Online programme manager (OPM) market under pressure this year

- The threat of expanded legislation, shifting business models, and downward pressure on enrolments have combined for a more challenging outlook for OPM providers this year

- At least two major players have exited the business, and those that are publicly traded are seeing significant dips in stock values

Online programme enrolments surged during the pandemic, and global forecasts continue to project robust growth through the mid-point of this decade.

One recent analysis from HolonIQ, for example, pegs the global online programme management (OPM) market alone at US$5.7 billion as of 2019 and projects that the segment will grow to US$13.3 billion as of 2025.

By way of background, OPMs help universities and colleges bring their programmes online. They typically offer a broad basket of services – everything from strategic advice and instructional design to technology and systems to recruitment, retention, and student support. Universities remain responsible for core academic functions, notably admissions, teaching, and curriculum. OPMs typically also cover the upfront costs of converting an existing university programme for online delivery, in return for which they receive a portion of the resulting programme revenues.

But the OPM sector has been under pressure over the last year and more as growth has slowed, and as more institutions, especially in the US, are challenging some conventions of the established business model.

Phil Hill is a market analyst with a focus on ed tech, and he has written extensively about some of the forces acting on the OPM segment over the last couple of years. In late 2022, he reported, based on public disclosures from leading OPM provider Wiley and 2U, that OPM contracts were now being written for shorter terms, with some ranging from five to seven years in length as opposed to the more standard length of ten years or more.

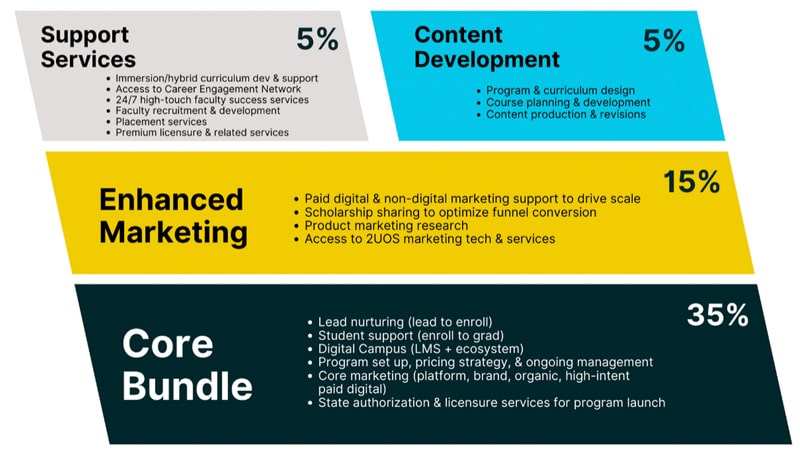

Mr Hill noted as well that revenue sharing has by far been the most common type of revenue model for OPM partnerships. In previous years, OPM providers might command 50% or more of programme revenues, but those percentages were dropping on at least deals last year, down to 30-40%, or, in the case of 2U, with stackable options ranging from 35%–60% based on the service options selected by the institution. "Market forces are changing the terms with lower share percentages and reduced contract lengths," he added. "Not in every case, but as a general market trend."

Part of the issue is that online enrolment in one of the largest OPM segments (graduate programmes in the US) is falling over the last two years. That flattening growth curve in the sector and downward pressure on provider revenues is now being reflected in stock prices and even in some exits from the OPM business and the part of major providers.

"Market valuations of publicly-traded OPM companies have continued to drop," observed Mr Hill in April 2023, "with 2U/edX, Coursera, and Keypath all down 75% or more from March 2021."

We see further evidence of this pressure on established business models in the news earlier this year that the education publisher and service provider Pearson had decided to sell its online education services subsidiary, including its OPM business, to a private equity firm. The move comes as Pearson's largest OPM contract, with Arizona State University, was drawing to an end as of June 2023.

In a similar vein, UK-based MOOC platform and OPM provider FutureLearn was sold to Global University Systems in December 2022

And most recently, Wiley, which, along with Pearson, 2U, and Academic Partnerships, was counted among the "Big Four" leading OPM providers, has announced that it too will now also divest its OPM business.

Another important bit of context for those high-profile exits is the looming question of increased regulation in the sector, at least in the US, where the Department of Education has indicated its intention to expand its oversight of third-party providers, and OPMs in particular. The shape and reach of that new regulation is not clear but it has sufficiently alarmed the sector that at least one major player, 2U, has taken the issue to court with a legal action that asserts, "By broadening the definition of third-party servicer, the [Department of Education aims to impose] an expansive and onerous regulatory regime on companies that facilitate online educational programming and related services for brick-and-mortar colleges and universities."

For additional background, please see: