Irish ELT sector sounds note of “cautious stability” for 2024

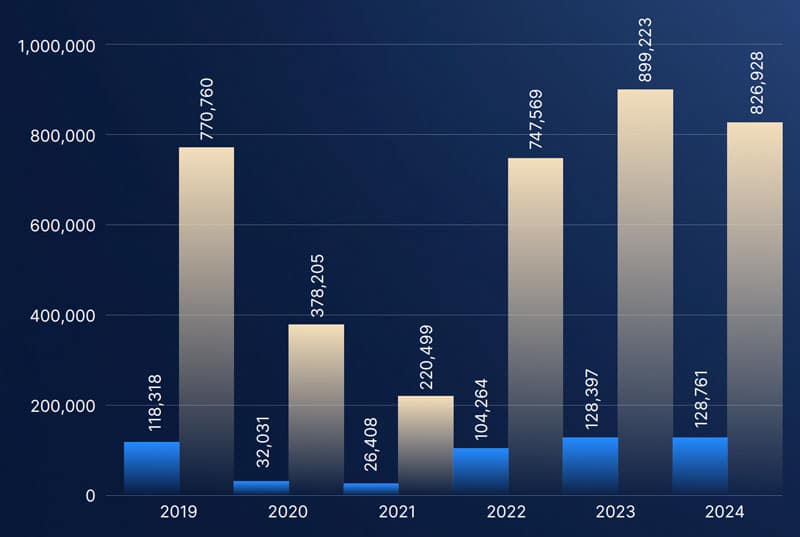

- The peak ELT body for Ireland is reporting that enrolment in English language programmes in the country held steady in 2024

- Student-weeks, however, declined year-over-year during to a continuing drop in average course duration

After a year of very strong growth in 2023, Ireland's English Language Teaching (ELT) sector is reporting remarkably stable numbers for 2024, with overall enrolments for the year virtually identical to those from the year before.

The full-year data comes from peak body English Education Ireland and was produced by sector research specialists BONARD.

As the chart reflects, however, student-weeks declined by -8% year-over-year owing to a continuing decline in average course duration. From a pre-pandemic average of nearly 12 weeks, the average time on course for an ELT learner in Ireland has been trending downwards since 2020 to reach a historical low of 6.4 weeks in 2024.

That trend reflects in turn an underlying dynamic where the composition of enrolment in Irish ELT is shifting toward a greater share of junior students, and those students are coming for shorter programmes. The report notes that, "In a global context, Ireland presents a relatively balanced ELT market in terms of the share of adult and junior students, similar to other European destinations such as the UK and Malta. In contrast, ELT sectors in countries like Australia, the USA, and Canada have traditionally catered predominantly to adult learners.

Given that rising levels of English language proficiency have increased local provision and that price sensitivity is growing, the adult segment is expected to continue contracting. Future growth in the ELT sector is likely to be driven by the junior segment."

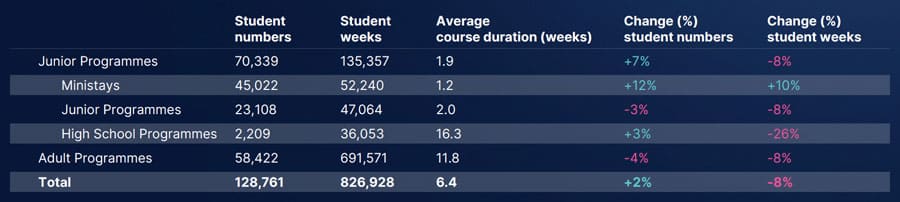

In 2024, junior students accounted for more than half (55%) of all ELT enrolments in Ireland, but that programming for younger students added up to only 16% of all student-weeks for the year. Put another way, the 45% of adult learners enrolled last year accounted for roughly 84% of total student-weeks. We see the year-over-year impacts of those trends in the more detailed breakdown by learner and programme type in the table below.

Writing in the foreword to the 2024 report, English Education Ireland CEO Lorcan O’Connor Lloyd says, "The global landscape of English Language Education continues to shift, shaped by economic headwinds, evolving student expectations, and a more competitive international marketplace."

"This year’s data tells a story of cautious stability. While overall student numbers remained steady and above pre-pandemic levels, a decline in student weeks reflects a growing trend toward shorter stays. The increase in Mini-stays signals strong demand for group-based, immersive experiences, while adult learners continue to choose Ireland for longer-term study, driven by quality education, cultural appeal, and the warmth of our welcome."

Where are students coming from?

Perhaps not surprisingly, the mix of sending markets varies quite a bit between the junior and adult segments. In broad terms: most junior students come from elsewhere in Europe – and especially from Italy and Spain – whereas adult students come from further afield, and from Latin America (e.g., Brazil, Mexico, Chile) and Asia in particular.

The top ten source markets overall are shown in the graphic below, with year-over-year changes in student numbers and student-weeks reflected for each. These ten student markets accounted for 80% of ELT programming in Ireland in 2024.

Nearly seven in ten (69%) ELT students booked their programme in Ireland through an education agent. The sector's direct economic impact for the year is estimated at €792 million.

For additional detail, please consult the complete report for 2024.

For additional background, please see: