UK ELT posts another year of growth to reach 75% of pre-pandemic volumes in 2023

- The UK’s ELT sector performed significantly better in 2023 than in 2022, driven by private sector business

- The share of junior students (under the age of 18) has never been higher

- Jodie Gray, chief executive of English UK, notes ELT sector performance – in the UK and elsewhere – is greatly influenced by government policies

- In a related development, English UK has offered six recommendations for government policymakers

The UK’s English Language Teaching (ELT) sector continued its post-pandemic recovery last year, enrolling more students and delivering a higher volume of student weeks in 2023 than in the previous three years.

English UK, the national membership association of accredited English-language teaching centres, has released its annual report, compiled by its research partner BONARD. Data provided by member centres shows that student numbers increased to 76% of 2019 levels and student weeks to 71%. The year-on-year enrolment increase for full-time, face-to-face students was 52%, and student weeks increased by 19%.

More than 300 English UK member centres provided data for the report, and collectively in 2023 they:

- Taught 360,517 students;

- Delivered 1,153,870 student weeks (marking the first time that total weeks exceeded 1 million since 2019).

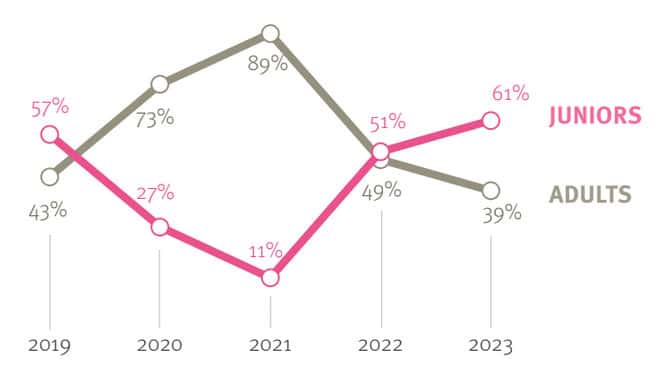

The proportion of students who were juniors (under 18) in 2023 was the highest ever: 60% compared to less than half in 2022 and 54% in 2019.

Jodie Gray, chief executive of English UK, said:

“It’s great to have better news in this year’s student statistics. The story of 2023 is one of promising but steady recovery. Global ELT is a maturing industry, with student numbers static or falling. It’s a zero-sum game. Destinations compete for a stable or shrinking pool of students. One destination’s gain is another’s loss.

The government can make a huge difference to our success, as recent clampdowns in competitor markets have demonstrated. Right now, the UK’s approach is more welcoming than that in some of our competitor destinations. Canada and Australia are currently grappling with high visa refusal rates and caps on international student numbers.

These statistics not only help English UK members take individual marketing decisions but also demonstrate how and why targeted government support is needed.”

Private sector is recovering much faster than state sector

English UK notes that “recovery was more evenly distributed than in 2022, with twice as many English UK members exceeding their 2019 student weeks – 26% compared with 13%.” However, there was a marked difference in the degree of recovery experienced by private and state sub-sectors.

Private providers compose the vast majority (about 90%) of English UK’s membership, and they taught 55% more students in 2023 versus 2022 and delivered 24% more weeks. By contrast, state sector members taught 20% fewer students, and their student weeks decreased by 28%. In 2023, state sector weeks reached only 27% of what they were before the pandemic. English UK says that part of the issue lies with structural changes, and it is working with state sector “to maximise their potential for growth.

State sector highlights from the report include:

- Junior students accounted for the highest share ever of enrolments (10%).

- Students stayed in their courses for a relatively short period compared with other years (8.4 weeks on average).

- China remained the top market, with 29% of student weeks, followed by Saudi Arabia (11%), Japan (8%), Romania (7%), and Kuwait.

Private sector highlights include:

- Junior students made up 61% of all enrolments, up from 51% in 2022.

- Students stayed on average for 3.2 weeks (on par with 2019).

- Italy displaced Saudi Arabia as the top market and accounted for 16% of student weeks (up 58%), followed by Saudi Arabia (up 2%), and then Spain (up 27%).

The following graphic shows the dramatic variation in junior enrolments for private sector members over time.

Growth markets

The fastest-growing markets for the UK’s ELT centres were Peru (up 188%), Taiwan (up 124%), and Colombia (up 108%). In addition, notes English UK, “Italy rose 57%, helped by the Estate INPSieme Estero scholarship scheme.”

In 2023, the EU contributed the largest share of students (59% versus 41% for non-EU countries), while non-EU countries were responsible for the most weeks (64% versus 36% for EU countries).

English UK calls on government to do more to support the sector

Earlier in May, and leading up to the country’s just-announced general election on 4 July 2024, English UK issued a manifesto with six recommendations for the UK government. The manifesto argues that “UK ELT could contribute so much more to the UK's economy, healthcare system and international relations with just a few small policy changes which only a government can make.”

The association’s recommendations for government are:

- Expand career-enhancing travel opportunities for young people by expanding the Youth Mobility Scheme.

- Legalise short work placements on all ELT courses.

- Extend ID card travel for groups of under-18s from the EU.

- Recognise UK ELT's accreditation scheme for immigration purposes.

- Increase government marketing support for UK ELT.

- Increase rent-a-room relief to help address our capacity challenge.

Ms Gray added:

“We believe all of our six recommendations could be adopted by any political party without major cost or compromise, and we will use these to campaign into the general election and beyond.”

For additional background, please see:

- “Canada’s language training sector continues to strengthen amid new immigration settings”

- “Irish ELT market continues to exceed pre-pandemic levels of business”

- “UK confirms easing of travel rules for French school groups”

- “Global ELT market estimated to have recovered to 90% of 2019 levels in 2023”