China now the leading host for international branch campuses

A new report from the Observatory on Borderless Higher Education (OBHE) points to continued growth in the number of international branch campuses (IBCs) worldwide, but notes as well that much of that growth has been concentrated in Asia.

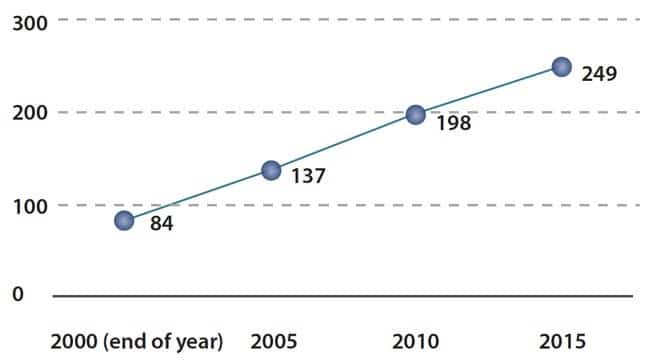

Co-authored with the Cross-Border Education Research Team (C-BERT), International Branch Campuses, Trends and Developments, 2016 reveals that there are now 249 IBCs located in more than 70 countries. These offshore campuses are “owned, at least in part, by a foreign education provider; operated in the name of the foreign education provider; and [provide] an entire academic programme, substantially on site, leading to a degree awarded by the foreign education provider.” OBHE Senior Researcher Rachael Merola describes IBCs as “the most ambitious kind of cross-border higher education,” and as initiatives that redefine “institutional identities and national systems”.

OBHE estimates that there are at least 180,000 student enrolled in IBCs today, but the report adds some important context as well in noting, “This is a significant number in absolute terms but is equivalent to less than 4% of the five million international students in the world…and a tiny fraction of the 150 million+ higher education students globally. In a few countries, such as UAE, IBCs constitute a significant proportion of total higher education enrolment; but in most they are niche players.”

“The relative ease of student and programme mobility, compared to the institutional mobility inherent in a branch campus, suggests IBCs will remain substantially niche operations. The open question is whether over time IBCs of a certain type or within certain countries will achieve a stronger reputation for capacity and quality at scale, influencing national policies and institutional brands. IBCs, in all their diversity, have much room for growth.”

On that note, OBHE reports that 66 new IBCs were established between 2011 and 2015. On the heels of a roughly equivalent number of new IBCs launched from 2006-2010, the absolute growth in IBC numbers has been quite stable over the decade. In addition to the new IBCs opened over the last five years, the final tally for 2015 also reflects the 15 campuses that closed or changed status during that same period.

Importers and exporters

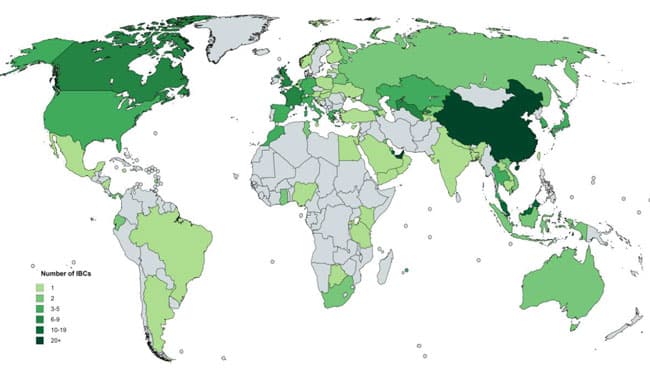

The number of countries hosting IBCs has increased somewhat since 2011: 76 countries host IBCs today, which represents a 10% increase over the 69 host countries that were active as of early 2011. The top five hosts are now home to nearly four in ten IBCs (39%): China (32 IBCs), the United Arab Emirates (31), Singapore (12), Malaysia (12), and Qatar (11).

Most Recent

-

ICEF Podcast: Together for transparency – Building global standards for ethical international student recruitment Read More

-

New analysis sounds a note of caution for UK immigration reforms Read More

-

The number of students in higher education abroad has more than tripled since the turn of the century Read More