Canada and the US are losing international student enrolments to Europe and Asia

- A new study paints a clear picture of the challenges faced by North American universities as a result of government policies

- Enrolments and commencements are down in the US and Canada for both bachelor’s and master’s programmes

- Asia and Europe are gaining market share, and the UK is holding steady

Canadian and American universities are struggling amidst government policies meant to curb immigration and/or international student numbers. Meanwhile, Asian and European institutions are gaining market share of international student enrolments.

These are the highlights of the newly released Global Enrolment Benchmark Survey by NAFSA, Oxford Test of English, and Studyportals, which surveyed 461 universities across 63 countries about their international enrolments in the latest intake (August–October 2025).

An important methodological note is that more than half the sample was composed of universities in Canada (20), the UK (39), and the US (201). Just over 130 European universities participated. Asia was the least represented (26 across all Asian countries in the sample).

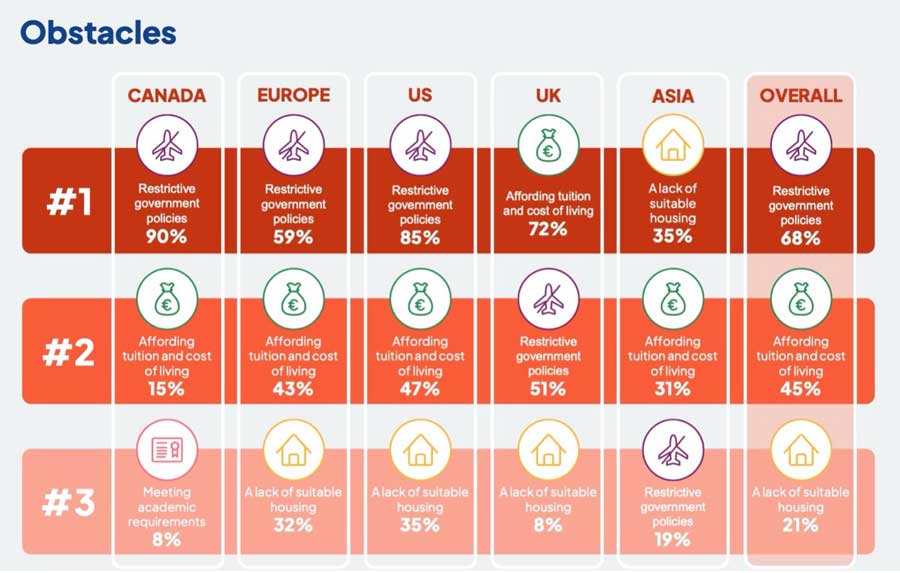

Overall, a majority of institutions reported having more issues with visa restrictions and government policies: 68% vs. 51% in 2024. This is a big leap, and it is being driven by the responses of university respondents in North America. In the US, fully 85% of institutional respondents said visa barriers are now a major concern (up from 58% in 2024). Visa and immigration issues rose even further in Canada (90%).

Canadian and US universities report significant enrolment drops

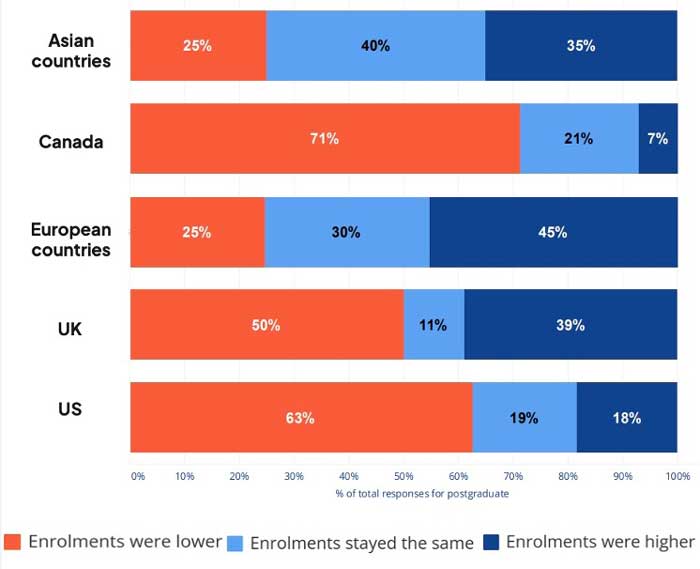

Of the Canadian university respondents surveyed, 82% said their undergraduate enrolments are lower than last year, and 71% said the same about postgraduate enrolments. Nearly half (48%) of their US counterparts saw fewer undergraduate students in the fall 2025 intake, and 63% said the same for postgraduate students.

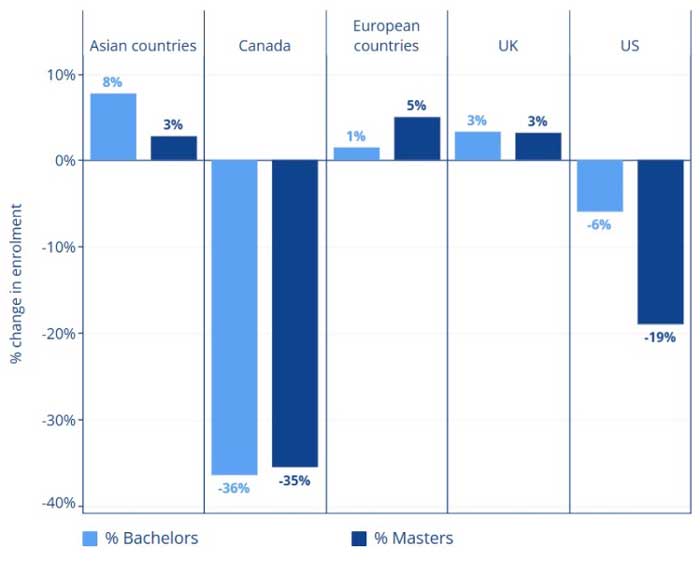

The situation is especially worrisome for Canadian universities, which are recording large decreases in new international enrolments (i.e., students coming for a study programme in Canada for the first time). As shown in the table below, new enrolments are down by more than a third at both the bachelor’s and master’s levels. The US is down significantly in new enrolments at the master’s level, and moderately for bachelor’s programmes.

Meanwhile, Asian universities are welcoming notably more new students into bachelor’s programmes, and European institutions are seeing a nice bump at the master’s level. UK university respondents report moderate increases in new international students at both levels.

One Asian respondent commented: "The Big Four countries' policies of restricting international student admissions have given a favorable opportunity for East Asian countries to increase their intake.”

Postgraduate enrolments have declined more comprehensively than undergraduate ones

Across all regions in the survey, under half of institutions saw their postgraduate enrolments grow in the fall 2025 intake. That said, European universities are faring better than most, with three-quarters (75%) experiencing stable or increased growth and only a quarter (25%) hosting fewer international graduate students. By contrast, just 28% of Canadian university respondents reported stable or increased growth.

Major obstacles to recruiting international students

UK university respondents see government policies as less of a concern than those in the US or UK. For them, affordability is the biggest issue in terms of attracting international students, as shown in the table below. For Asian institutions, lack of affordable housing is the top barrier, followed by affordability. But other than in Asia, visa policies are either the first or second top concern.

An American respondent said, “Restrictive immigration policies will continue to impact international student enrollment. The proposed changes to the H-1B process and possible changes to CPT and OPT will impact decision-making regardless of the outcomes of those policy proposals."

Priorities moving into 2026

Overall, most university respondents in the sample chose “diversifying into new markets” as their top priority for the next 12 months (see table below). Interestingly, Asia was the outlier, with “more aggressive enrolment goals” narrowly edging out diversification (27% to 23%, respectively). In Asia, many countries (e.g., South Korea, Japan, Taiwan, India) have official goals to increase their international enrolments, and we see that reflected in this top priority for Asian respondents.

Universities in Canada and the US are the most intent on diversifying (60% and 51%, respectively), perhaps because risk mitigation is more of a concern as Chinese and Indian demand has become more unpredictable.

Unfortunately, Canada stands out as the country in which at least half of universities are planning budget cuts (60%) or staffing cuts (50%). These percentages are far above the ones we see in other regions in the sample.

Highlighting the importance of diversification, one Canadian respondent said: “We're seeing sharp declines from major source markets like India and China, while interest grows in emerging regions such as Africa and Southeast Asia. Canadian institution.”

The big shift

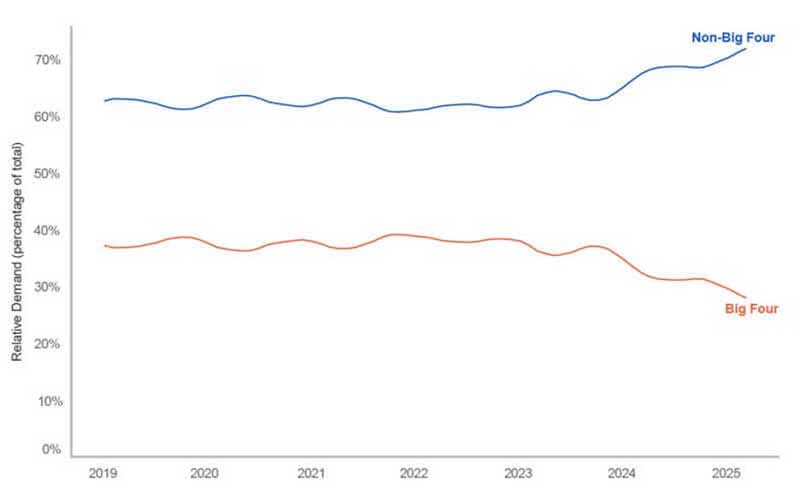

As government policies continue to challenge North American and UK institutions, international students are demonstrably switching their focus to alternative destinations. In the last Global Benchmark Report, which centred on the January-March 2025 intake, Studyportals produced this graph that shows student search volumes for bachelor’s and master’s programmes on Studyportals websites over the six months leading to that study.

A call for industry collaboration and lobbying

Dr Fanta Aw, executive director and CEO of NAFSA: Association of International Educators commented on the study findings:

“We are navigating one of the most dynamic moments in international education, driven in no small part by shifts in U.S. visa and immigration policy. The ripple effects of these policy changes are being felt across campuses and communities around the world. This moment calls on our higher education institutions to be nimble and deeply attuned to the needs of their students—and it calls on us, as an ecosystem, to continue pressing policymakers for greater consistency and clarity throughout the international student journey.”

Looking at the findings for the UK, Jamie Arrowsmith, Director, UK Universities International (UUKi) said:

“This report highlights the importance of affordability, even before the proposed introduction of the international student levy in England. This means that most institutions will have to absorb the cost to remain competitive. However, it's welcome to see confirmation that students value the Graduate route and certainty in the policy environment. That's why it’s absolutely vital that we now have a period of sustained policy stability in our offer to international students.”

For additional background, please see: