How have changes in policy settings impacted international student recruitment at Australian universities?

- It is more expensive for international students to apply to, and enrol in, Australian universities in 2025

- Universities affected by the “soft cap” of Ministerial Direction 111 face the greatest recruitment challenges in the sector

- But external factors in the other three of the Big Four may benefit Australia in general

Over the past couple of years, Australian universities have been operating within a policy framework that makes it more challenging to recruit foreign students, and especially so for some institutions. According to Studymove’s Keri Ramirez, this is leading to greater variability in recruiting strategies across the Australian university sector. Mr Ramirez hosted a webinar in late June in which he analysed enrolment trends and current conditions for university operations.

Ministerial Direction 111 (MD111), introduced in 2023, is effectively a soft cap for universities considered by the government to have grown their international enrolments to undesirable levels, or to have increased them too quickly or irresponsibly. Those universities are subject to a less favourable visa processing environment than others in the sector.

As a result, says Mr Ramirez, what was a fairly level playing field for recruitment – in terms of policy constraints – is now not. One group of universities is growth-constrained, and the other is able to recruit more or less the same way as before the introduction of MD111.

Universities with growth potential tend to be focused on increasing their market share. Those that are constrained are attempting to maximise revenue, often by significantly raising international tuition fees.

Challenges for all Australian universities

An analysis Mr Ramirez presented earlier this year found that the average tuition fee hike over the past year for growth-constrained universities is 5.5% compared with an average increase of 4.9% in the other group. Both groups, however, have raised fees more aggressively than in 2023, when the average increase across the board was 3.5%. This is because even universities that can still recruit as intensively as before MD111 still have more challenges than in 2023. These include:

- The governing Labor Party's increase in the application fee for an Australian study visa from AUD$1,600 to AUD$2,000;

- A 2024 increase in the financial requirements for foreign applicants to AUD$29,710, the highest of the Big Four destinations.

Clearly, the financial cost of studying in Australia for international students is much higher than in 2023, no matter which university they are considering.

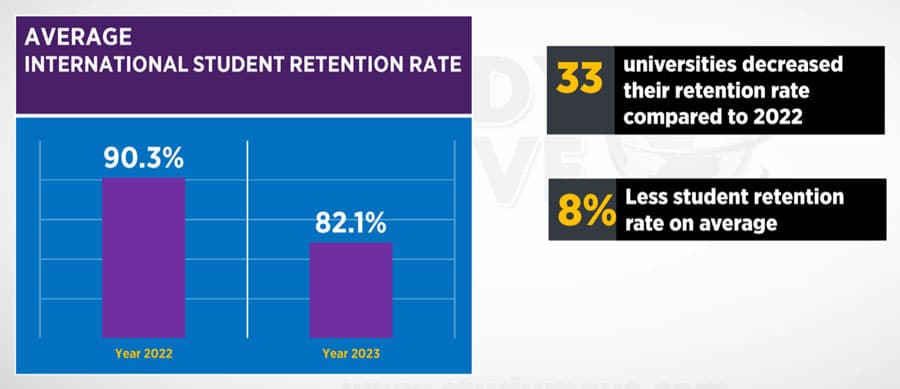

Retention matters

Increasing the degree to which students remain in their programmes for the full duration – i.e., the retention rate – has never been more important, particularly for Australia’s growth-constrained universities. Mr Ramirez notes that the retention rate worsened in 2023 versus 2022, a trend that universities can ill afford considering all their other challenges.

Reason for cautious optimism

Mr Ramirez predicts a 5–10% reduction in international student commencements in 2025 compared with 2024, following very modest growth in 2024 over 2023. The effect of higher financial requirements and policy is apparent in the discrepancy between the predicted decline this year and the fact that international commencements were actually 7% higher in 2023 than in 2019, when the recruiting environment was less restrictive.

That said, on the domestic side, Mr Ramirez said there is room for cautious optimism for two reasons:

- Inflation having come under control, which provides a level of comfort to families considering higher education;

- A softening labour market, which may convince more students to study rather than look for a job.

Across the Big Four, downward pressure on international student demand

Another factor that could positively influence both domestic and international enrolments is the external competitive context. President Trump’s anti-immigrant stance and his government’s harsh treatment of some international students is likely to greatly deter foreign students from studying in the US. In Canada, visa approval rates are tanking (45% in 2024 compared with 62% in 2023) and it is more difficult for many students to follow an immigration pathway after studying. And in May, the British government introduced a plan to reduce international student numbers and to limit the popular Graduate Route to 18 months (from 24).

In short, universities in all Big Four destinations face new recruiting challenges in the form of policies, but American institutions are arguably the most affected due to the shocking treatment of immigrants in the US and the effect this has on student demand. Already, a NAFSA survey has found a 13% drop in postgraduate enrolments for 2025/26, and separately, CommonApp data released in March showed that international student applications to US institutions in general were down 1%.

For additional background, please see: