Analysis shows impact of immigration settings on international tuition fees at Australian universities

- A new analysis of tuition fees and tuition fee increases for international students applying to Australian universities highlights the effects of the volatile policy environment in Australia on university operations

- Pricing strategies for international student tuition used to be quite uniform across Australian universities, but the volatility of government policies over the past couple of years has led to great uncertainty and to greater variation in tuition fees across the university sector

Keri Ramirez, managing director of sector data specialist Studymove, hosted a fascinating webinar recently that looked at the factors influencing Australian universities to set their pricing strategies in 2024/2025. Mr Ramirez noted that determining pricing is complex for any organisation, but perhaps particularly so for universities facing challenges due to volatile immigration settings.

Across the 40 Australian universities Studymove analysed, enrolment fees for international students rose by 5.2% between 2024 and 2025, compared with only 3.5% in 2023, bringing the year-over-year increase rate back to a level not seen since 2019. Underlying the broad trend is sector-wide unease with ever-changing policies as well as inflationary pressures.

Behind the average 5.2% increase are important underlying trends influenced by which universities are most and least negatively impacted by a current Australian immigration directive called Ministerial Direction 111 (MD111).

Policy context

Over the past two years, the Australian government has introduced a number of measures to control the flow of international students into Australia, including proposing, and subsequently withdrawing, legislation to establish a cap on foreign enrolments. There are currently no formal caps on new international student numbers. However:

- As a result of the government’s Ministerial Direction 111 (MD111), enacted in December 2024, individual universities have received guidance about how they should target foreign enrolment levels. Some institutions have been given the green light for growth, while others have been told to constrain their international recruitment.

- MD111 instructs the immigration department to adapt visa processing (including times, approvals, and rejections) according to those groupings, which is in effect controlling the general flow of students (1) from certain countries and (2) into different institutions.

How MD111 has changed the pricing landscape

Mr Ramirez notes that the MD111-created groupings of universities is a large factor in the more variable pricing models that are being observed in Australia this year. Specifically:

- Growth-constrained universities are tending to raise international student tuition fees more than those without constraints. Their revenue potential has been sapped by de facto enrolment caps, so they need to find ways to make up the difference. Their average international tuition fee hike over the past year is 5.5%.

- Those with room to build international enrolments are more likely to be working to increase their market share. They have room to increase their volume of international students, and so are less pressed to raise tuition to the same extent as the other group. Their average international tuition fee hike over the past year is 4.9%.

A wide range of pricing models

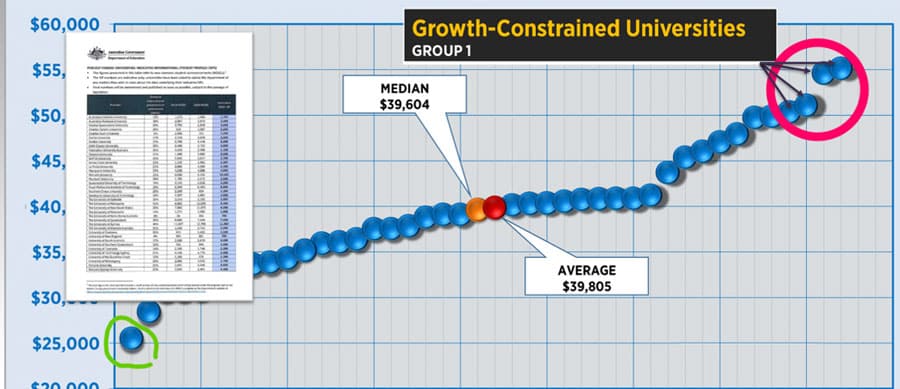

The chaotic environment over the past couple of years has led to a very wide range of undergraduate tuition fees charged to international students across the 40 universities Studymove analysed. Each blue dot in the following graph represents one of those universities. The average fee is AUS$39,805, but the extremes are AUS$25,000 at the low end and AUS$55,000 at the high end.

Looking at those extremes, the university charging international undergraduate students AUS$25,000 – the first dot on the graph – reduced its fees by 17% to claim a position around value for money. Not coincidentally, this university falls under the “potential to grow” grouping according to MD111 calculations. By contrast, in an unprecedented move, four universities have set their international undergraduate fees at or higher than $50,000 in 2025. As you might already have guessed, those are large universities that are growth-constrained under MD111. Those two examples highlight the very different pricing discussions going on in universities around Australia.

Fewer scholarships

The height of scholarship-giving to international students was 2021, when Australian universities collectively offered 632 scholarship programmes to international students. In 2025, this has fallen to 494, lower even than in 2018, before the COVID-19 pandemic. As Mr Ramirez notes, this decline is understandable especially when it comes to growth-constrained universities, because scholarships tend to boost international student enrolments. More broadly, many Australian universities are facing financial challenges, so that is also part of the decline.

Country-specific scholarships are also much less common in 2025. This year, 65% of Australian universities offer at least one country-specific scholarship. Last year, it was 70%. In 2024, India, Sri Lanka, Indonesia, and Vietnam were the countries in which the most scholarships were offered. In 2025, it was Vietnam, Indonesia, Philippines, and Malaysia in the top four. India has been bumped to number five, and Sri Lanka to number six. Other top ten countries, Nepal and Pakistan, have been bumped out of that tier. This reflects to a large part the countries in which visas for Australia are most likely to be rejected.

The profound effect of government policies

The disruption created by the implementation of new government policies is clearly adding challenges to the already-complex decisions that Australian universities make when setting pricing strategy for international students. These policies – and the uncertainty around them – are creating additional considerations for all Australian universities re: pricing, but they are especially affecting for the 14 universities that Ministerial Direction 111 has identified as needing to curb new international enrolments.

For additional background, please see: