New study forecasts slowing growth in international student mobility

The latest research report from the British Council predicts a slowing of outbound student mobility over the next decade. International student mobility to 2027: Local investment, global outcomes draws on data from UNESCO and the United Nations Department of Economic and Social Affairs/Population Division, along with analysis from Oxford Economics, to forecast trends for the 56 top sending markets worldwide. The headline finding here is that outbound mobility is expected to grow less quickly going forward. Indeed, the British Council’s findings echo those of other experts and observers that have noted a slowing in outbound growth, and particularly so from about 2010 on. Overall, the number of outbound students from the 56 markets in the study sample grew by roughly 6% per year between 2000 and 2012. From 2012 to 2015, that growth began to slow to an average of 5% per year, which has the effect of pushing the 15-year average growth rate down somewhat to about 5.7%. Leaning mainly on population and economic forecasts for the next ten years, the study projects that annual growth rates will drop further still: to an average of 1.7% per year through 2027.

Local capacity the key

Population trends figure prominently in these forecasts and there is some downward pressure on the global population of 18-to-22-year-olds today, in large part because of the ongoing decline in this key demographic cohort in China. This dip is expected to persist through 2020, at which point China’s college-aged cohort will begin to grow again (but slowly). This will have a knock on effect in that the population of 18-to-22s worldwide will also see marginal growth for the next several years. As this single variable illustrates, any material change in the primary demand factors in the key Chinese market can ripple around the world. China and India account for about half of the world’s college-aged population, and the two markets contributed about 40% of the total global growth in outbound student numbers between 2012 and 2015. Looking ahead, the British Council expects that China and India will continue to drive growth through 2027, accounting for a combined 60% of overall growth in outbound over the next decade. This in spite of the fact that tertiary enrolments in both countries will also expand considerably through 2027. Both markets, and none more so than China, have invested heavily in domestic higher education provision, and this, in the British Council’s analysis, is the other key factor that will shape demand in the years ahead. As the report concludes, “We have found that local education provision has been potentially the weightiest driver in shaping the current global higher education landscape. In a tumultuous global context, visas and student safety are often cited as factors that influence the sector but the impact of domestic investment on global student mobility has been profound. China, as an example, has improved its domestic system and we will start to see this across a number of different markets. Currently many students go abroad because there is neither capacity nor high-quality education at home but as this changes outbound mobility will suffer.”

The need to diversify

This finding underscores a key market dynamic in global mobility: China and India must continue to be a focus for educators and recruiters as they remain unmatched in terms of their overall scale and growth potential. But there is also ever more reason to build enrolments from other important growth markets.

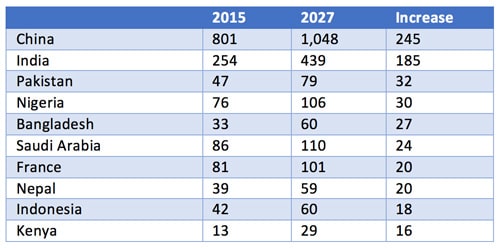

The study report has a view on this as well, and it highlights the top ten projected growth markets for outbound mobility through 2027. As the following table summarises, along with China and India, Pakistan, Nigeria, and Bangladesh are expected to be the biggest contributors to overall outbound growth during the decade.