A closer look at post-Brexit trends in European student mobility

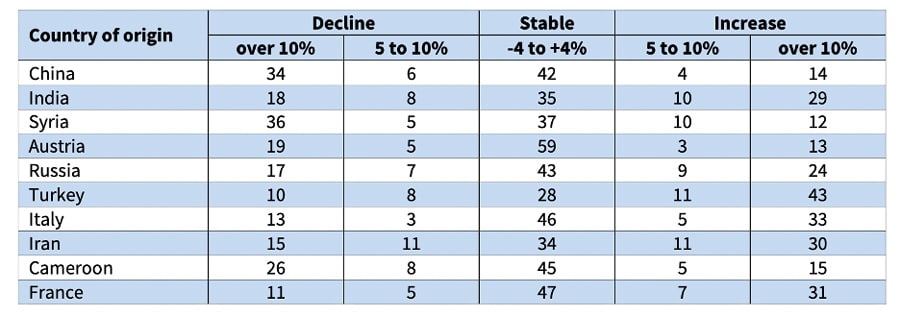

- An analysis of EU outbound student mobility since Brexit sheds light on which major destinations are gaining and losing share of European students

- EU enrolments in the UK have plunged over the last five years, but there are signs of greater stability in 2023

On 23 June 2016, the British electorate was asked, via a much-anticipated referendum, whether they would like their country to remain in the European Union or prefer that the UK leave the EU. Just over half (51.9%) voted “leave,” a result that would have massive implications for students in the EU and for UK schools, ELT providers, and universities.

During a transition period lasting through 2020 and into part of the next year, EU students retained the same rights in the UK as they always had, including the right to pay the same tuition as domestic students and the right to apply for the same student loan. But in the summer of 2021, EU students lost their “home fee status,” their permission to apply for a student loan in the UK, their ability to enter the UK without a passport, and their freedom to secure a job in the UK after graduation without a work permit.

Today, we explore data that sheds light on the new shape of European student mobility after Brexit.

Brexit triggered a decline in EU enrolments

The shock of the Brexit announcement had an immediate effect on EU students’ interest in studying in the UK: first-year EU enrolments in UK universities declined slightly in 2017/18. The negative trend deepened after that, peaking in 2021/22 when EU students were faced with paying full international fees to study in the UK. That academic year, the number of new EU students declined by 53% compared to pre-pandemic levels.

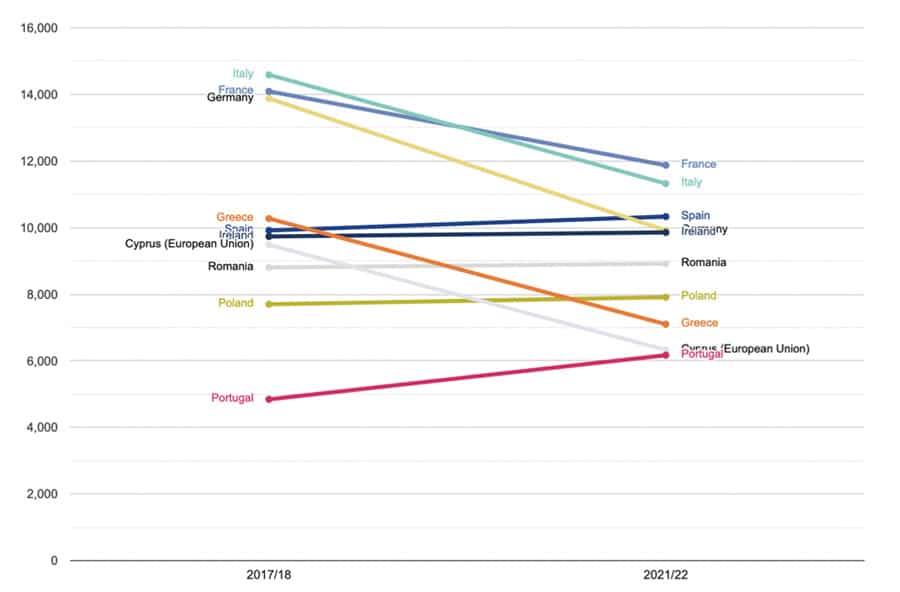

The following chart provides a vivid illustration of what happened to EU enrolments after Brexit. Declines from top markets Italy, France, Germany, and Greece have been particularly acute.

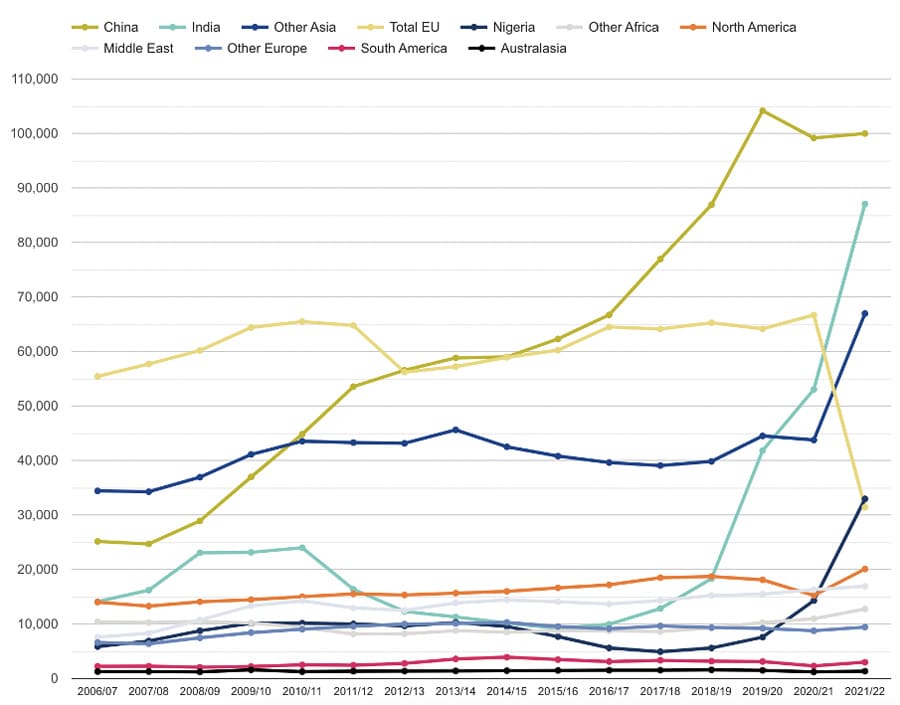

The next chart shows first-year enrolment trends in UK higher education institutions from the perspective of sending regions over a longer time frame. The diverging trends in EU versus non-EU enrolments in recent years are well illustrated.

Faced with declining EU enrolments, UK universities expanded recruiting activity in non-EU markets. Their success has been helped along by the introduction of the UK Graduate Route that allows international students 2-3 years to remain in the UK to work after completing a degree. There are now more than 5x as many non-EU students in UK universities as EU students (559,825 versus 120,140, respectively).

Earlier this year, the International Higher Education Commission, supported by Oxford International Education Group, released a report arguing that the UK must intensify recruitment in the EU to reduce a growing reliance on non-EU enrolments.

Have other destinations picked up share of EU students since Brexit?

The answer appears to be yes.

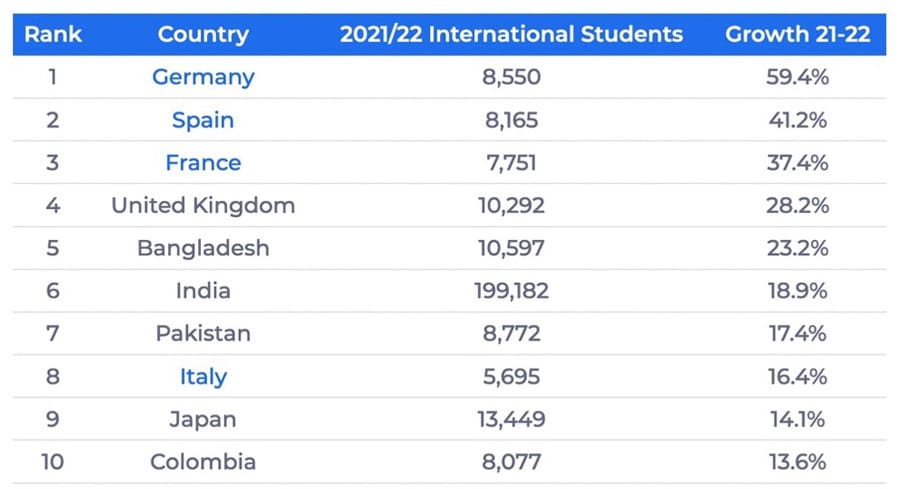

In the US, the three fastest growing student markets are Germany, Spain, and France. The UK and Italy are also in the top 10 fastest growing markets, as shown in this chart from ApplyBoard.

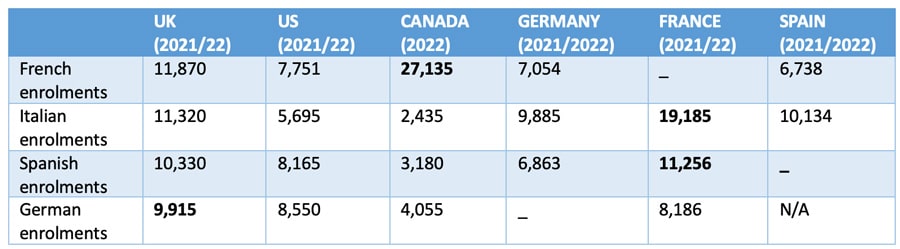

In Canada, France is now the fourth-largest sender of students to Canadian schools, colleges, and universities (27,135 in 2022, up 13.8% over 2019). Other notable growth is coming from:

- Germany: 4,055 in 2022, up 37.7% over 2019

- Spain: 3,180 in 2022, up 44.9% over 2019

- Italy: 2,435 in 2022, up 25.5% over 2019

- Belgium: 1,025 in 2022, up 50% over 2019

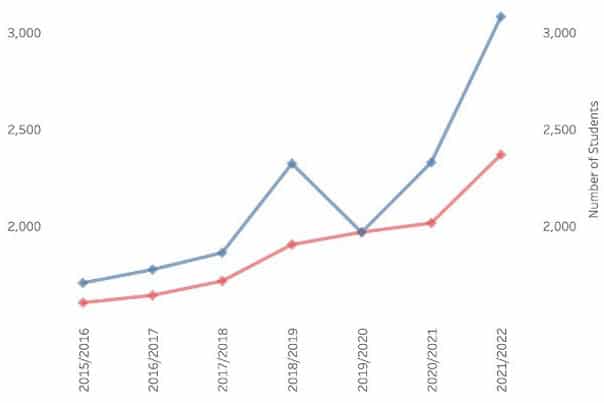

In Ireland, the number of applications from EU students to Irish universities reached 6,383 in 2022 – more than triple the number lodged in 2017. The following chart shows EU enrolment trends over time in Irish higher education institutions. The blue line represents EU students 23 and under, whereas the red line is students aged 24+. The younger cohort’s enrolments were up 56.5% (to 3,083) in 2021/22 versus 2019/20. The older group contributed 20.4% more enrolments in that same time span.

In France, several European countries in the top 10 sending markets were growing fast in 2021/22, including Italy (19,185, +16% over the previous year), Spain (11,256, +25%), and Germany (8,186, +17%).

In the Netherlands, the number of European students “surged” in 2021/22 according to Statistics Netherlands. Nuffic also reports that European students are driving the overall increase in international students in the Netherlands: “The number of international students from within the EEA increased by 14% in 2021-22, compared to a 7.6% increase in students from outside the EEA (including UK students) in the same period.”

In Germany, Austria is the fourth-largest market and there were 14,600 Austrian students in German higher education in 2022, up 26% over 2019. Italian student numbers in German universities rose 7% from 2019 to 2022 for a total of 9,885. DAAD reports that there was a significant rise in the number of “newly enrolled” French and Italian students in German institutions in the 2021/22 winter semester, as shown in the chart below.

And in Spain, the number of Italian students in degree programmes jumped 8.8% from 2019/20 (9,402) to 2021/22 (10,234). The number of French students increased by 26.4% in the same timeframe for a total of 6,738 in 2021/22. The number of German students moved from 5,445 to 6,639, a 21.9% increase.

Comparing enrolments across destinations in 2021/22

When we look at five destinations for EU students in the chart below, we can see that the UK enrols the most German students. Canada is the top enroller of French students, while France is the leading destination for Italian and Spanish students.

In the UK, Spanish enrolments have ticked slightly upwards since 2019, but French, German, and Italian enrolments are down. In the US, enrolments from all listed EU countries are up significantly since 2019, and the same is true for Canada. This upward trend characterises EU enrolments in France, Germany, and Spain.

Is the shock of Brexit fading?

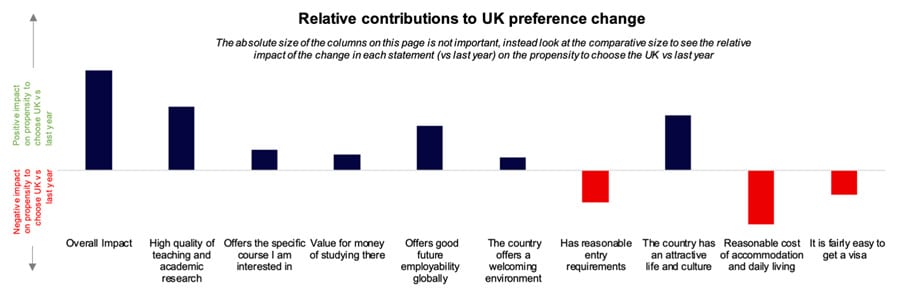

A recent online survey of EU students commissioned by the British Council suggests that EU students are warming again to the notion of studying in the UK. They are attracted by the excellent quality of education, but the impact of Brexit remains an issue and there is a perception that the UK is expensive.

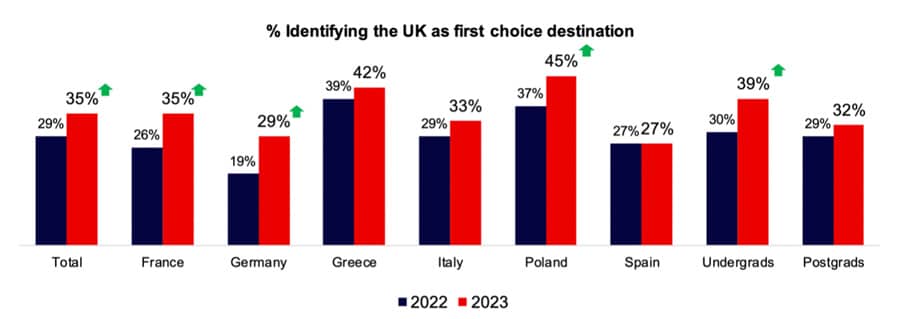

The survey was conducted online with more than 1,700 students spread equally across Germany, France, Greece, Poland, Spain, and Italy. Students had to be “considering studying abroad, in English, at a university/higher education institution in the UK, Ireland, USA, Australia, Canada, or New Zealand in the next three years.”

Compared to 2022, prospective EU students were six percentage points more likely to say they were considering the UK for their studies, rising to a nine and ten percentage-point increase among French and German students, respectively.

Quality of education and availability of programmes of interest are the main drivers of interest in the UK, while “reasonable entry and visa requirements, and particularly cost of day-to-day living and accommodation” are seen by EU students as drawbacks.

Positive impressions of the quality of education increased by three percentage points over 2022, as did the feeling that the UK offers “good potential for employability.” As the British Council notes, these are top factors influencing ultimate decisions about study abroad. But students were less likely than in 2022 to agree that the UK has reasonable entry requirements (-3), “reasonable cost of accommodation and daily living” (-6), or that it is “fairly easy to get a visa” (-3).

The following chart illustrates that there has been an uptick in students in the six surveyed countries considering the UK to be their first-choice destination.

The survey report provides good recommendations for how UK institutions can craft messaging to respond to areas where the UK is trailing competitor countries (such as cost of living) in the minds of students.

Quality of education matters a lot, but so does affordability

While the UK remains competitive as a study abroad destination due to the exceptional quality of education provided by many of its schools and universities, its appeal to EU students has weakened because of Brexit terms. Quite simply, it has become more expensive and more difficult for EU students to study in the UK since Brexit, and so these students are considering other destinations.

The Guardian notes, “Before Brexit, [EU] students paid home fees of just over £9,000 (USD $11,484) and had student finance available. Fees have risen as high as £38,000 (USD$48,488) after Brexit.” However, the British Council points out that “the average cost for international undergraduate students is estimated to be around £22,200 (USD$28,327) per year” and for postgraduate students, around £17,109 (USD $21,832) per year.”

Comparatively, in Canada in 2022/23, international undergraduate students paid an average annual tuition of CDN$36,123 (USD$27,168) and international graduate students paid an annual average of $21,110 (USD$15,880).

In the US in 2022, average annual tuition fees for international undergraduate students enrolled in public universities were USD$26,290 and in private universities, USD$35,800. Tuition for most master’s programmes is at least USD$20,000 annually.

Therefore, the US and UK are quite similar in terms of their relatively high tuition, and Canada is also expensive at the undergraduate level. But for EU students, the loss of home fee status means that the UK no longer the competitive advantage of lower tuition vis a vis the US or Canada, and it means that other European countries have become more attractive for students concerned with affordability.

In 2023, IDP research among 21,000 students in 100+ countries puts Canada first among leading destinations in terms of attractiveness, followed by Australia and the US.

For additional background, please see: