US ELT sector continues a gradual recovery

- Intensive English programmes (IEPs) in the United States recovered to roughly 72% of pre-pandemic volumes in 2023

- This lags behind the rate of recovery noted in other major English-speaking destinations, and it appears that visa processing – including high rejection rates for IEP-bound students – continues to play an important role

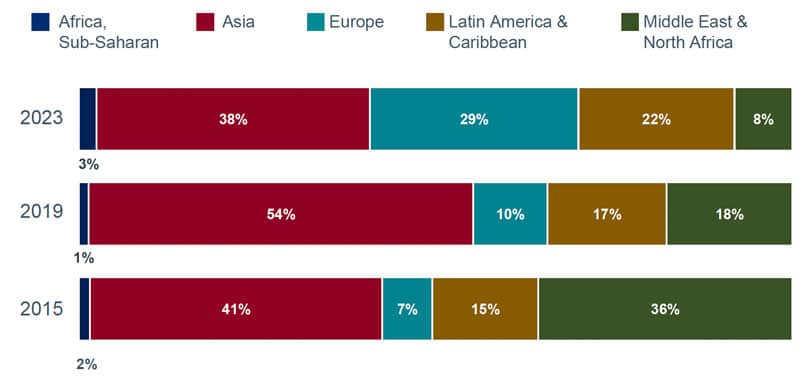

- The student mix is changing as well with an increasing share of total IEP enrolment coming from Europe and Latin America, as opposed to the historical leader: Asia

Intensive English programmes (IEPs) in the United States are reporting more modest growth for 2023, after a post-pandemic surge the year before.

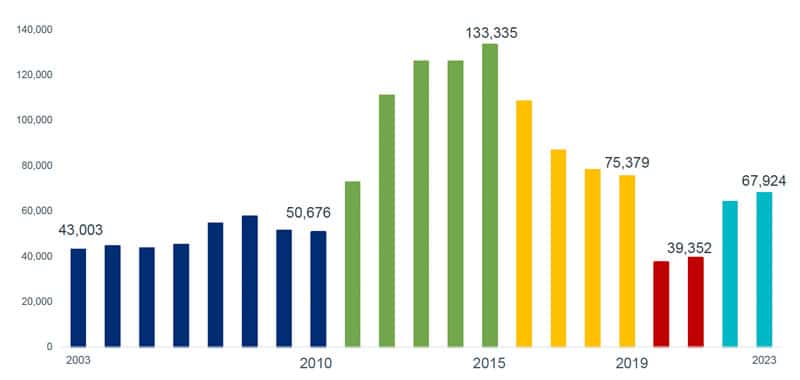

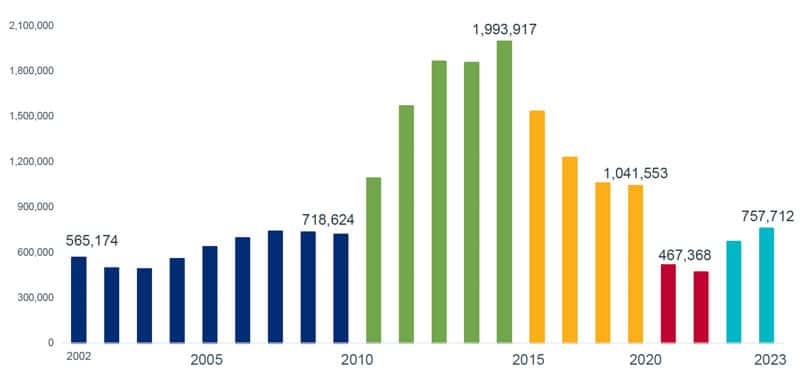

The latest data from IIE's annual survey of IEPs was released at NAFSA last week. The 700+ responding centres reported a combined enrolment of 67,924 students for 2023, representing a 6% year-over-year increase, and a total of 757,712 student-weeks (+13% compared to 20222).

Comparing 2023 enrolment levels to those from 2019, the IEP sector has now recovered to roughly 72% of pre-pandemic volumes, in terms of student-weeks. This suggests the US is lagging behind other major ELT destinations in the pace of its post-pandemic recovery. A recent analysis from BONARD indicated that globally the sector had recovered to 90% of pre-COVID levels.

BONARD's analysis referred to visa processing issues – high rejection rates in particular – as a factor dragging on the sector's recovery in the US. This is reflected as well in a flash survey of EnglishUSA members conducted in spring 2024, in which respondents cited "visa issues" as the leading factor in any downward pressure on enrolment growth though 2024.

Where students come from

The top five countries of origin for US IEPs in 2023 were: Japan (16%), France (8%), Brazil (7%), China (6%), and Italy (5%). Those five combined accounted for nearly half of IEP enrolment last year.

The top ten list is rounded out by South Korea (5%), Saudi Arabia (4%), Taiwan (4%), Colombia (4%), and Germany (3%) – meaning that those leading ten sending markets accounted for nearly two-thirds of all IEP enrolments in the US in 2023.

Notable movers among those countries of origin include, Brazil and Italy, which continued to work their way up toward the top of the list in 2023. By contrast, China (from 3rd in 2022 to 4th in 2023), South Korea (from 5th to 6th), and Colombia (from 6th to 9th) all slipped down the ranking in 2023.

That shifting student mix is well illustrated in the following chart, which tracked IEP enrolments by world region. It reflects a falling proportion of US IEP enrolments accounted for by students from Asia, while the combined percentage of European and Latin American students has more than doubled since 2015.

Other key stats

The IIE data also described a slight uptick in length of study for 2023, with IEP students enrolling for an average of 11 weeks. It also reveals that more than one in four IEP students (27%) intend to go on to further studies in the US after their language programmes.

For additional background, please see: