New study highlights global language travel trends and the role of agents

Two million people travel abroad every year with the primary purpose of learning a foreign language. About two-thirds study English and those enrolments are heavily concentrated in the leading destinations of the US, UK, Australia, and Canada. The market, however, is highly fragmented with as many as 3,000 centres providing language training worldwide and some 16,000 youth and student travel agencies acting as intermediaries. Each of those agents represents, on average, 45 schools and refers 11 students per school. These are among the findings of a new study commissioned by the International Association of Language Centres (IALC) and released at the 2015 IALC International Workshop in Rouen, France last week. The study, Perception of independent and boutique chain schools in language travel, was carried out by the international consultancy StudentMarketing and relies heavily on an online survey of education agents. The survey is particularly notable for its scale and reach. It compiles responses from 472 agents from 72 countries and represents by extension a pool of 230,000 language travel students.

The supertrends

The study report describes a mature language travel industry, one that is expected to continue to grow, albeit at a slower rate than in the past, and where we can expect an increasing drive to consolidation among industry players as well as more regulation (whether from government or from within the industry itself) in the years ahead.

“The effects of market consolidation have already begun to manifest themselves, and are evident in the case of the school market, but less present at the agents’ end of the market,” notes the study. “Consolidation speeded up the process of school acquisition, creating chains and consortia, to establish an economy of scale. It is estimated that a minimum of 200 mergers and acquisitions will take place in the course of the next five years.”

- “Independent schools/boutique chains” are language schools independent of a large chain or corporate group, each of which may consist of up to five language centres.

- “Chain schools” are language centres that are a part of a bigger group of schools - that is, a network of five centres of more.

That framing of independent and chain schools aside, IALC, as an association, is still reflecting on its official definition and usage of the term “boutique” in reference to member schools. “Boutique doesn’t necessarily mean ‘small,” says IALC Executive Director Jan Capper. “It’s all about market perception. There are many attributes that people associate with the word ‘boutique,’ and they fit very well with [independent language schools]: high quality, personal service, a certain local character, something unique or special.” In its internal discussions around terminology, IALC is clearly thinking beyond the question of how the industry understands independent language schools in relation to larger chains, but also to the importance of further differentiating independent schools in the minds of agents and, perhaps especially, in the minds of students and parents. This is not a small question in language travel today, as riding along with the first macro trend of consolidation is another strong move toward greater standardisation in programme offerings. “Without any exceptions, all agents interviewed concur that the programme portfolio has become increasingly standardised when compared to a decade ago,” notes the study. This reflects the increasing commoditisation of language programmes that we have observed previously, one of the main effects of which is to exert a downward pressure on price. This standardisation also opens the door to a greater reliance on online booking channels, or even the emergence of global distribution systems (GDS) for the language training sector along the lines of international booking systems currently in use in the wider travel industry. Opinion among responding agents was split on the future for a language-specific GDS. While one-third of interviewed agents indicated their interest in such a system, many others felt it was either redundant to current systems within their respective agencies or that the need for individual counseling would place a limit on the extent of commoditisation in the language travel market. More to the point, agent expectations as to the growth of direct-to-school bookings were somewhat tempered as well. “Agent usage across the world fluctuates between 40% and 80%, depending on a wide array of factors,” says the study. “The most important of these are language course type, proximity to the particular destination, maturity of the source market, and the extent a language barrier presents to prospective students and/or their parents.” A majority of respondents to the IALC study felt the industry would see an increased proportion of technology-enabled direct bookings with schools but that the pace of growth would be slower than in the travel industry as a whole. Agents responding to the survey noted factors such as student visa requirements, as well as the high level of investment and involvement of parents in booking language travel, as important curbs on the growth of direct bookings.

Chains vs indies: the agent’s view

The study finds that, “When it comes to agents, they strongly prefer independents, as it comes almost as a natural choice. They are mostly valued because of easier access to senior management, greater ability to adjust the offer, friendlier approach and higher customer satisfaction… In contrast, chains are valued for the provision of the ‘one-stop shop’ option and quality of premises and facilities.” The report notes as well that chain schools are often “more creative and energetic” in their marketing efforts, including a greater emphasis on marketing to the end customer, the student, which helps to drive brand awareness of the school before the student ever visits an agent. Perhaps partly because of this greater marketing reach, the study finds that chain schools tend to have an edge in emerging markets where demand trends and student preferences are still taking shape. Overall, chains accounted for 35% of schools in the agents’ portfolios while 65% could be classed as independent or boutique schools. The proportion of referrals reported by agents followed this breakdown pretty closely, with 36% of students booking through agencies choosing chain schools. However, only 13% of agencies indicated that their customers are able to distinguish between the two types of schools. “This indicates that school type, and the resulting differences, is not a determinant that students or their parents would often factor in when choosing a language school.” Equally, it reflects that agents have an important role to play in educating customers as to the benefits of either type of school.

Building the agent-school relationship

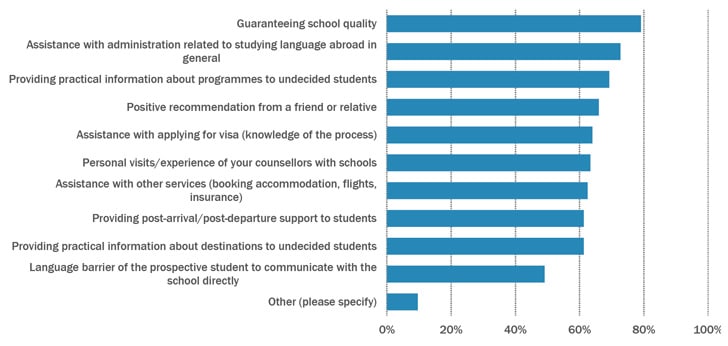

The report also underscores the importance of personal relationships in building agency-school connections. “The single most preferred way for agents to get in touch with prospective partners is to meet at a workshop,” followed by familiarisation (FAM) tours, other face-to-face meetings, or referrals from fellow agents.

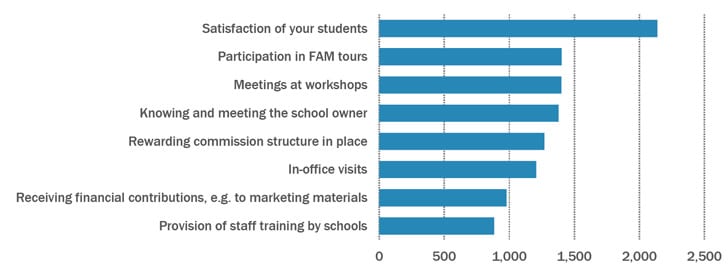

And, as the following chart illustrates, once the agent-school connection is made, student satisfaction and responsiveness of school staff are key.