Non-EU markets boosting recovery of Malta’s English language training sector

- Malta’s English language training sector is rebounding nicely from pandemic losses

- In 2022, the total volume of student weeks was higher than in 2019 or in any year before that

- Enrolments grew by 103% over 2021 but are still off pre-pandemic levels

- Colombia is an increasingly important market for the sector

Malta’s English language training (ELT) providers welcomed 56,675 international students in 2022 – a 103% increase over 2021. The news of the dramatic uptick in the number of students was released by Malta’s National Statistics Office (NSO).

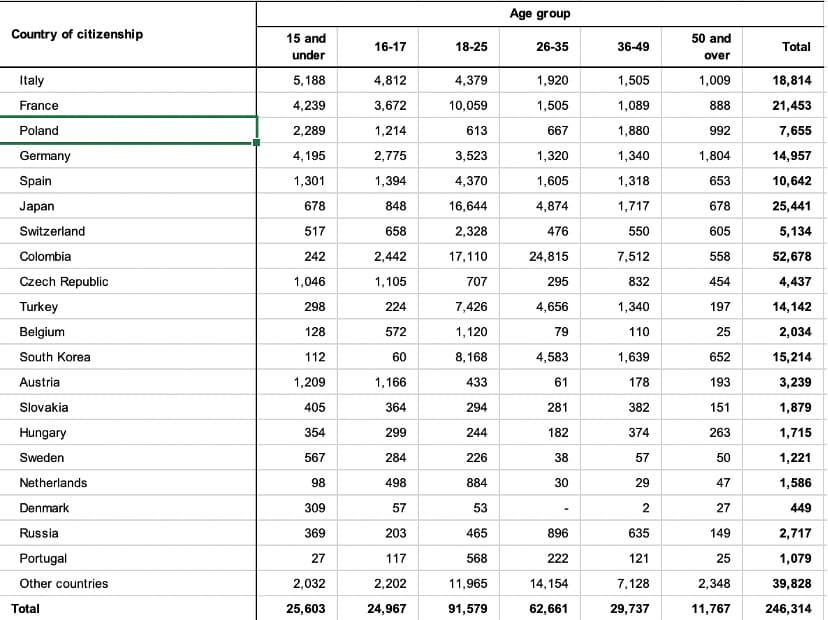

The number of student weeks in 2022 was 246,315, up from 137,108 weeks in 2021, an 80% increase. Almost all instruction (99%) was conducted in-person rather than online.

Pre-COVID, in 2018, Malta’s ELT providers had welcomed just over 87,000 students and student weeks totalled 215,250. In other words, the number of students in 2022 remained lower than pre-pandemic levels but the volume of student weeks was substantially higher.

The record number of student weeks (higher than the past record reached in 2014) reflects Malta’s growing popularity in non-EU markets. While students from outside the EU make up a much smaller proportion of all ELT students in Malta, they tend to stay for longer.

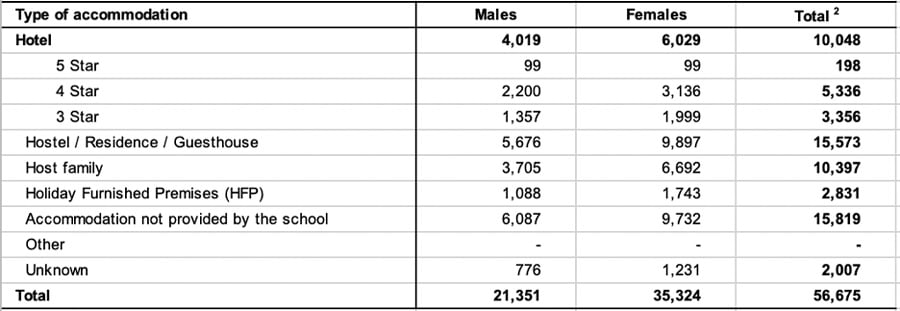

The increase in student weeks may also indicate that it is now easier for students to find accommodation in Malta, as in 2018, a trend of declining weeks had been attributed to insufficient student housing. The following table shows the distribution of students across various types of accommodation in Malta in 2022.

The average length of stay for ELT students in 2022 was 4.3 weeks overall, but this surged to 14.5 weeks for Colombian students, 13.3 for South Korean students, and 13.1 for Chilean students. The Colombian market is increasingly important for Maltese providers. There were many more Colombian students studying in 2022 than in 2019, especially those in the 18-25 and 26-35 age cohorts. Most other markets have not yet recovered to pre-pandemic levels for Maltese language schools.

Young students aged 15 and under made up the largest proportion of those enrolled (24%), and their number more than doubled over 2021. Significant increases were also recorded for the 16-17 age group and students aged 18–25. Female students outnumbered male students by a considerable margin.

The return of students has allowed for more staff hires. In 2021, staff had numbered under 900, while in 2022, this increased to over 1,200 (mostly teaching/academic staff).

As in previous years, the largest EU sending markets were Italy (16% of student weeks booked) and France (13%). Germany was the third largest market (13%). Overall, 7 in 10 students came from an EU country. Outside of Europe, Japan and Colombia sent the most students to Malta.

Intensive English courses were the most popular, accounting for 69% of all English-language courses on offer in Malta. The previous year, Intensive English courses had been less popular than General English courses among international students enrolled with Maltese ELT providers.

As usual, July was the busiest month for business, followed by August and October.

If we look at Malta’s ELT recovery trajectory compared with what happened in 2022 in competitor countries, we see that Malta is closer to a return to pre-pandemic business than the UK (where both student numbers and weeks are still down considerably from 2019), Spain, and Australia. Malta and Ireland bear the strongest resemblance in that:

- Enrolments have yet to reach pre-pandemic levels;

- Weeks have now surpassed the total in 2019;

- Latin American markets are a big part of the recovery story, especially in terms of student weeks.

For additional background, please see: