Strong recovery of Irish ELT in 2022 means that student weeks have now topped pre-pandemic volumes

- English-language centres in Ireland are reporting strong growth in 2022, with student numbers now approaching pre-pandemic levels and student weeks exceeding those recorded in 2019

- Along with key EU senders, several major markets in Latin America are contributing to growth

- A strong summer season for Irish ELT centres looks likely this year

Ireland's English Language Teaching (ELT) sector is reporting very strong numbers for 2022. The latest data from peak body Marketing English in Ireland (MEI) reveals that student weeks for adult learners exceeded pre-pandemic levels last year by nearly 10%, while weeks for junior students reached roughly 90% of pre-COVID volumes. Overall, Irish ELT centres delivered 6% more student weeks than they did in 2019.

Even so, the total number of ELT students remained -12% below 2019 levels, though there was strong growth for both adults and juniors. Most adult learners (representing 87% of adult student weeks) went to Ireland for General English programmes.

The tables here highlight the notable growth in junior numbers for summer 2022, and it appears the sector is heading for another strong peak season in 2023.

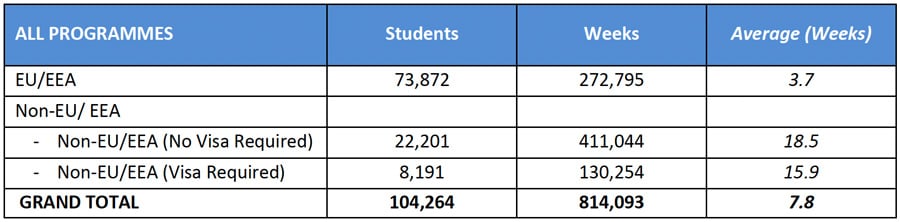

We can parse student totals by sending region and visa status, as summarised below.

The table points us to a fascinating aspect of the student mix in Ireland, where EU students accounted for 71% of all enrolments in 2022. But because those students came, on average, for a much shorter period of study, non-EU students (who represent less than 30% of students) accounted for about two-thirds of student weeks.

"Students from outside the EU/EEA generally stay for longer periods than their EU/EEA counterparts (3.7 weeks)," observes MEI. "Students from non-EU/EEA countries where visas are not required stayed an average of 18.5 weeks, whereas students from non-EU/EEA countries where visas are required stayed an average of 15.9 weeks."

Italy and Spain were the big EU senders in 2022, contributing a combined 146,241 weeks (more than half of all weeks spent in Ireland by EU students that year). Other important EU sending markets include France (22,713 weeks in 2022), Austria (6,797 weeks), Germany (13,117 weeks), and Switzerland (5,265 weeks).

Brazil, meanwhile, is the clear leader (by a considerable margin) among non-EU sending markets whose students do not require a visa for Ireland. With 254,277 weeks in total, Brazilian students accounted for nearly half of all non-EU bookings all by themselves.

In general, no-visa-required Latin American markets played an important role in the sector's performance in 2022. Mexico (53,995 weeks), Chile (33,609), Argentina (19,987), and Bolivia (14,416) round out the top five senders.

Non-EU markets whose students require a visa for Ireland accounted for a relatively small proportion of total weeks (130,254 weeks, representing 16% of the 2022 total). Within that sub-group, Turkey (60,130 weeks) and Mongolia (29,948) were the leaders last year and together accounted for seven out of ten non-EU students (visa required) for Irish ELT centres.

For additional background, please see: