some significant policy interventions in a number of leading destinations.

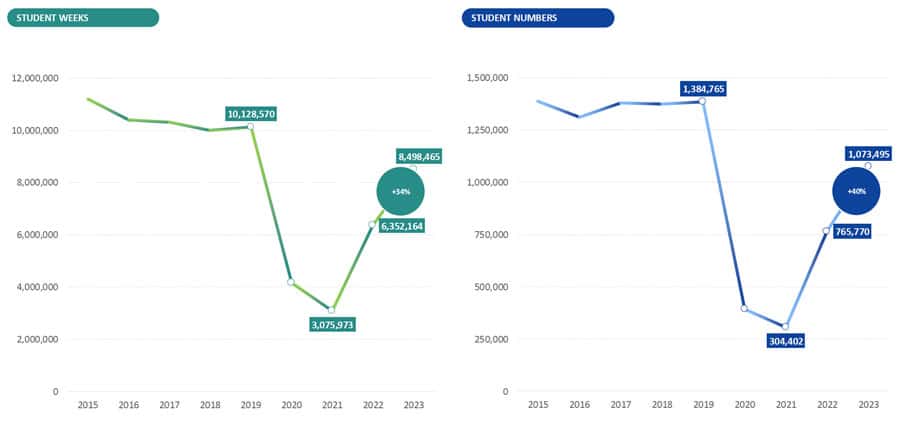

The report focuses on aggregate trends for eight leading ELT destinations: the UK, Australia, Canada, the US, Ireland, New Zealand, Malta, and South Africa. It finds that the total volume of student weeks increased +34% year-over-year, allowing the sector to recover to 84% of its 2019 volume in 2023 across those eight destinations.

A similar pattern played out in terms of student numbers, for which BONARD reports a +40% increase year-over-year. In 2023, total ELT enrolments passed the 1 million student mark for first time since the onset of the pandemic and overall recovered to 78% of 2019 volumes.

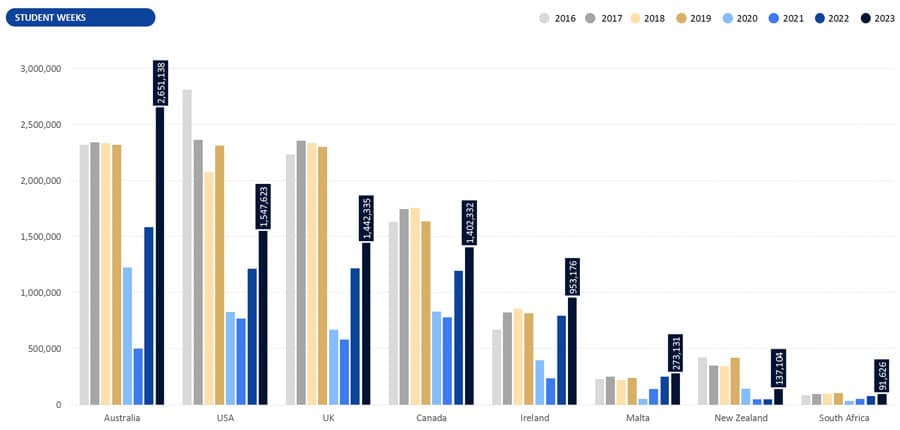

"What we see is a gradual recovery but we also see a slight slowdown in the pace of the recovery," said Ivana Bartosik, international education director at BONARD, who was speaking during a webinar to present the report's key findings this week. "One important note is that the pace of the recovery was uneven across individual destinations. In 2023, there were three destinations that stood out as top performers: Australia, Ireland, and Malta. Each exceeded their 2019 student volume and captured a larger share of the global market. These three destinations benefited from being relatively affordable while also offering work rights to English language students."

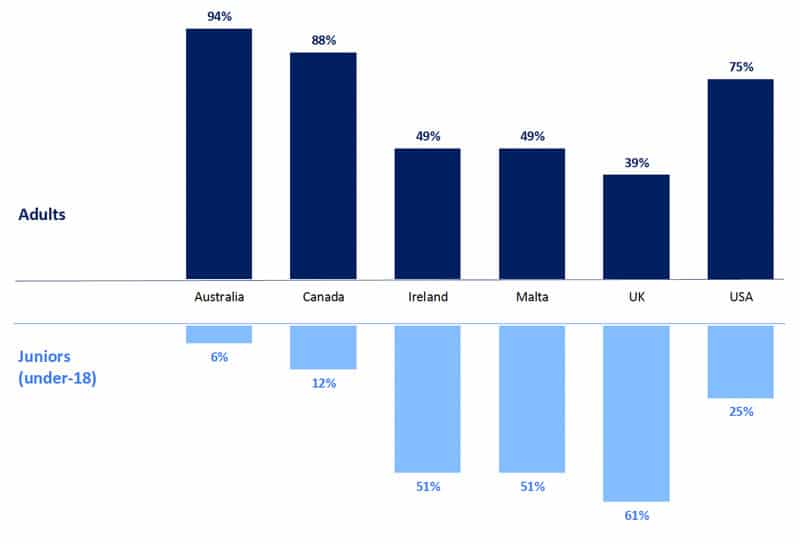

As the following chart reflects, Australia affirmed its position as the leading destination, in terms of student weeks. "This was driven predominantly by growth coming from the LATAM region, and the tendency of adult students to take longer courses," explained Ms Bartosik. She added that 94% of ELT learners in Australia in 2023 were adults, and that contributed to an average course duration of 15.7 weeks, which is "well above average."

Growth in the junior segment

"We see more under-18 students travelling to study abroad, and they are starting to travel at a younger age," said Ms Bartosik.

Indeed, the data shows Ireland and Malta returning to a more typical adult-learner split in 2023. In the years leading up to the pandemic, that distribution was roughly 50:50 in both destinations. The UK, however, reported a significant increase in junior numbers, with the proportion of junior ELT learners there reaching 61% in 2023. This compares to 54% in 2019.

A similar pattern is playing out in the US, where the number of junior students continues to grow while adult numbers are declining. Most ELT students in the US are still adults (75% of all ELT enrolments in 2023). "This suggests a trend we have seen across different destinations," says Ms Bartosik. "That is that the potential of the sector will continue to lie [more] with junior students."

Where are students coming from now?

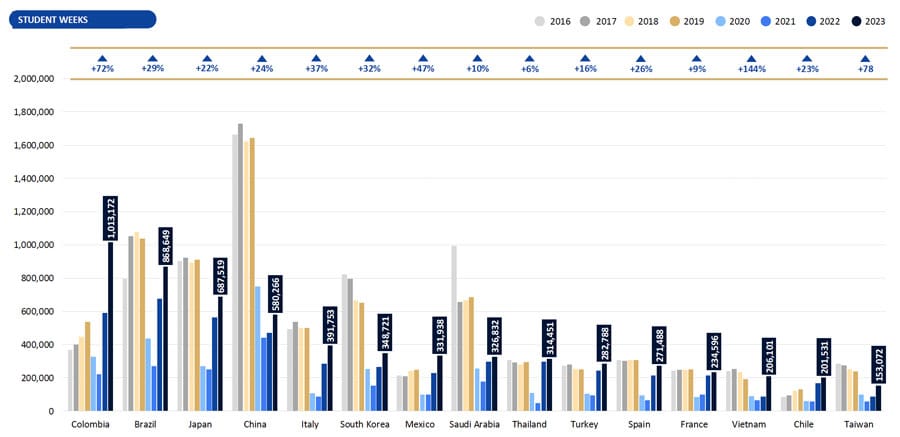

The following chart outlines the top 15 sending markets for ELT students, with year-over-year growth for 2023 indicated at the top of the figure. Among other things, it shows the importance of LATAM markets for ELT, with Colombia taking up the #1 spot for the first time, followed by Brazil, Japan, China, and Italy.

"If you are looking for conclusions that can be drawn from 2023 [data], it is that growth was really driven by countries in LATAM," explained Ms Bartosik. "You have Colombia rising by 72%, you have Mexico rising by 47%, and you also have Chile increasing by 23%."

More broadly, only six of those top 15 sending markets have reached or exceeded their pre-pandemic volumes as of 2023, with half of those in LATAM. Among the top Asian markets for ELT students, only Thailand and Vietnam have now surpassed their 2019 volumes.

2024 and beyond

"Major ELT destinations are currently facing difficulties due to visa restrictions and added government regulation," said Ms Bartosik. "We are already seeing some declines in the statistics available for [the first half of 2024]." BONARD expects that because of those headwinds in some of the top destinations, that demand will continue to shift to other destinations, such as Ireland, Malta, New Zealand, and South Africa.

"There are also opportunities," she added, "and those lie in the junior market. There is stable growth predicted for the junior market globally in 2024."

The dramatic impact of new policy settings

Commenting on the 2023 data, English UK Chief Executive Jodie Gray confirmed that UK providers were reporting softer numbers for the last quarter of 2023 and first half of 2024. "There is definitely a feeling that that is being driven by a dampening of student demand globally, created by – shall we say – less-than-helpful government policies in various markets," she said.

Languages Canada Executive Director Gonzalo Peralta picked up the theme in his remarks, adding that, "It's not so much about the cap [on foreign enrolments announced in Canada in January 2024], it is 100% about how it was handled. The fact that it was announced and then there was this huge gap in not knowing how it would be [implemented]. This caused so much uncertainty."

Meanwhile in Australia, "The government here did a complete backflip," said English Australia CEO Ian Aird. "They went from urgently trying to grow the sector post-COVID to kickstart the economy…to a really significant shift in how visas are processed, and they have brought in one change after another over the first six months of the year." Those changes include "a really significant increase in the visa fee and that has really hurt the [ELT] sector. The visa went up on 1 July and we've seen since that visa grants have dropped by about 45% and [visa] applications have dropped by a similar proportion." Overall, he added, "2024 has [dropped] back to COVID-level student numbers and we expect that 2025 will be quite weak, at least initially, unless the government have a rapid change of heart."

While the immediate political outlook is challenging in many destinations, the panel set a more optimistic tone looking ahead, based in part on the considerable resilience that the ELT sector has demonstrated during and after the years of the pandemic. The group also saw continuing opportunities in the junior segment and in key growth regions, especially in Latin America.

For additional background, please see:

- "Canada’s language training sector reached 82% of pre-pandemic benchmark in 2023"

- "US ELT providers flag visa denials as key area of concern"

- "UK ELT posts another year of growth to reach 75% of pre-pandemic volumes in 2023"

- "US ELT sector continues a gradual recovery"

- "Student weeks for Malta’s ELT sector surpassed pre-pandemic levels in 2023"

- "Irish ELT sector continues to exceed pre-pandemic levels of business"