Brazilian market showing its strength this year

- Brazilian agents are reporting growth through September this year with language programmes and courses for juniors leading the way

- Demand for study abroad remains strong but economic headwinds remain a challenge for outbound students

Brazil has long been one of the most important student recruitment markets in Latin America. Outbound mobility patterns fluctuate, especially in relation to economic headwinds or shifting currency values, but the market is notable for its scale and for the continuing strong demand for study abroad on the part of Brazilian students.

Speaking at ICEF Berlin this week, Alexandre Argenta, president of Brazilian Educational and Language Travel Association (BELTA) and CEO of TravelMate Intercâmbio, presented the findings from the latest cycle of the BELTA Seal market research programme.

The survey was conducted in October 2022 and drew responses from 756 respondents, roughly 80% of which were BELTA member agencies.

The headline finding for this year's survey is that 55% of respondents are reporting growth year-to-date through September. This is 13% higher than the proportion of agents that reported growth for the same period in the 2019 BELTA survey. This is perhaps not surprising given the overall recovery in outbound mobility in countries around the world, but it nevertheless an encouraging observation for such an important sending market.

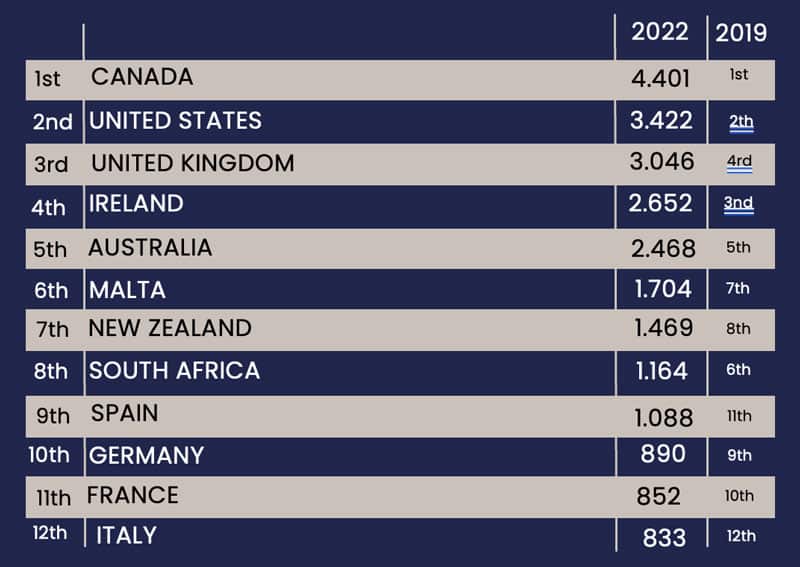

This year's findings reflect some important pre-pandemic demand patterns with the top destinations for Brazilian students once again Canada, the United States, UK, Ireland, and Australia.

And once again we see that language study remains the key programme area for Brazilian students, followed, quite interestingly, by programmes for junior students, secondary schools, and work-study courses.

Mr Argenta noted that the main factors driving demand this year were the easing of concern and public health measures around the pandemic, alongside more durable factors for Brazilian students, including an interest in gaining a competitive advantage in the labour market and a strong underlying demand for language study.

In contrast, factors that are dampening demand this year are the devaluation of the Brazilian currency (the real) against other world currencies, and increasing costs for flights and housing abroad. The real is a relatively volatile currency, which is of course impacted by global economic trends as well as the political and business outlook in Brazil.

For additional background, please see: