Brazilian outbound recovery projected for 2022

- With borders reopening and visa processing underway again, Brazilian students are going abroad in greater numbers this year

- The market is expected to recover to pre-pandemic volumes by 2022, aided by an expanding vaccination programme and relative stability in currency exchange rates

Brazil is the largest student market in Latin America and has been an important growth driver of student mobility over the past decade. The most popular destinations for Brazilian students are Canada, the United States, the United Kingdom, Ireland, and Australia, and those preferences have been fairly stable in the years leading up to the pandemic.

Speaking at ICEF Virtual Latin America 2021 this week, Alexandre Argenta, President of the Brazilian Educational and Language Travel Association (BELTA), shared recent research on the Brazilian market commissioned by Education New Zealand. It shows that that destination ranking is holding steady during COVID, with Canada, the US, the UK, Australia, New Zealand, and Ireland still the most popular choices among Brazilian students.

Surveys of both Brazilian agents and prospective students found that Canada, Australia, New Zealand, and the UK were most highly rated among leading destinations for their pandemic response and perceived safety. Those parallel surveys also clearly showed, however, that student confidence or readiness to undertake study abroad generally lagged behind agents' perception of destination readiness to receive students.

Mr Argenta, who is also the CEO of the TravelMate Intercâmbio agency, noted that those same student surveys indicate that 90% of Brazilian students are waiting for the opening of borders of their intended destination countries before investing in studies abroad. "At this point during the pandemic, students tend to start organizing or re-organising their exchange programme abroad to countries that have started to process and issue student visas. Canada and the US are the first destinations that started to process student visas so that has helped to put those countries at the top of our list."

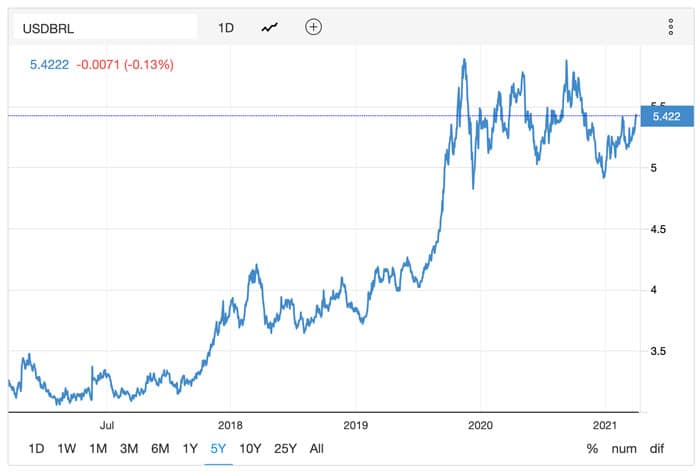

Mr Argenta also highlighted the important role of financial factors in student planning, including currency exchange rates and flexibility in payment plans. "In Brazil, the currency exchange rate is always fluctuating so the agents are forced to organise – through their own funds or with the help of banks or Credit card companies – different payment options for clients," he explains. "Not everyone comes to the agency and pays for their programme with one payment. Brazilians are culturally used to paying things in monthly installments."

The immediate outlook

"Throughout the pandemic, the main courses chosen by Brazilian students were, number one, higher education, [then] high school, and then language courses," said Mr Argenta, who added as well that this had a lot to do with how destination countries began to tackle visa application backlogs this year. "Countries that restarted processing visas for Brazilians, they started with higher education programmes, and then high school programmes, and then only [in September 2021] they started processing visas for language programmes."

BELTA estimates that roughly 390,000 Brazilian students went abroad in 2019, and that member agencies sent only about 25% of that volume in 2020. The association expects that outbound volumes will recover to roughly 50% of 2019 levels this year, and then will reach or exceed pre-pandemic numbers in 2022. "When borders are 100% open for Brazilians once again, and consulates are processing visas once again, we should be able to see the market back to normal."

That outlook will be buoyed by continuing progress in Brazil's COVID vaccination programmes. The rollout is going slowly but as of September 2021, just over 40% of the population is fully vaccinated against the virus.

Meanwhile, the Brazilian currency, the real, has depreciated significantly against the US dollar since 2018 (see chart below). It has however stabilised over the past year and is largely expected to hold its current value over the next 12 months.

For additional background, please see: