Irish ELT sector continues to exceed pre-pandemic levels of business

- Ireland’s English-language sector posted another year of solid growth in 2023, with student numbers up 23% and weeks up 20%

- The “mini-stay” segment – which consists mainly of students aged 12–16 who come to Ireland off-season – is becoming an increasingly important market niche for Irish ELT providers

The Irish English-language sector continues to expand, with business in 2023 once again surpassing performance before the pandemic, according to Marketing English in Ireland (MEI), the leading association of English-language schools in the country which represents 65 institutions.

The positive trend is driving jobs in the sector, with 11.4% more staff employed in various roles than in 2022.

Student numbers and weeks post double-digit growth

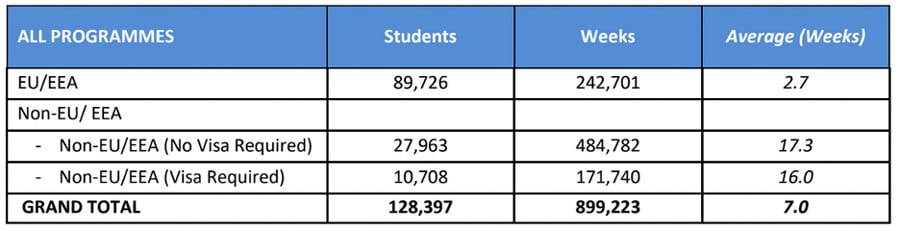

Student numbers were up by 23% and weeks increased by 20% in 2023 compared with 2022. A total of 128,300 students were enrolled in MEI last year versus 104,265 in 2022. About 70% (89,200) of those students were from the EU/EEA, with the remainder from non-EU countries.

Student weeks jumped to 899,220 and about three-quarters of those weeks were accounted for by non-EU students on visas (e.g., Turkey, Saudi Arabia, and China) as well as non-EU students who do not require visas (e.g., Brazil, Mexico, South Korea).

Those numbers compare to the 118,320 students enrolled, and 770,760 weeks delivered, in 2019.

Lorcan O’Connor Lloyd, CEO of Marketing English in Ireland (MEI), commented:

“MEI is delighted to see such impressive growth in Ireland’s English Language Education sector, surpassing pre-pandemic figures and welcoming students from around the world. The increase in student numbers, across all programmes and a diverse network of source markets, demonstrates the sector’s resilience and appeal. We are committed to providing exceptional education experiences and look forward to continuing to contribute to the growth and success of Ireland’s international education sector.”

Non-EU students tend to stay for longer than European students (not least because their countries are farther away and flights more expensive), with an average of 16 weeks for students from visa-required markets and 17.3 for students from countries where visas are not required.

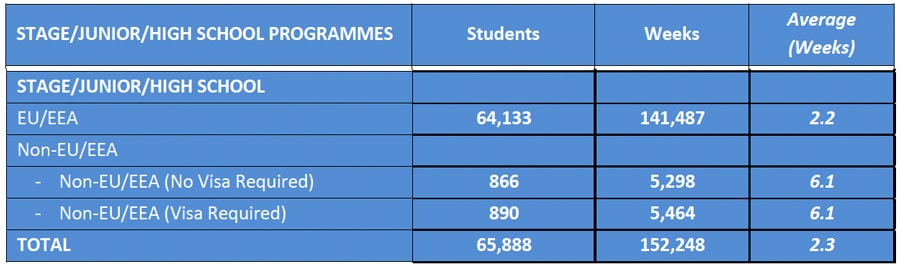

An increasingly important segment of the market is the “mini-stay” niche – aka “Stage” programmes – which are short-term closed group programmes that often offer learners exciting cultural, recreational, and social opportunities as well as English-language learning. These groups usually consist of students aged 12–16 who come to Ireland off-season. The number of learners in Stage programmes surged from 23,625 in 2022 to 39,845 in 2023 – a 69% increase.

Overall, the number of junior students in Junior, Stage or High School programmes jumped from 51,660 to 65,890, despite a slight decrease in the number of 12–17 years old staying one or two weeks. About 97% of the Junior, Stage, High School business is contributed by EU/EEA students.

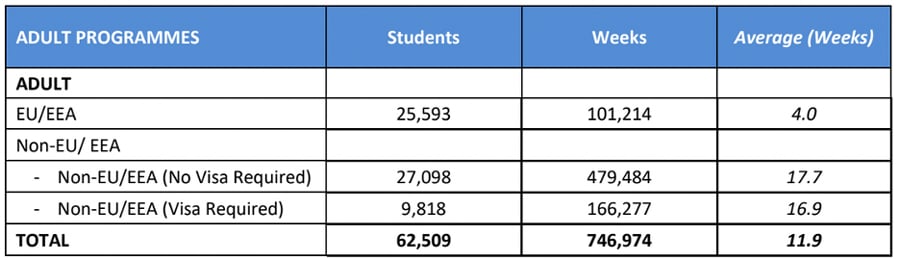

The Adult sector now enrols over 62,000 students, about 10,000 more than in 2022, and the growth is being driven both by EU and non-EU students. About 4 in 10 adult learners come from within the EU/EEA region, 43% come from countries outside the EU/EEA where no visa is required, and 16% come from non-EU countries where a visa is required. The average stay for adult learners is 11.9 weeks. By far the most popular course is General English.

Top markets

The top markets in the EU/EEA for Irish English-language schools are:

- Italy (which together with Spain, accounts for 73% of all students from Europe)

- Spain

- France

- Austria

- Germany

The top markets in the non-EU/EEA segment where visa is not required are:

- Brazil (53% of all students in this segment)

- Mexico

- Japan

- Chile

- Argentina

And the top markets in the non-EU/EEA segment where a visa is required are:

- Turkey (32% of all students in this segment)

- Mongolia

- Bolivia

- China

- Ukraine

Significant increases in business came from East Asia, especially from Japan, South Korea, Taiwan, China, Malaysia, and Mongolia. Mongolia accounted for 38,935 student weeks all on its own – up from 29,950 in 2022.

For additional background, please see: