The four key trends that will shape international student mobility for the next decade

- There are four linked macro trends that will shape international student mobility over the next 10 years

- They include the continuing strong growth in demand for education, more restrictive policy settings in the world’s top destinations, a shift in student demand to a wider field of destinations (and especially those in Europe and Asia), and a much greater emphasis, for students, on affordability and the return on investment for study abroad

The following has been adapted from the opening plenary given by Editor in Chief Craig Riggs at the ICEF Monitor Global Summit in London, 12 September 2025.

A year ago, in this very room, we looked at two macro trends that are shaping the international student market. One is the considerable and continuing demand-side growth – that is, the considerable growth in demand for study abroad and for access to education across markets worldwide.

The other is the pushback on historically high levels of immigration in a number of the world's leading study destinations, and the changing political culture around immigration in many of those countries.

There are obviously some significant implications for us in both of those points, and so let's just revisit them very quickly.

The 9 million students

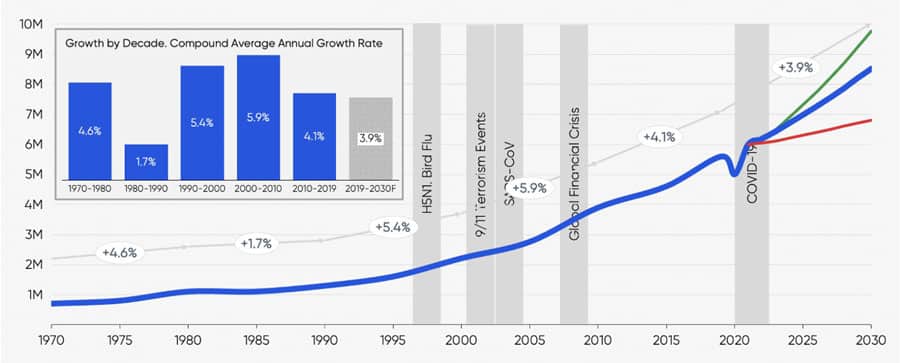

In the following chart, we see a forecast from HolonIQ. It's one that I pay attention to and I appreciate the detail and thought reflected here, but it's also in line with other serious forecasts that we have for how student mobility is likely to take shape over the rest of this decade.

The short version of all that is that – tracing the arc of student mobility over the previous decades up to the present day and looking ahead through the rest of this decade – the most likely scenario is that we will reach around 9 million students abroad in higher education by the end of this decade, whereas we're at about 7 million right now.

I should highlight as well that this chart describes only students abroad in higher education, and of course there are other really significant aspects of student mobility that are not factored here, including language learning and K-12.

But we can take the higher education trend line as an important proxy for the sort of broader movement of students in all segments around the world. This is important as an evidence-based projection, but it also points us to that reality that the number of students is going to continue to grow. The question is how will that really take shape? Where will those students go? And what and how will they study?

Public sentiment and political culture

The other thing that's in play is that context around immigration that I mentioned earlier. These are recent headlines from our coverage on ICEF Monitor.

This has obviously been a big story going back about 18 months or so now where we began to see some of the major study destinations – Australia, the UK, Canada, the US – introducing new policy settings and new processes that essentially all add up to a more restrictive environment for international students.

What we're really seeing there is that the political culture in those destinations is changing in an important way. It reflects a growing public concern around historically high immigration levels, and that gets rolled into domestic concerns around costs of living, access to housing, access to healthcare, and more.

International students are a very small part of that historically high immigration globally, but of course, they're caught in that same dynamic. And the result is that more restrictive policy framework for students and really in particular an active effort on the part of many of those national governments to reduce the number of new students coming into each country.

Right now we're about 18 months or so into that cycle, and indeed we can see the effect is profound in Canada and in Australia where the number of new student commencements has been reduced quite significantly.

And that brings us to our first related trend for this year.

The Big 14

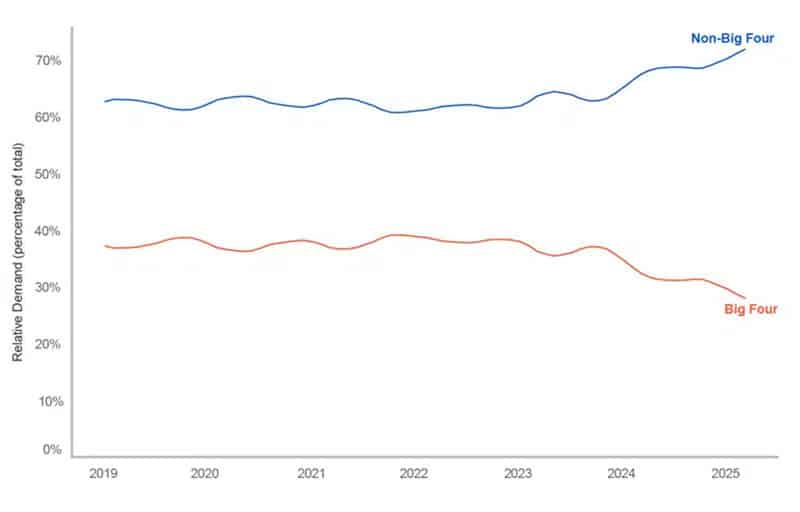

One of the most important trends we are tracking this year is the shift in student demand to destinations outside of those Big Four destinations.

We speak colloquially about the Big Four, meaning Australia, Canada, the UK, and the US. They are thought of as the Big Four, because historically and up to the present day, they are the hosts for a majority of the world's internationally mobile students.

There are of course many students who go to many other destinations besides, but those four English-speaking host countries have always had a lion's share of the international student market.

But what we're seeing now is that we're actively moving from that Big Four state to something that's more like a Big 14. You can quibble about what the number is, but the point is that really we're seeing a shift in student demand, student interest, and student movement to a wider field of destinations. And we see more and more evidence of that shift all the time with every passing month.

I was looking recently, for example, at the QS ranking this year for the top student cities. And this year, for the first time, the top-rated city was Seoul. The number two city in this year's ranking was Tokyo, and they are just two of the eight city-destinations in Asia that appear in the top 20 cities in the QS ranking.

The point is there is a lot of movement happening there. We can explore in a minute what some of the factors are that are driving that, but that has to get our attention that it's not London, it's not New York that is in that top spot. We're seeing a lot of movement in that table that's reflecting something about the attractiveness of those cities and their success in attracting greater numbers of mobile students.

As we highlight those cities, we're really talking about a pattern where that student interest and student movement is flowing across a wider field of countries, particularly in Europe and in Asia.

So in Europe, we'd be talking about countries like Germany, France, Spain, Italy, and Turkey. In Asia, we're looking at destinations like Korea, Japan, China, Malaysia, and Taiwan.

They're all notable in that this is not a new story. I mean, many of these countries have been growing their international enrolment for some time. But it feels like something has tipped over in the last year, and we're seeing more significant growth in many of those destinations.

Many of them are also becoming much more active recruiters of students. And this is really changing the market dynamic in an interesting way – at the very least, global market share is becoming more widely distributed.

Part of that is a function of that disruption in those Big Four destinations that I mentioned. But part of it is that at the same time as those leading destinations are being disrupted by that type of policy change, those growing destinations in Asia and Europe are taking steps to gain a greater share of the international student market: in the form of expanded marketing activity, in policy alignment that smooths visa processing and opens up new work and settlement opportunities, and in new programmes and services for international students.

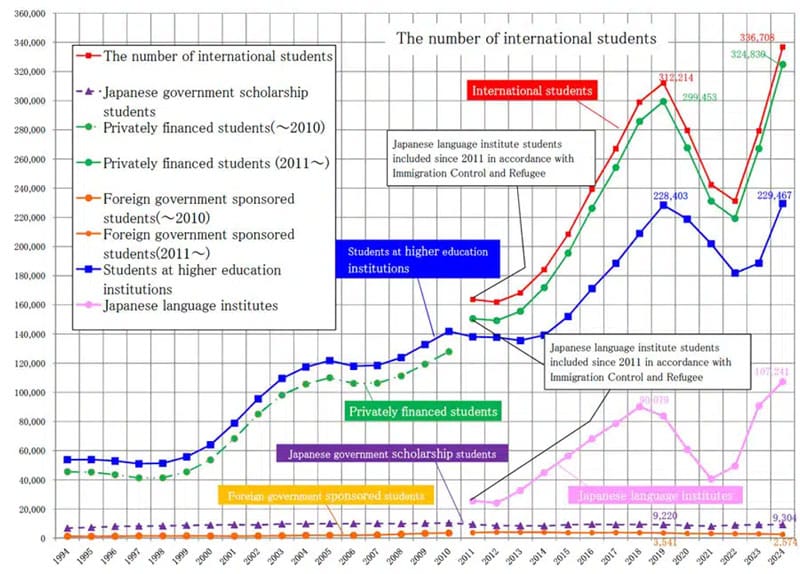

Take Japan as an example. The following chart shows foreign enrolment in Japan over an extended period of time. And it happens that that enrolment reached a historic high last year.

At that point there were, in 2024, just under 337,000 international students in Japan. So once you're into that 300,000–400,000 enrolment base, you're starting to talk about real numbers that have a material effect on the marketplace.

That 337,000 students last year reflects, you can tell from the sharpness of that red line at the top of the graph, really significant year-over-year growth, 21% last year alone.

So that a clue that those students are moving in greater numbers to this type of destination. Japan has a target to grow its foreign enrolment to 400,000 students by 2033. And as you can see, they are well on their way and they'll almost certainly reach that goal. In fact, they will probably exceed it by the time we get to 2033.

Most of those students, it should be said, are coming from within Asia, particularly from China, from Nepal, from Vietnam.

Just think about those three markets for a moment. Up until the last several years, China had been the driver of global growth for decades, in terms of international student mobility. And the major destinations were in the habit of relying on that steady and reliable flow of students from China.

But think about what Nepal and Vietnam represent. Those are some of the fastest-growing outbound student markets in the world. And a couple of years ago, I started looking at Vietnam more closely. We have been following the Vietnamese market for some time, but I was not seeing the numbers of students coming through to some of those traditional destinations – like the US, like Canada – as we would've expected.

And it took us a little while to understand what was happening. But what was happening – what is happening – is that those students from Vietnam are going elsewhere in Asia in greater numbers as opposed to coming through to those Big Four destinations as we would've expected in earlier years.

Japan is a great example of that, and they're earning a greater share of those important growth markets.

It is early days for this shift that I'm talking about. It will take another year or so before we have more detailed data, obviously for this year and for 2026, where I think we can expect that movement, that wider distribution of students across destinations, to become a lot more established. But you can see plenty of indicators of it already, like the student city ranking that I mentioned, like some of that early growth data that we can see for individual destinations.

This next chart, for example, is showing us aggregated search data from Studyportals. They have a number of online properties where students can search for programme options abroad. And what this is tracking is just the destinations that students are searching for across those properties over the years and leading into the first half of 2025.

Where is that demand going? Obviously, for the Big Four destinations, we see it trailing off. And we see that spike in student interest for destinations about the Big Four.

And what's interesting about this, I mean you can only take this so far, but I do pay attention to this type of search data from Studyportals. IDP is very good about sharing this type of search volume data as well because it provides you with a kind of early indicator of where demand is going.

We can understand that students that are searching on these platforms are probably 12 to 18 months out from a programme start. So they're at some early stage in their search and in their planning process for study abroad. The pattern that we're seeing here in terms of where that interest is going, we might expect will play out in 12 or 18 months in terms of actual enrolments.

That's what I mean when I say when we get that actual full-year enrolment data for 2025 and eventually 2026 I think we're going to see what the real effect of some of this shift in interest might be.

But what we see across all these indicators is that global student flows are disrupted and they're changing from those historical patterns. And I think the bottom line is that in the next five years, student demand will be much more widely distributed across the range of destinations that we're talking about. And the competition to attract those students will become only more intense than it is even today.

How do you spell ROI?

And that brings us to our last macro trend, which is the greater emphasis across student markets on affordability and on the return on investment for study abroad.

Those factors – affordability and ROI – have come to the fore in recent years. This is not new, but what we're talking about here is a matter of degree. The extent to which this is a priority for students in the decisions that they make about where and how they study abroad.

When you look across all the large scale student surveys – IDP, Etio, QS, Keystone, Studyportals, you name it – you see the same findings coming through. Issues around affordability and the expected value of study abroad are now the most important decision factors for students when planning their study abroad programmes. The importance of that reflects in different ways. Students talk about cost of study, cost of living, availability of scholarships, work opportunities, graduate outcomes, but we can understand that what is underpinning those priorities are these important drivers in terms of affordability and return on investment.

We see even this year that in some of the, there's early indications that these decision drivers are changing the value proposition for students when they think about study abroad. They're changing, for example, how students look at and how they measure quality of education. IDP had a really interesting finding earlier this year, which was indicating that students increasingly are equating quality of education with graduate outcomes.

It's not that rankings are not important anymore, but what is the case is that students are looking past that to say, what can I really expect? What am I going to get from this experience? And what is that return on investment going to look like?

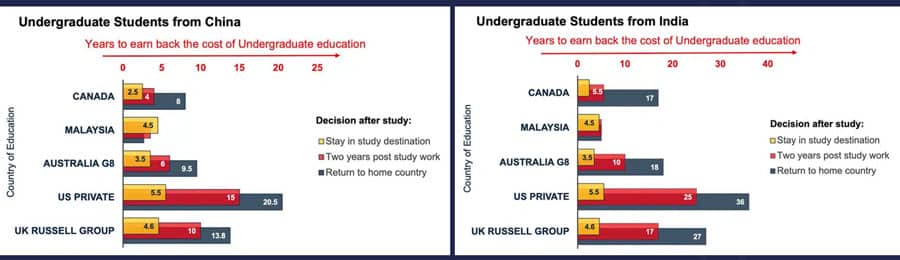

To put that another way, this is something that Tim O'Brien from INTO University Partnerships shared with us. And I thought it was a really interesting illustration of what return on investment actually looks like.

Basically what is happening here is that Tim and his team are measuring cost of study against opportunities to work during and after study in the destination against the earning expectations of a student when they return to their home market.

And what this is illustrating to us is that in these different destinations, under these different scenarios, a student stays and works for X number of years and so on, how long it takes the student to earn back the cost of study abroad. And as you can see, there's considerable range there that hinges on things like the availability of work opportunities in the destination country, the cost of study there, the earning potential at home. This is, in short, a very vivid illustration of what that ROI driver means to an individual student.

The changing face of student mobility

But sitting behind those calculations is another important reality, I think, for all of us, which is that the composition of the international student body has shifted quite a bit over the last 10 or 15 years, and it's continuing to shift in terms of where students are coming from.

In 2010, there were just about four million students abroad in higher education. Just under a third of those were from China. And as I said earlier, China was the driver of global growth in international mobility for a couple of decades.

Just think for a minute about the profile of those students coming out of China. They're supported by a burgeoning economy, by an exploding middle class. They were self-funded, they were able to return to their home country and have an expectation of a higher earning potential.

In 2024, with more like seven million students abroad in higher education, only 14% of that total now comes from China, another 19% from India.

And indeed, the lion's share of that international student body writ large is now coming from South Asia, Southeast Asia, and Africa.

This includes a greater mix of students who are loan-funded or who are funded with family support or by scholarships. They come with very different needs and expectations. And, as Tim's work demonstrates to us, they have a different earning potential at home. So that ROI calculation is necessarily different, depending on where you are coming from.

That top city ranking from QS that I mentioned earlier perfectly reflects this. The reason that so many of those Asian cities are moving into the top 20 is because not only are they having greater success in attracting international students, but they are relatively affordable. They're rising up the rankings on the strength of that affordability. And that is obviously a huge driver as these numbers would suggest to us of student movement.

The point I'm making here is that these macro trends are all linked.

That continuing surging demand for education, the more restrictive policy settings in the top destinations, the ambitious growth plans of a much wider field of destinations in some of the major global regions (particularly in Europe and Asia), and those changing student priorities and decision factors, especially around affordability and ROI.

Everyone sitting here is thinking those are not new ideas and they're not new factors in the marketplace, but what is different through 2024 and now into this year is really the first time that we're seeing them act on each other in the way that I'm suggesting here.

And that as a result, we're beginning to see the market move at scale in a way that it hasn't done before. The full impact of those shifts will become more clear over the next five years in particular. But there are plenty of implications in those trends for every institution and every organisation in this room.

For additional background, please see: