New report maps the scale of TNE opportunity in India

- Indian enrolments are surging in major study destinations around the world

- There are many more destinations, however, outside that top tier of global leaders, that also host significant numbers of Indian students

- A recent analysis suggests that Indian demand for some of those leading destinations may have peaked over 2021 and 2022

- The report also highlights, however, a major opportunity to expand transnational education provision in India, a major market that has arguably been underserved in this sense up to this point

Major English-speaking destinations – notably Canada, the UK, Australia, and the United States – have been reporting two contrasting trends in recent years. Chinese enrolments, which have powered growth in international student mobility for decades, have been trending downward, even as Indian student numbers are surging.

However, a new report from Times Higher Education (THE) and Studyportals makes it clear that Indian students are pursuing their studies in many more countries worldwide. Spotlight on India Report: Recruitment Insight and Transnational Education Trends notes that, outside of the four leading destinations, countries with more than 5,000 higher education students from India include Bangladesh, the UAE, China, Georgia, Germany, Ireland, Kazakhstan, Kyrgyzstan, New Zealand, Oman, Philippines, Russia, and Saudi Arabia.

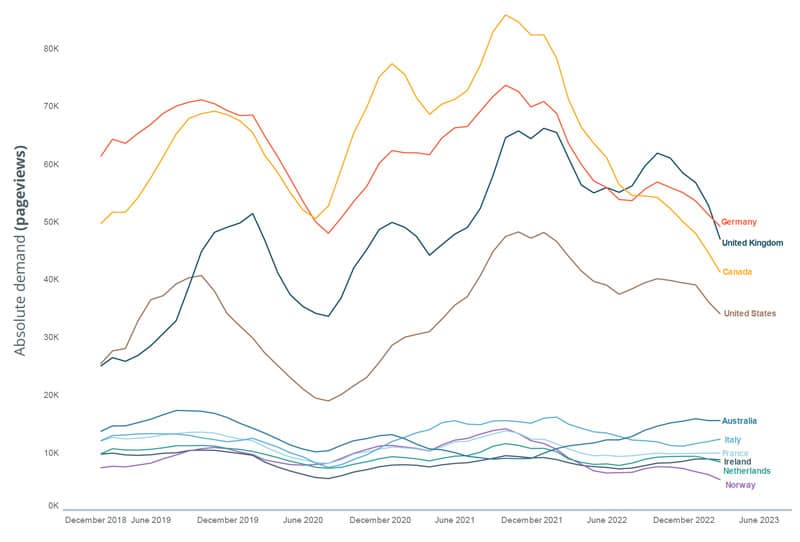

In fact, there is some indication – largely in the form of website traffic data from Studyportals platforms – that Indian student interest in some top destinations peaked over 2021 and 2022 and has been trending downward since.

To say the least, this is a noteworthy observation. While not totally indicative of the larger pattern of Indian student demand, it does reflect an important trend in terms of where Indian student interest is shifting at an early stage of their course search and planning for study abroad - that is, at the point where they are searching for programme options on a Studyportals website. That type of search activity is an early indicator of future trends as it reflects student intent at a point roughly 12 to 18 months in advance of the start of the students' study programme.

That bit of context sets us up for the chart below, in which we see that Studyportals is reporting lower volumes of pageviews (for undergraduate and graduate programmes combined) for Germany, the UK, Canada, and the US through June 2023.

"Whilst, business and management, computer science and engineering related disciplines are still the most popular the report shows rising interest in studying hospitality, leisure and sports," adds an accompanying release from Studyportals, in commenting on trends in terms of fields of study. "Business, computer science and engineering are also the most sought-after for master's students, with natural sciences and medical-related programmes also in demand."

The TNE opportunity

Drawing on HESA data, the report observes the dramatic increase in Indian enrolments in the UK, with overall growth of 543% between 2017/18 and 2021/22 largely driven by post-graduate students. That sharp upward trends, says the paper, positions India as "arguably the most important market for UK university international recruitment."

This key sending market, however, is also underperforming in terms of transnational education (TNE) enrolments. TNE is a broad spectrum of activity, which includes joint or dual degree programmes, licensing arrangements, and even international branch campuses.

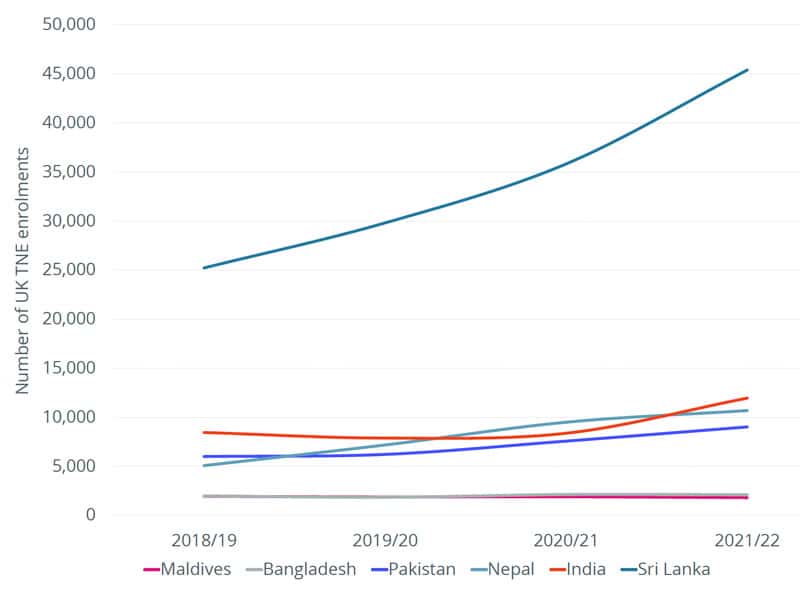

It is also, for some destination countries at least, a huge component of total education exports. The UK, for example, reported 553,190 TNE enrolments in 2021/22, with most of those in China, Malaysia, Singapore, Sri Lanka, and Egypt.

The THE/Studyportals paper points out that in contrast, "India has traditionally had lower rates of [TNE enrolment]. Previous barriers to growing TNE provision in India including perceived over-regulation and lack of clarity about collaboration requirements. However, the release of the National Education Policy in 2020 signalled the Indian government’s intention to encourage greater collaboration between Indian universities and the rest of the world and ensure clearer guidelines and incentives for foreign universities to deliver higher education in India."

Within South Asia, Sri Lanka has historically been the leading market for UK TNE. The chart below provides a stark illustration of the gap between Sri Lankan TNE enrolments and those of some much larger markets, notably India.

"Although India still lags considerably behind Sri Lanka, there was a 43% increase in UK TNE enrolments in 2021/22, making it the fastest growing market for TNE in the sub-region." notes the paper. "With encouraging regulatory changes having been made in 2022 to encourage foreign university partnerships, and potentially more regarding branch campuses and other forms of TNE in 2023/24, there is every possibility of this trend continuing."

"A key question that emerges from this research is whether the falling demand in studying abroad might instead be captured by studying foreign degrees within India, aligning with the Indian governments ambition to increase transnational education in India,” adds Dr Ishan Cader, THE’s Director of Consultancy.

Either way, that large gap between Sri Lanka, a country with a population a fraction of that of India's, and India in TNE enrolments suggests a considerable opportunity for foreign institutions to expand their provision in the sub-continent. A 2021 analysis from HolonIQ estimates that for every student who goes abroad, there are another four who would like to study outside their home countries but are unable to do so – perhaps because of family or career commitments or because they lack the qualifications or funds to support studies abroad.

If that estimate is even half true for India, then the scale of opportunity that is being spotlighted by the THE/Studyportals report is massive indeed.

For additional background, please see: