UK confirms levy on international student fees as new analysis argues that government is “drastically underestimating” the impact of the move

- The UK government has confirmed that it will introduce maintenance grants for disadvantaged students with the new supports to be funded by a levy on international tuition revenues earned by universities in the country

- The Home Office expects some drop-off in student demand, since universities would likely have to increase international fees to absorb the cost of the levy

- An analysis by consultancy Public First says the government is significantly underestimating just how much demand would fall, especially from non-EU markets

Updated for 30 September 2025: On 29 September, the Department of Education announced that it would reinstate "means-tested maintenance grants for higher education – at college or University – paid for by a new levy on international student fees" for "disadvantaged students studying priority courses." The prioritisation of fields of study is not expanded on as yet, except to note that they will be courses that are aligned with the government's industrial strategy.

Reaction from the higher education sector was swift and universally critical of the move. "Extra money to support students from diverse backgrounds to study courses critical to economic growth is the right idea – but this would be executing it in the wrong way," said Universities UK Chief Executive Vivienne Stern. "A levy on international students will not help disadvantaged students, it will hinder them. As emerging evidence already shows, it would reduce the number of places available for domestic students and mean universities have even less of their scant resource to invest into expanding access and supporting students."

The UK Council for International Student Affairs added, "International students invest hugely into their decision to study in the UK, and they are entitled to expect that their fees will be invested to support their academic and pastoral experience. We urge the government to consider the ethics of using their tuition fees to subsidise activities that bring them no direct benefit...Whether through higher fees to make the UK unaffordable, or through restricting activity at institutions trying to cover costs, this levy risks damaging the experience of all students in higher education."

"The ultimate irony is that the levy will mean fewer places for UK students as a portion of international fee income is already used to offset the deficit on teaching undergraduate courses," said a statement from the Russell Group universities. "It will also undermine the significant investment universities already make in bursaries, hardship funds and other measures designed to support students…The levy is a terrible policy that will damage universities at a time when they are already facing financial challenges."

–––

A new analysis from policy think tank Public First attests that a policy proposal from the UK Home Office would depress international student demand far more than government strategists have factored into their math.

As part of an effort to further tighten immigration to the UK, the Labour government released a whitepaper in May 2025 entitled “Restoring Control over the Immigration System.” The paper sets out a series of measures aimed at reducing the flow of foreigners into the country. One of the proposed policies is to impose a 6% flat levy on all international fee income earned by UK universities, to “be reinvested into the higher education and skills system.” The whitepaper states:

“In 2021, international students at UK universities generated an estimated £20.65 billion in exports through living expenditure and tuition fees, but it is right that these benefits are shared.”

To cope financially with the levy, many UK universities would need to increase international tuition fees. Those fees are already some of the highest in the world. For years, the UK’s stellar reputation for educational quality has braced it against a drop in demand due to the cost of studying in the country, but a further hike in fees could change this.

Non-EU countries – with strong representation from Asia and Africa – send 90% of the current volume of international students in UK universities. It is those countries in which a rise in tuition fees could have the greatest impact on demand, according to Public First.

The analysis points out that the government’s rationale for the 6% levy is flawed because it is based on a London Economics estimate of price elasticity of demand of EU students from 2021. This assumes that this level of price elasticity would be the same for non-EU students in 2025. However, says Public First, price elasticity in non-EU markets is almost three times higher than in other sending countries. Because of this:

“[The government] is drastically underestimating the impact of price increases on demand; almost three times the number of non-EU students would be put off coming to the UK than predicted by the 2021 estimate, in the first year of any price rise.”

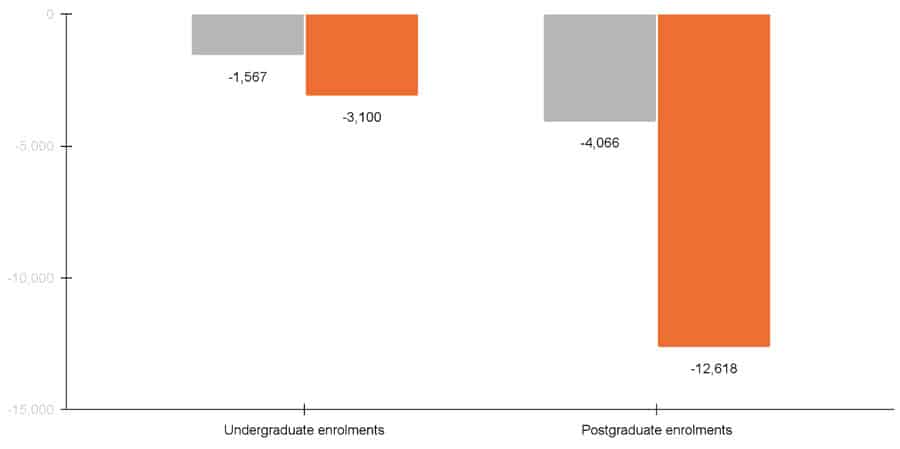

London First estimates that if tuition fees were to rise by 6.38%, around 4.68% fewer non-EU students will enrol in the first year that any levy is introduced. More granularly, these are the forecasts:

- A decrease of 5.17% of non-EU postgraduate students

- A decrease of 3.38% of non-EU undergraduates

- A permanent contraction of non-EU enrolments at both the undergraduate and postgraduate levels (1.53% and 2.94%, respectively)

- A loss of more than 16,000 international students in the first year alone of the levy and an associated loss of £240 million in fee income

- A loss of 77,000 students over five years and an associated loss of £2.2 billion in fee income

Broadly speaking, London First believes the UK will lose 10,000 more international students than expected by the Home Office in the first year of a 6% levy.

London First expects that the cities that would be hardest hit by such declines would be “London, Coventry, Manchester, Glasgow and other cities where student populations are high.” International student spending is far greater than tuition fees alone; their spending outside of tuition (e.g., accommodation, food, recreation, etc.) is a major contributor to local economies.

Jonathan Simons, partner at Public First, says: “It is not widely understood just how much our economy is supported by international students and it’s really crucial that any policy that could affect international student numbers is considered through this lens.”

Domestic students would also be affected

If universities were to reduce places for subsidised domestic students in order to offset the reduction in international income, London First predicts 33,000 and 135,000 fewer domestic places, respectively, in the first year and over five years of the levy.

Demand may be slowing even without the levy

Speaking to The Observer, Simon Marginson, professor of higher education at Oxford University, warns that an imminent imposition of a levy would coincide with signs that demand for study in the UK is already softening in some quarters: “Early indications in parts of the Russell Group [of elite universities] are that student numbers from China in 2025/26 are well down.”

For additional background, please see: