Report projects need for greater diversification in international student recruitment this year

- A new analysis from British Council projects softening student numbers from China and India this year

- The report argues that educators will need to extend recruiting efforts across a larger number of sending markets in order to offset that projected near-term downturn

The British Council has released its Five Trends to Watch report for 2025. The macro trends in focus this year echo some of the important shifts we have been tracking in recent months. They include a shift in student demand to destinations in Asia and the need for greater emphasis on diversifying international enrolment this year.

The report projects an uptick in student interest for the UK this year, arising in part from the continuation of more restrictive policy settings in Australia and Canada but also from the uncertainty a newly installed Trump administration may create for some students considering study in the US.

"Markets in East Asia will continue to benefit from an eastward shift in international student mobility in 2025," adds the report, projecting that more of the student demand that would have gone to a Big Four destination in previous years will now stay within the region. The British Council notes Malaysia's growing appeal as a regional destination in particular (and especially for Chinese students). But the report also highlights growing student numbers in a number of Asian host countries, including Singapore, Hong Kong, South Korea, and Thailand.

China's continuing shift to postgraduate studies

Most major study destinations continue to rely heavily on China and India for the lion's share of their foreign enrolment base. The Five Trends report projects that continuing economic headwinds in China – including historically high levels of youth unemployment – will continue to shape higher education demand this year.

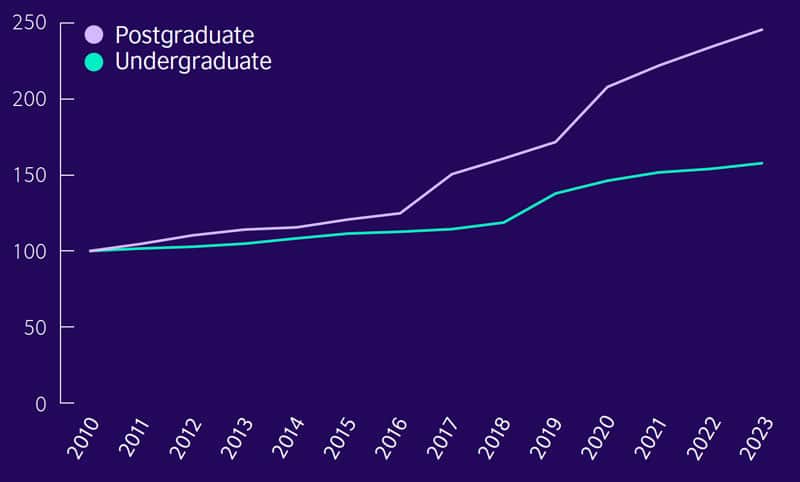

The British Council especially highlights the growing proportion of postgraduate enrolment in China's domestic higher education system. And we have of course seen the same pattern playing out in major study destinations in recent years in terms of a shift from undergraduate to postgraduate studies for Chinese students.

"Economic woes in China will drive stronger demand for postgraduate education in 2025," says the report. "Youth unemployment rates in the country remain stubbornly high. This has increased the appeal of postgraduate study both to improve students’ competitiveness in the fierce local job market and to wait out more favourable economic conditions."

"Chinese students seeking to enrol in postgraduate studies are particularly rankings conscious – both at home and abroad – viewing a degree from a top-ranked foreign university as more likely to secure them a job after graduation…For lower-ranked [HEIs], attracting prospective postgraduate students in China will mean appealing to their core concerns: value and impact. Pairing master’s degrees with internships, for example, and tailoring career services to the needs of Chinese students will go a long way toward distinguishing their postgraduate offerings in an increasingly competitive marketplace."

Peak India?

The report goes on to project that the number of students from India "will almost surely decline" for major study designations this year. While the fundamentals – including the massive demand for higher education – remain very strong for the Indian market, "the broad-based slowdown in outbound mobility from India is driven in part by a market correction after enrolments from the country surged in 2022 and 2023. Tightening visa restrictions in major host destination countries are also depressing demand from less qualified Indian students."

The need to build new markets

The overarching conclusion of the report is that educators will now have to extend their recruitment efforts over a larger number of smaller markets (that is, smaller than China and India) in order to make up for enrolment shifts and softer numbers coming out of those two major senders this year.

For additional background, please see:

- "Beyond the Big Four: How demand for study abroad is shifting to destinations in Asia and Europe"

- "Survey highlights the disruptive effects of visa delays on international students"

- "Tracking the internationalisation goals for 10 leading destinations"

- "How diverse is the international student population in leading study abroad destinations?"