New analysis forecasts international student mobility through 2030

- The number of students abroad for higher education is projected to reach nearly nine million by 2030

- The marketplace for those students, however, will only become more competitive over the balance of this decade

- The leading destinations will increasingly compete for share with alternate and emerging destinations in Europe, Asia, and the Middle East

A new analysis from QS maps the major trends and push and pull factors that will shape international student mobility for the rest of this decade. Based on findings from the Global Student Flows Initiative, Three Scenarios for International Education in 2030 explores a series of overlapping, non-exclusive future states for the sector.

As the title suggests, those forecasts and findings revolve around three possible scenarios. The first, "Regulated Regionalism", imagines continuing restrictive settings for international students in a number of leading destinations, such as the US, UK, Australia, and Canada, against which alternate or emerging destinations in Europe, Asia, and the Middle East will have a chance to "significantly expand their market share."

A second scenario, "Hybrid Multiversity", forecast a greater role for digital and hybrid delivery. It relies on a combination of technology advancement and economic uncertainty to elevate those modes of delivery to great prominence across the sector. The third and final future state, "Talent Race Rebound", describes an intensifying competition for foreign students, driven in large part by demographic trends and labour shortages in study destinations. Within this scenario, destinations compete for students by streamlining visa processes, expanding work rights and investing in international recruitment.

In an important sense, all three scenarios are concerned with greater competition in international student markets, and likely across more than one dimension. Destinations will compete with each other, yes. But so too will competition expand across modes of delivery, with more space for innovation in programme models and collaborations across borders and institutions and other stakeholders.

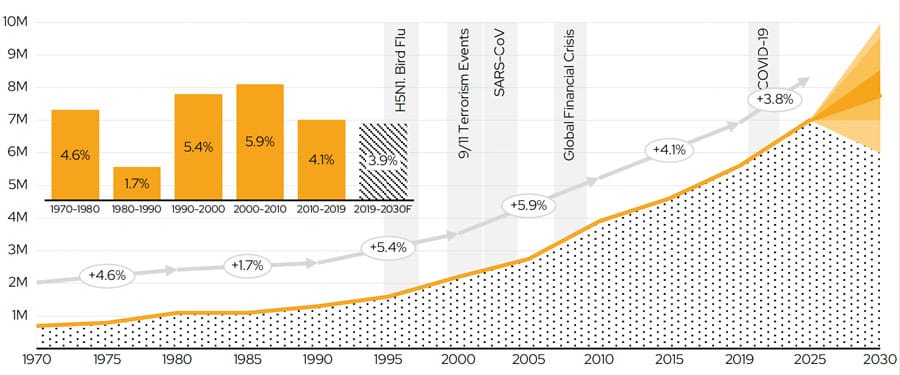

That outlook is underpinned by a demand-side forecast that anticipates continued, strong growth in international student mobility. QS's work in this respect lines up with other credible projections for the sector, which more or less coalesce around the projection that there will be roughly nine million students abroad in higher education by the end of the decade (from a current base of just under seven million this year). In other words, there is little question that demand for study abroad will remain strong and total student numbers will continue to grow. The big questions that remain are where will those students go, what will they study, and how?

The destination table

"International student mobility is entering a more fragmented, policy-sensitive phase," notes the report, which is a measured way of highlighting that significant policy disruption in the so-called Big Four destinations has opened the door to some shifts in market share. Leading up to the pandemic, the leading English-speaking destinations – the US, UK, Australia, and Canada – hosted roughly four out of every ten internationally mobile students. While all four destinations are projected to return to growth over the balance of the 2020s, that combined share, QS projects, will slip closer to one-third by 2030. Alternate destinations in Europe, Asia, and the Middle East are expected to pick up a correspondingly greater share of the global flow of students.

"The top 30 destinations collectively host nearly 90% of all international student flows," explains the report. "Looking at projected changes among the top 15 between now and 2030, Türkiye, the UAE, Malaysia, and Japan are each forecast to climb one position, while the Netherlands is projected to drop one rank." Within that top 15, Russia is projected to move the most, dropping three places from 7th to 10th. "Safety concerns due to the ongoing conflict, along with reputational and logistical challenges, have already prompted a notable decline in student numbers in Russia," adds QS.

The growth forecast for destinations in the Middle East and Asia is backed by heavy investments in internationalisation in those destinations, including in campus facilities and English-medium instruction, and by a growing attention to policy alignment with national international education strategies. "While growth to 2030 in these regions may slow compared to past cycles, it is still expected to outpace the global average," says QS, in explaining how that market leadership group is already gradually shifting from the Big Four to something more like a Big Fifteen.

Where will students come from?

"The global supply of international students is set to grow over the next five years, but not evenly," says the report. Factors such as domestic economic conditions, demographic trends, government policy, and geopolitics will all play a part. As always, market fundamentals, including growth in the middle class, economic performance, and large, youthful populations, will also be key determinants of outbound mobility.

"Vietnam and Indonesia stand out in this regard," says QS. "They are already among the top 20 source countries, and they are projected to climb further in the ranks by 2030." In a perfect illustration of that shifting market share among destinations, however, the report also notes that, "These students tend to favour destinations like Japan and increasingly Europe, where visa openness and affordability are becoming key attractors."

Other markets singled out in the QS analysis for outbound growth include India, Cameroon, Morocco, and Nigeria.

The complete report is available for download now, and QS intends to expand on its reporting out of the Global Student Flows Initiative this year with a series of regional reports as well.

For additional background, please see: