2.28 million abroad for language study in 2014

New research indicates that nearly 2.3 million people travelled abroad for a language course in 2014. This is the top-level finding from the IALC Study Travel Research Report 2016: Trends in the Demand for Foreign Languages, and it sets the tone for an interesting new view of the global market for language travel. The report provides a very wide frame indeed with its focus on nine major languages: Chinese, English, French, German, Italian, Japanese, Portuguese, Russian, and Spanish. It draws on extensive desk research paired with a global survey of 466 education agents from 74 countries (which was in turn supplemented with a small interview panel of 21 leading agents). Starting, for example, with the estimate that a “minimum” of 2.28 million students studied a language abroad in 2014, the report quickly sets this total in a larger context. It represents about .25% of all second language learners worldwide, meaning that even though that global movement of language learners is significant in absolute terms it represents only the smallest fraction of those learning a second language around the world. English is not the most widely spoken language in terms of native speakers - that distinction goes to Chinese - but it is the most popular second language choice. English language travel accounts for an estimated 61% of the global population of mobile language students, or about 1.4 million English language travel students in 2014.

The agents’ view

Nearly all (97%) of the responding agents currently promote English language courses. French and German courses - both at 62% - are the next most-commonly represented, followed by Spanish at 51%.

The report’s authors suggest that this indicates a certain saturation of English courses within the agent channel, with each agent representing on average 60 English schools. They also note that this may point to new areas of opportunity for agents to expand by adding courses in other languages to their programme options for students.

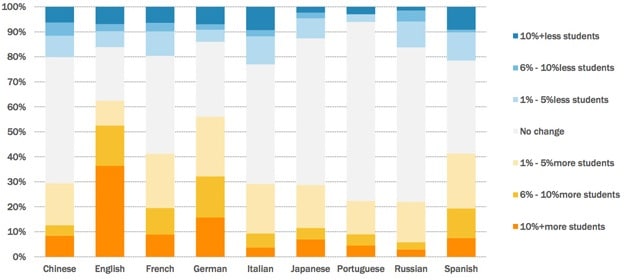

Most respondents reported strong growth over the past three years, as reflected in the following chart. As it reflects, 63% reported an increase in demand for English language study, followed by German (56%) and then French and Spanish, each at 41%. In the same period, growth in demand for Chinese study outpaced the demand for Italian and Russian.

More immediately, "The majority of agents marked 2015 as a year of growth for their businesses - 59% of respondents reported an increase in the number of students sent abroad, with 27% achieving double-digit growth in the number of language students served. However, 26% of agents experienced a downturn from 2014 to 2015. The highest ratios of agents reporting growth were predominantly from Argentina, China, Colombia, India, Mexico, Pakistan and Vietnam. Conversely, the majority of agents experiencing a decline in student numbers were based in Russia."

Why study?

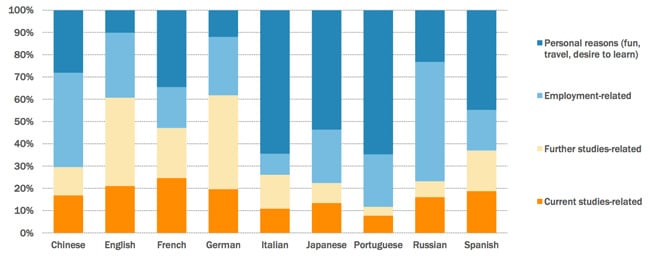

The report describes a shifting landscape in which the reasons for learning a foreign language abroad continue to become more practical, with a pronounced shift away from study for personal reasons (e.g., cultural interest, desire to learn or have fun) toward career reasons (i.e., related to employment goals or plans for academic study abroad).

As the following chart reflects, German and English skills are now mainly sought in connection with current or future studies. At the other end of the spectrum, "personal reasons" remain key drivers of demand for Portuguese and Italian whereas motivations for French study are more balanced across personal interest and academic or career goals.

Learning earlier

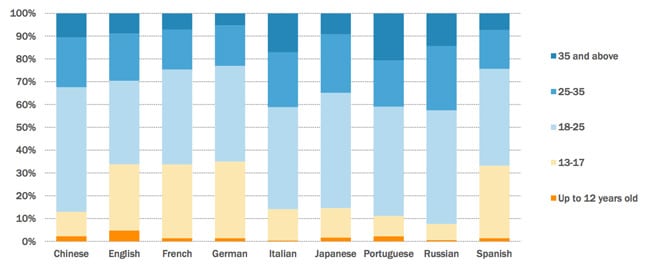

The key target group for language travel remains 18-to-25-year-olds, which comprises on average 46% of all bookings. Even so, the report finds that people are learning languages at an earlier age, calling this, "A driver that will also shape the future of the global language travel market."

The following chart reflects this emerging reality, where we see a much greater role for the "junior market" (the 13-to-17-year-old segment) and particularly so for English, French, German, and Spanish.