Brazil: Affordability will be key to unleashing demand for study abroad

- The Brazilian economy is showing some signs of recovery and consumer spending is strengthening

- Demand for travel is strong among Brazilians, as is demand for study abroad

- Students and their families are far more likely to be financially stretched than before the pandemic

- Scholarships, strong relationships with agents, and providing work opportunities will be major determinants of being able to attract Brazilian students in the next few years

Brazil remains severely affected by COVID-19 infection rates, but a year and a half into the pandemic, the country’s economy is beginning to rebound, at least in certain sectors. Gross Domestic Product (GDP) grew by 1.2% in Q1 2021 to return to a pre-pandemic level, driven in part by 5.7% growth in the agricultural sector.

Brazilians are also looking to a brighter future complete with travel to exciting places. Nearly two-thirds (63%) of Brazilians surveyed recently by Booking.com said that travel has become more important to them than before the pandemic, and 70% would be willing to prove that they were fully vaccinated in order to enter international destinations.

Before the pandemic, the Brazilian outbound student market had recovered after a steep decline around 2015, increasing by 20.5% in 2018, with a then-record 365,000 students studying abroad during that year. Outbound numbers grew again in 2019, by nearly 6%, to reach 386,000 students abroad that year.

Demand remains exceptionally strong for study abroad in Brazil. For example, Brazilian students’ applications to US institutions on Common App, a standardised college application form used by nearly 900 higher education institutions in the US and other countries, surged by 41% in 2020/21 compared with 2019/20. This increase was the highest of all nationalities on the platform; Pakistan was next with a 37% increase, while Chinese students’ applications fell by 18%.

Economic hardship will dampen ability to fund studies

As much as the Brazilian economy is returning to growth overall, that recovery is uneven across sectors and the country is being hard-hit by record-high unemployment rates, inflation, and the declining value of the real currency, which fell against the US dollar by -29% between 2019 and 2020.

Adriana Dupita, a Latin America economist for Bloomberg says,

“The number of people working is still 8.3% lower than pre-pandemic levels…and total labor earnings remain depressed. A sustained recovery in labor market conditions depends crucially on the pandemic outlook.”

The weak real means that international travel and study will be more expensive for Brazilian students. This is a crucial consideration for educators in Australia, Canada, France, Ireland, Malta, Portugal, the UK, and the US, all of which have substantial investments in growing the size of their Brazilian student numbers. Brazil sends thousands of students out every year for ELT studies, and the number of degree-seeking Brazilian students has also been on the rise.

The potential negative impact of the real’s devaluation can also be imagined given the huge impact of exchange rates on Brazilian students’ choices about study abroad. In 2019, when the Brazilian Educational and Language Travel Association (BELTA) asked Brazilian students which factor was the most influential in where they chose to study abroad, “favourable exchange rate” was the most-cited influence.

Affordability will trump many other factors

Brazil is forecast to be among the top five countries worldwide in terms of total tertiary enrolments by 2035, making it exceptionally fertile ground for student recruitment. There is no time like the present to be thinking about how to help Brazilian students to study abroad once borders open again.

Even before the pandemic, many Brazilians chose neighbouring Argentina for study over farther-flung destinations due in large part to affordability. Going forward, once Brazil’s and Argentina’s COVID crises ease, this mobility flow may become greater due to reduced ability to spend among many Brazilian families.

An example of how much financial hardship may impact Brazilian outbound can be found in recent study permit approval trends in Canada. In 2019, Brazil was Canadian institutions’ fifth-largest source market, helped along by the fact that Brazilian students’ study permits were (and continue to be) among the most likely to be approved of any international student permit applications. But study permit approval rates issued to Brazilians fell more steeply for Brazilian students than for any source country other than Jamaica last year: from 83.2% in 2019 to 62.8% in 2020. The main reason for the lower approval rates reported in 2020 was the students’ inability to meet financial requirements.

Financial incentives and the ability to work

Canada is not the most expensive of the leading destinations, and Brazilians’ ability to go to Australia, Europe, and the US will likely be at least as challenged. Offering more scholarships (or even flexible payment terms) going forward may be a crucial way of maintaining share of the Brazilian market and keeping Brazilian student populations healthy and thriving on campuses after the pandemic.

The ability to work while studying and to have the opportunity to secure a job/permanent residency afterwards in a host country will also be a major draw for Brazilians. In 2019, BELTA attributed the growing popularity of Malta to new Maltese policies that opened up more opportunities for visiting students to combine study and work.

Agent support will be key

Finally, many educators right now are increasing both their use of agents in local markets as well as the quality of their relationships and communications with agents. This will be key in Brazil as well. These partnerships are key as institutions remain hindered in in their ability to send their own institutional staff out to target markets. Working with trusted agents and equipping them with excellent information for students and their families can help to keep demand alive in Brazilian households for institutions’ programmes. BELTA noted in 2019,

“Although most students started searching on the Internet and having the first contact with the agency online, 67% of them completed the purchase in the physical agency and the rest bought through online tools. This represents that personal care is still what brings security to this student.”

A recent ICEF Agent Voice survey among over 1200 agents from 108 countries found that 49% reported that communications with students have gone up since last year, and 16% said they are about the same. A strong majority said they have either increased or maintained their communications with educators as well and 74% have actually entered into new partnerships with schools/universities.

When will more Brazilians be able to travel again?

The answer lies in part in when enough Brazilian students become fully vaccinated, as all destinations now require proof of full vaccination to allow international students in. The vaccination rollout in Brazil has been tragically slow given the high rates of infection and death, but this is expected to pick up soon. A recent report from FecomercioSP (Federation of Commerce of Goods, Services and Tourism of the State of São Paulo) says,

“Brazil should reach high rates of vaccination in the second half of the year, and the forecast is that the process is ended between October and December. In São Paulo, all adults are expected to have received at least the first vaccine dose by September.”

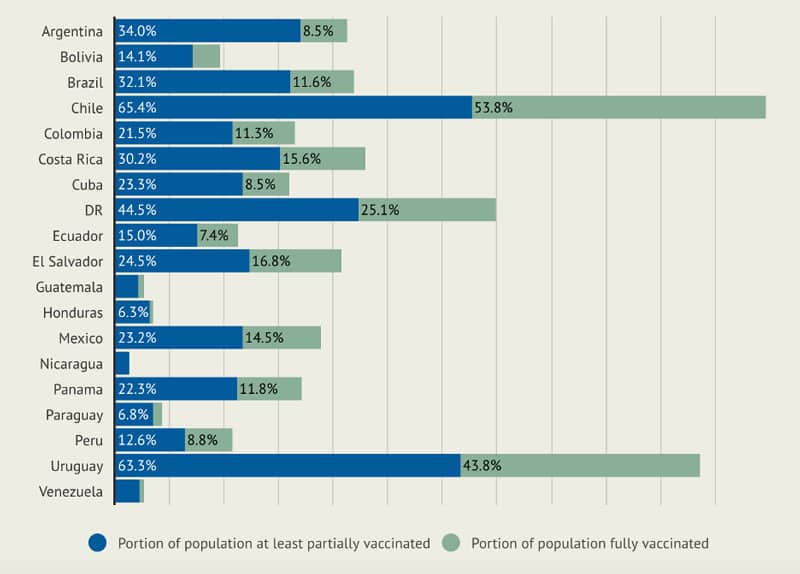

At the end of June, this was how Brazil’s vaccination rollout was progressing versus the rest of Latin America according to American think-tank AS/COA:

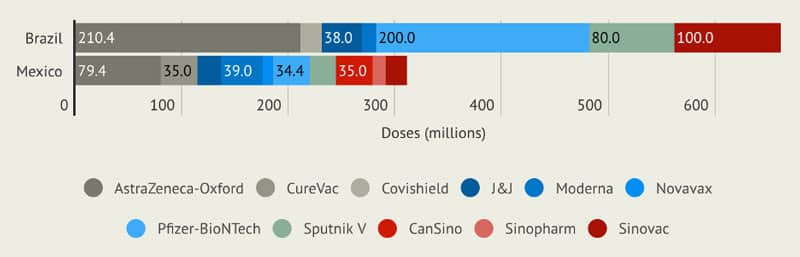

One unknown is what percentage of Brazilian students will be given vaccines approved by the destinations they want to travel to. A number of vaccines, including Russia’s Sputnik-V and China’s Sinovac, have been contracted by Brazil, as shown below. Currently in Canada, only international students with Pfizer, Moderna, AstraZeneca/COVISHIELD, or Janssen (Johnson & Johnson) are allowed to enter without quarantine, and other Western destinations will have their own criteria and exclusions.

Keeping students well supported a priority

Especially because of all the pandemic-related hurdles facing Brazilian students wanting to study abroad right now, keeping communications steady and encouraging with them and with agents in Brazil is crucial. Just as important is making sure current Brazilian students enrolled with your institution are well supported in every way, not the least in terms of financial supports/flexibility and mental health counselling if needed. As Brazilian Senator Omar Aziz told The Guardian this month,

“There is no Brazilian today who does not know someone who died from COVID, no Brazilian who has not lost a family member, a neighbour, a friend.”

For additional background, please see: