Canada: How is study permit processing taking shape this year?

- The latest data highlights a substantial decline in the volume of new study permit applications in Canada for the first half of 2025

- That pattern, combined with historically low approval rates, could result in another significant shortfall this year in the number of study permits granted relative to Canada’s enrolment cap for 2025

There are two important and recurring themes in our conversations with education agents over the last few months when it comes to study permit processing for Canada. Experienced agents are reporting long delays in processing along with a greater percentage of study permit applications that are being declined. Both processing times and approval rates vary from market to market and by level of study, but the overarching observation is of a study permit system that is hindered by processing capacity and by a more restrictive approach to assessing study permit applications.

In many ways this extends the story we found in the actual data for 2024, the first year under Canada's current enrolment cap on new foreign enrolments and a year in which:

- The number of new study permits issued fell by -48% compared to 2023

- The total volume of study permit applications fell by nearly a third compared to 2023

- The overall approval rate for the year fell to 48% (from nearly 60% the year before)

We do not yet have comparable data for 2025, but the early indicators are that those trends are continuing – and in some ways deepening – into this year.

First, the initial IRCC data on the number of applications processed for new study permit applications points to a troubling decline in overall application volumes for the first half of 2025.

In the first two quarters of 2024, IRCC processed 290,635 new study permit applications, or just over half of the total number of applications received for that year.

The IRCC data for year-to-date 2025, however, indicates that only 143,485 new study permit applications were processed between January and June of this year. That represents a roughly -50% decline in overall application volumes over the first two quarters of 2025.

If the same distribution of new study permit applications from 2024 plays out again this year, that could mean that total application volumes will drop to something in the range of 290,000 student files for 2025, down from just under 580,000 in 2024 and just over 860,000 in 2023.

And if approval rates remain around 2024 levels – with roughly half of all applications refused – then that could mean that the number of new study permits granted for the year could fall significantly below 2024 levels. And that will also put them considerably below the official enrolment cap for 2025.

Why are rejection rates climbing?

An analysis from ApplyBoard finds that in 2024 the most common refusal reason cited by visa officers was that the officer was unconvinced the applicant would leave Canada at the end of their stay. "The extensive use of this reason last year suggests that many applicants are perceived as having permanent residency as their primary purpose, instead of study," says ApplyBoard.

The other major factor in rising rejection rates appears to be concern, on the part of visa officers, that applicants may not have access to sufficient financial resources. The increasing citation of this reason for refusal may in turn be tied to increases in the financial requirements thresholds in Canada over the last 18 months.

Study permit applicants are expected to demonstrate that they have sufficient funds to pay for tuition fees for their planned programme of study as well as living expenses while in Canada. On 1 January 2024, the cost of living requirement for a single study permit applicant was raised to CDN$20,635, a notable increase from their previous threshold of CDN$10,000 that had been in place for roughly 20 years up to that point. A further increase will come into effect on 1 September this year, raising the threshold for a single applicant to CDN$22,895.

A related examination of Q1 and Q2 data for 2025 by BorderPass indicates that approval rates improved over the first half of the year. That analysis finds, however, that approval rates remain variable by sending market. Applications from China, for example, are now trending at above 65% approval rates whereas rejection rates for Indian applicants continue to rise.

BorderPass adds, "One thing is clear: institutions prioritising quality and readiness are winning. Schools using application intelligence – whether by tightening documentation review, prioritising travel-readiness, or working with legally backed partners – are seeing dramatically better outcomes."

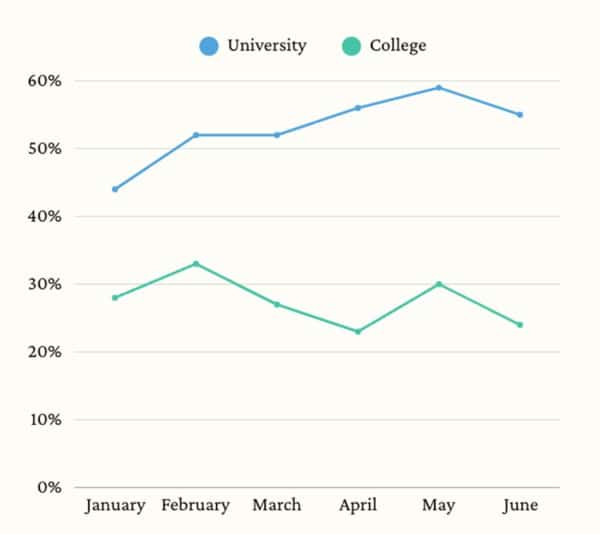

BorderPass also points out that approval rates vary by institution type, explaining that, "When we looked at the top 20 high-volume universities and 20 high-volume colleges across Canada, the contrast between universities and colleges was clear…Universities outperform colleges consistently (averaging [approval rates of] 45–59% vs. 23–33%)." That analysis finds as well that approval rates for universities are trending upward through the first half of 2025 (as illustrated in the chart below) whereas those for colleges remain more volatile.

For additional background, please see: