Global survey underscores demand shift from “Big Four” to “Big Ten”

- A survey of institutions in destinations around the world finds that student demand is shifting away from the “Big Four” in favour of alternate study destinations in Europe and Asia

- Many institutions are anticipated budget or staff cuts in the coming months, and many are prioritising diversification into new markets

A new global survey makes it clear that the more restrictive visa policies introduced in leading destinations over the past 18 months continue to profoundly impact international student mobility. Student demand is shifting away from the "Big Four" destinations – the United States, United Kingdom, Australia, and Canada – in favour of alternate destinations in Europe and Asia.

The second edition of the Global Enrolment Benchmark Survey was produced in collaboration by NAFSA, Oxford Test of English, and Studyportals. It focuses on the January–March 2025 intake, and includes survey responses from 240 institutions across 48 countries.

We should acknowledge at the outset that this is a small sample, and all the more so when the findings are focused on a individual destination. There were 14 responding institutions from Australia, for example, and 15 from Canada. However, the patterns described in the survey data are well reflected in other indicators that we have for the last three-to-six months, and they are backed by large volumes of search data from Studyportals that also provide important insights on demand shifts in the early months of this year.

The January-to-March focus is significant as well in that it captures a major intake window for many institutions. "Traditionally, the January to March intake has been the largest for countries in the Southern hemisphere, like Australia, New Zealand and South Africa," notes the study report. "In recent years, more and more institutions in the Northern hemisphere have added this as a second main intake." All in all, "32% of global bachelor's and master's programmes start between January and March. This compares to 59% of programmes with a start date between August and October."

Big picture

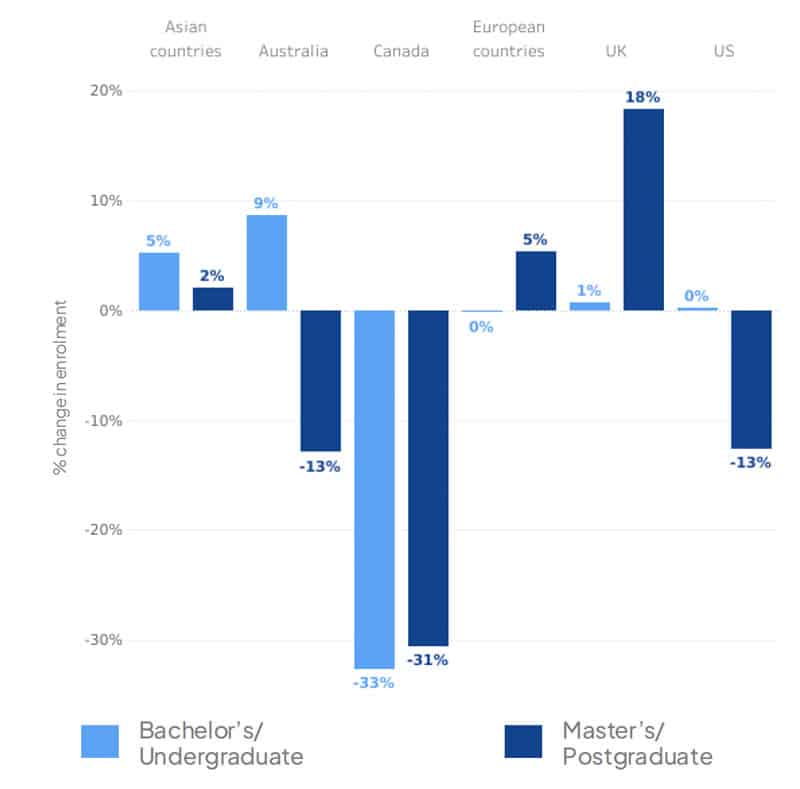

Market share is shifting among the major global regions and study destinations. Institutions in Asia report growth in both undergraduate and graduate enrolments. Australia, the US, and especially Canada are reporting lower student numbers this year. Europe is flat for undergraduate but up for graduate studies, and graduate enrolments in the UK are rebounding after a down year in 2024 following the introduction of restrictive policies for accompanying dependants.

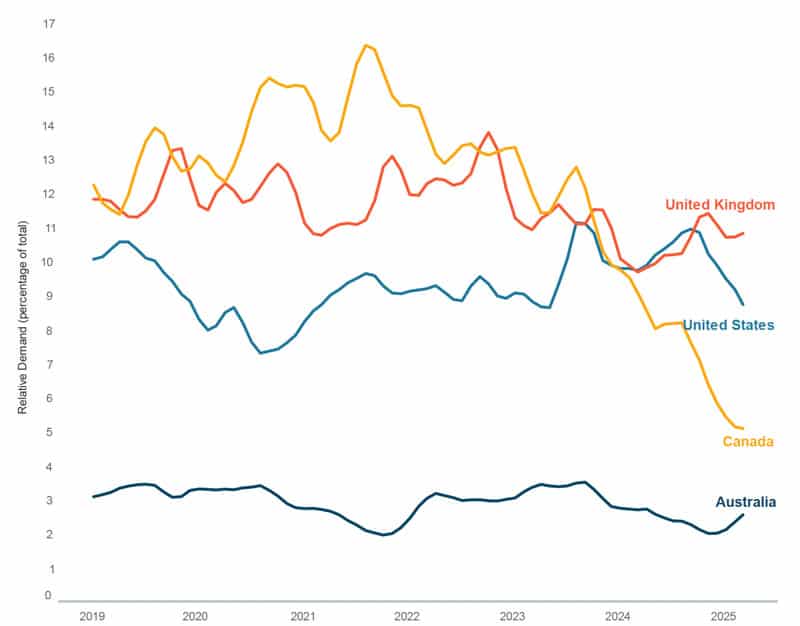

Those patterns are reflected in Studyportals' search volume data as well, as we see in the following chart.

“The global market for academic talent is as dynamic and complex as it has ever been, this poses unique challenges and uncertainties for students and universities in the traditionally largest destinations," says Studyportals CEO Edwin van Rest. "International students have proven to be of broad and unique contribution to their host countries, and some upcoming destinations are effectively making use of the current market situation to advance talent attraction.”

In terms of the factors that are impacting mobility this year:

- "Restrictive government policies and/or problems obtaining a visa" was cited by 62% of respondents as a significant issue. This includes 93% of universities surveyed in Canada, 86% of universities in Australia and 70% of those in the US.

- "Affording tuition and the cost of living" was reported by just under half of responding institutions as a significant issue, with responses for this factor spiking a little in the UK (where 57% of respondents cited it as a significant issue).

- "Lack of suitable housing/accommodation" was also noted as a significant issue by 20% of respondents globally, with the weight given to this factor skewing higher among European institutions.

The expanding field of study options

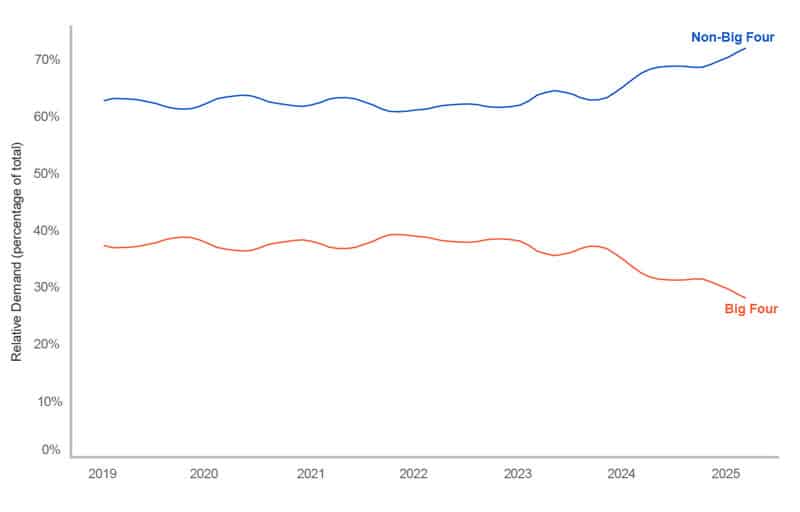

Aggregated search data from Studyportals also provides a stark view of where student interest is trending over the past two years. Destinations outside of the Big Four are claiming a greater share of search volumes across Studyportals websites.

“Amid sweeping political shifts in the United States, this survey offers a powerful snapshot of how policy turbulence is reshaping global student mobility," says NAFSA CEO Fanta Aw. "The message is unmistakable: international students are paying attention—and increasingly turning away from the traditional ‘Big Four’ destinations in search of stability, opportunity, and affordability. It is really about the “Big Ten” now. If higher education leaders and policymakers fail to act, they risk losing not just talent, but also the innovation, research, and economic vitality that international students generate.”

The road ahead

Nearly four in ten responding institutions (38%) said they expect budget cuts in the year ahead (an outlook shared by two-thirds of Canadian respondents). Close to half (43%) consider that diversification into new markets will be an important strategy – a finding that may have been influenced by the third of institutions anticipating being challenged to meet more aggressive enrolment goals this year.

For additional background, please see:

- "New research highlights the impact of policy on international enrolments"

- "Report projects need for greater diversification in international student recruitment this year"

- "Australia and Canada: Rising to the challenge of new immigration policies"

- "Beyond the Big Four: How demand for study abroad is shifting to destinations in Asia and Europe"