Demand for study abroad in Australia, Canada, UK already affected by new international education policies

- New research shows that new international education policies in Canada, Australia, and the UK are significantly dampening interest in study in those countries

- The US appears to be gaining a greater share of demand as a result

New, restrictive policies concerning international students in the UK, Canada, and Australia are already having a significant impact on prospective student demand for study in those countries.

IDP’s recent study, "The Voice of the International Student," conducted in January 2024 across 67 countries with a total sample of 2,500 students, indicates that many students are reconsidering their plans to study in those countries, and that the US appears to be picking up share of interest.

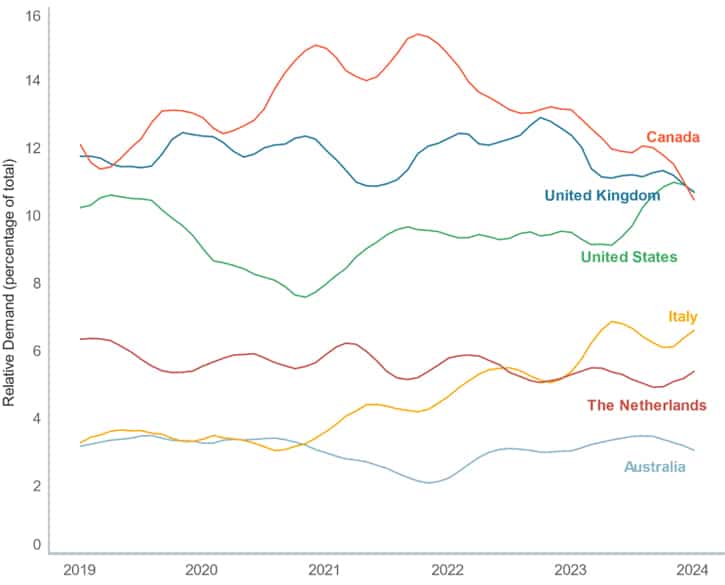

Similarly, Studyportals research published this month found that prospective student demand for Canada, in particular, is dipping dramatically, while interest in the US increased significantly in 2023. Italy has also grown much more popular. Interest in the Netherlands picked up again leading into 2024, but may soon decline due to Dutch universities’ stated intention to reduce international student numbers and English-taught programmes.

Looking for alternatives

Nearly half of the prospective students surveyed by IDP (49%) are reconsidering or unsure of their plans to study in the UK, and significant proportions are also hesitating to go to Australia (47%) and Canada (43%).

Simon Emmett, IDP Connect’s CEO, said the findings confirm that students are highly aware of the policies that may affect them in destination countries:

“This latest pulse survey highlights that international students are highly attuned to the ongoing discussions regarding policy changes, and that this is impacting the standing of the top global study destinations at a time when competition between destination countries is at an all-time high.”

The IDP research found that the US is the most attractive destination for students who are thinking twice about going to the UK, Australia, or Canada.

No doubt that policies shift international students’ perceptions and behaviours

Mr Emmett also pointed out that students naturally want certainty when they are making study abroad decisions, and the changing posture of British, Canadian, and Australian governments towards international students is not inspiring confidence:

“Our latest survey has identified that changing policy, regulations and restrictions are impacting the dynamics of student movement, with students open to changing their preferred study location. For a prospective international student, choosing to study overseas is one of the most important decisions of their lives and they want certainty when making these decisions.”

The Canadian and Australian governments had, until the end of 2023, supported a trend of rising international student numbers in their education institutions. In the UK, a favourable disposition towards higher international enrolments began to change in mid-2023 when the Home Office and Department of Education announced that in January 2024, most international students would not be permitted to bring dependants with them to the UK.

In all three destination countries, the new international education policies dovetail with governments’ attempts to control immigration more actively. In Canada and Australia, the policies are also geared at clamping down on unscrupulous institutions and agents and increasing quality controls across the international education sector.

A challenge ahead for Canadian institutions, but maybe not for graduate programmes

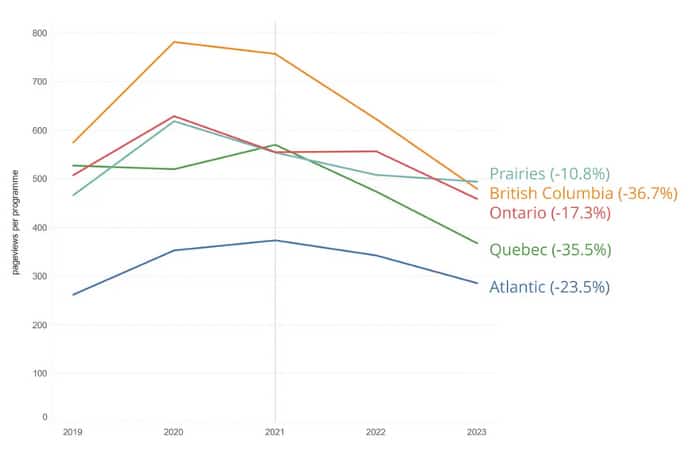

The Studyportals research – based on pageview data from the Studyportals search site – found that student interest in Canada has been declining for some time, especially for study in British Columbia, the province that holds the second largest share of international students after Ontario.

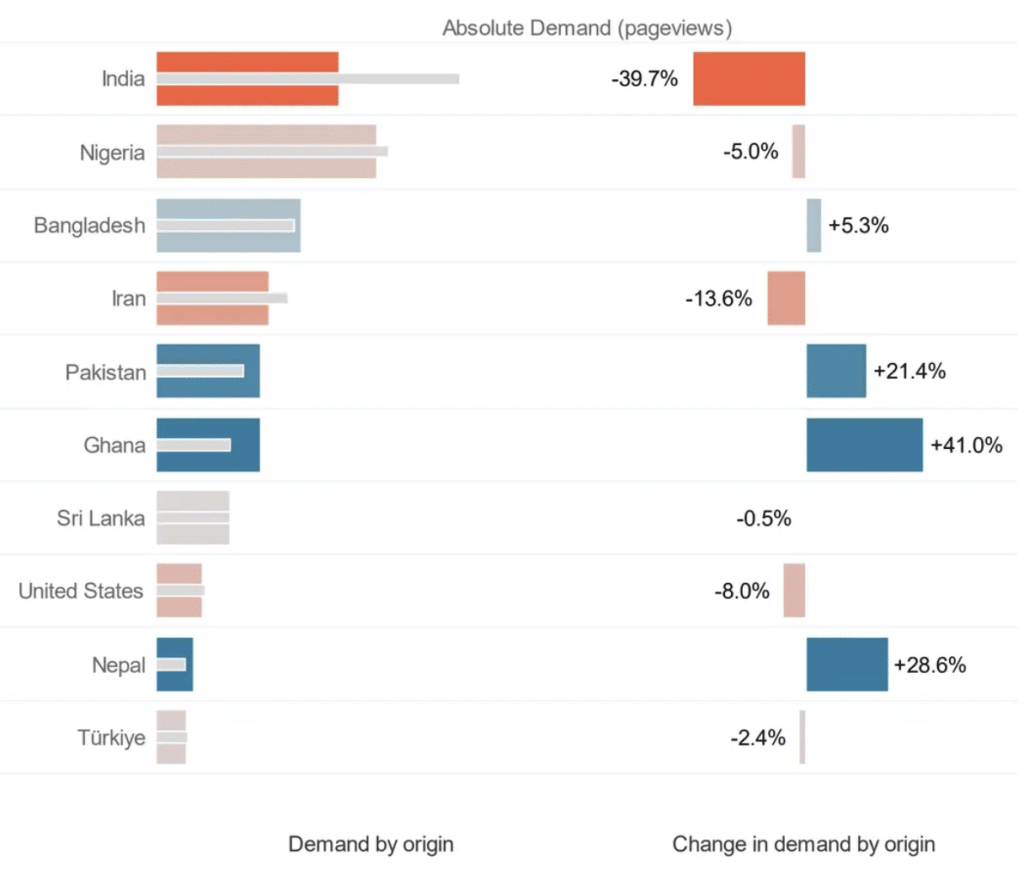

Studyportals data also show that demand from some key source countries is down, especially India (-40% between February 2023 and January 2024). An ongoing diplomatic rift between Canada and India that has caused visa processing delays is at least part of the story here, but Canada has also lost some allure in India for other reasons. Experts on a featured panel at the annual Canadian Bureau for International Education (CBIE) conference in Vancouver in late-2023 said there is a growing sense in India that study abroad in Canada isn’t as prestigious as it is in the UK or US. Meanwhile, the US government has recently increased visa handling capacity in India and is opening new diplomatic posts in the country.

Canadian undergraduate programmes stand to be affected most severely by the two-year cap on new international student permits, while master’s and PhD programmes may avoid negative fallout from the policy. This is because master’s and PhD students are exempted from the cap. Studyportals data indicates that demand for Canadian PhDs has been increasing steadily for the past year.

Good communications a must

Kim Loeb, Executive Director, Professional Applied and Continuing Education at the University of Winnipeg (PACE), provided this quote to Studyportals about the situation in Canada.

“While this announcement came without warning, all we can do is remain calm, as those “bad players” will be forced to change and those who were already providing housing supports and wrap-around services for students need to just keep doing what they are doing.

We have our current students to support, so they cannot get lost in the shuffle.

Canadian schools need to send a loud and clear message that we are still open to international students, and graduates from public institutions are still eligible for the PGWP. We still need to be in the market explaining the situation, and that Canada is still open but no longer wide open, and some areas like Toronto and Vancouver will have less spots.” (Editor's note: While the preceding quote refers to public institutions, we note that graduates of many private-sector institutions remain eligible for post-graduate work permits. The recent policy change in this respect applies only to students enrolled in programmes delivered via public-private partnerships, with graduates of such programmes no longer eligible for PGWPs as of 1 September 2024.)

For additional background, please see:

Most Recent

-

ICEF Podcast: Together for transparency – Building global standards for ethical international student recruitment Read More

-

New analysis sounds a note of caution for UK immigration reforms Read More

-

The number of students in higher education abroad has more than tripled since the turn of the century Read More