New analysis highlights UK universities’ reliance on international enrolments

- Many UK universities assume that a trend of increasing international enrolments will help their financial position, but there is now substantial downward pressure on student demand for higher education in the UK

- Modelling by PwC indicates that anywhere from 51% to 80% of UK universities could fall into deficit if international enrolments decline from 2024/25 onwards

- Meanwhile, enrolment data for January 2024 indicates that UK universities will lose traction this year in at least two of their most important source markets, India and Nigeria

A new analysis from the international consulting firm PwC offers a worrying view of the extent to which UK universities are dependent on international student tuition for their financial viability. According to the firm’s modelling, should international enrolments in UK higher education decline from their current level, more than half of universities in England and Northern Ireland could fall into deficit in 2025/26.

The report coincides with news that student acceptances and deposits made to UK universities through the Enroly platform are down by more than a third compared with last year. About 1 in 3 students who come to the UK do so using Enroly.

PwC’s UK Higher Education Financial Sustainability Report was commissioned by Universities UK and is based on analysis of “the 2022/23 regulatory forecasts (Annual Financial Return 2022 for England and Northern Ireland, and Strategic Plan Forecast 2023 for Scotland) of participating UUK members and assessing how those forecasts would be impacted by certain sensitivities.” The modelling discussed below used a “base case” group of 70 forecast financial returns from institutions across England and Northern Ireland.

The work was conducted between July and September 2023 and released this month.

January indicators

Before we explore the PwC analysis, it's important to note recent data from Enroly that shows that Confirmation of Acceptance for Studies (CAS) issuance for the January 2024 intake of international students coming to the UK is down by 36% when compared to January 2023, and deposits are off by 37%.

The most concerning market is Nigeria, a major contributor of growth in recent years. Deposits from Nigerian students have fallen by 72% year-over-year, and Indian deposits are 37.5% lower. Last year, India and Nigeria were the #2 and #3 largest source markets for UK universities, and growing much faster than the #1 market, China.

Profound vulnerability in the system

The softening enrolment for January 2024 provides an important backdrop for some of the challenges facing the UK higher education system, which PwC summarises as:

“Universities are feeling significant pressure given constraints on their ability to generate income, increasing investment requirements and an escalating cost base. This is placing strain on margins and driving greater reliance on cross-subsidisation, particularly from international student fee income, which has led to increasing concerns about overreliance.”

Fuelling that overreliance is declining revenue from domestic student enrolments. Domestic students’ participation in higher education fell in 2022/23 and domestic tuition fees have been fixed at £9,250 per year since 2017. PwC notes that “undergraduates are often taught at a net cost to the provider.”

It’s not difficult, then, to understand why UK universities have become so reliant on international students – this source of revenue has been both necessary and reliable for some time.

However, the years-long trend of increasing international enrolment at UK universities is certainly under pressure this year, due to:

- A recent immigration policy barring most foreign students from bringing dependants with them;

- The rising cost of living, which makes it more difficult for students to consider studying in the UK – especially students whose currency has been drastically devaluated (e.g., the Nigerian naira).

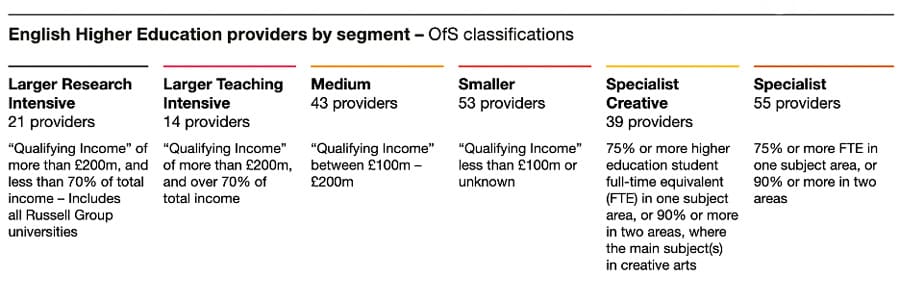

PwC notes that some types of HE institution are more vulnerable to volatility in the level of international enrolments:

“Larger Research Intensive providers and Specialist providers in England are particularly dependent on income from international students and risk being exposed if forecast international student volumes do not materialise.”

Overabundant optimism

Institutions in all provider segments analysed by PwC assumed that increased international fee income in the future would help them to improve their financial position; in 2021/22, 25% of them were in deficit. Their optimism is based on “international fees [accounting] for between 33–66% of all course fee income by 2026/27 (compared to a range of 24–64% in 2021/22).”

But downward pressures on foreign student demand could very easily throw off those assumptions – and even a 5% drop in international enrolments could double the number of providers in deficit. PwC warns that the percentage of the institutional sample operating in deficit could increase by:

- 8 percentage points if full-time international student enrolments stagnate from 2024/25 onwards, with the result that 27% of institutions could be in deficit by 2025/26;

- 32 percentage points if they decline by 5% from 2024/25 onwards, with the result that 51% of institutions could be in deficit by 2025/26;

- 61 percentage points if they fell by 20% from 2024/25 onwards, with the result that 80% of institutions could be in deficit by 2025/26.

Should domestic full-time enrolments fall by 5 percentage points, the situation would worsen as – on its own – this scenario could lead to more than half of the institutional sample falling into deficit.

As the PwC report notes about the possibilities outlined above:

“Whilst these sensitivities have been applied on a standalone basis, they could also materialise in conjunction with one another, compounding their financial pressures, and therefore likely increase the proportion of members falling into deficit.”

A wake-up call

In conclusion, PwC writes:

“Despite its strong international brand and academic excellence, the UK Higher Education sector and its institutions are facing significant financial challenges that threaten to impact the quality of provision and student outcomes. In the longer term, this may impact the UK's international standing and its ability to attract and retain students, and therefore undermine the considerable economic benefits the sector brings to the UK.

Constraints on income generation, alongside cost pressures, have driven providers to increasingly cross-subsidise domestic student teaching and research activities with higher levels of non-fee-capped international students. Capitalising on strong international student growth in recent years, this strategy has led to an over-reliance in some cases and leaves some providers exposed to international demand or geopolitical shocks that they cannot control.

Our analysis shows that, across the sector, providers would be materially impacted by a gradual or sudden drop in international student numbers in the coming years – with up to 80% falling into deficit …. it may be inevitable that there is some loss of provision across the sector …. in the absence of system-level intervention it is likely that consolidation within the sector is needed …”

To read the full analysis, please download the report here.

For additional background, please see: