Further private college closures predicted in US

In 2015, Moody’s Investors Service famously predicted that the number of small US colleges that would close annually would triple by 2017. In the analysts’ frame of reference, “small” describes a private institution with annual revenues of under US$100 million, or a public institution with revenues below US$200 million.

At the time that it published this earlier analysis in 2015, about five small US colleges were closing each year. The expectation, therefore, was that that number would spike up to roughly 15 colleges per year as of about a year ago.

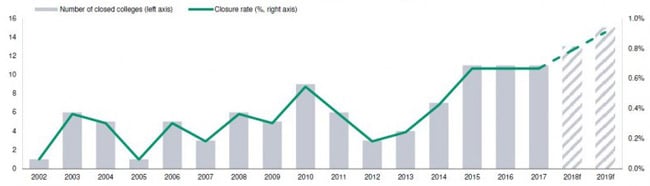

An updated analysis published this week (subscription required) reveals that this dramatic increase in closures has not yet come to pass, with an emphasis on the “yet”. The number of college closures in the US, however, continues to trend upward and Moody’s still expects that the number of institutions forced to wind up operations will reach up to 15 per year as of 2019 or 2020.

As the following chart reflects, the number of closures will hover between 10 and 12 institutions per year for 2017 and 2018, and is expected to continue climbing through 2019.

Confidence falling among finance executives

In a related development, Inside Higher Ed’s 2018 Survey of College and University Business Officers finds a growing financial pressure facing private colleges in particular, and a corresponding decline in the confidence of the executive financial admin staff at US institutions. Responding to this year’s survey, just under half (44%) of the chief financial officers at four-year undergraduate colleges say they are confident of their institution’s financial stability over the next ten years. This is down from 52% in 2017, and 54% in 2016. Reflecting a growing gap between costs and tuition revenues that was also observed by Moody’s, more than two-thirds of the 2018 survey respondents (68%) acknowledged that their tuition discount rates are no longer sustainable. This compares to the 59% of responding financial officers who said the same in 2017’s survey. In response, most US colleges are indicating that they will reduce tuition discount rates, expand enrolment, and introduce new “revenue-generating programmes” – as opposed to eliminating underperforming programmes or other cost-cutting measures. For many colleges, any such initiatives to build enrolment will largely focus on full fee-paying students, including those from overseas. Even so, the resilience and adaptability of smaller US colleges will continue to be tested in the years ahead. The overall context for US higher education is one of declining total enrolment with a net decrease (from a recent-year high in 2012) of more than 800,000 students through 2016. For additional background, please see: