Surge in new students has ELICOS sector leading Australian growth for 2022

- A 155% increase in commencements (and 90% bump in enrolment) has the ELICOS sector leading growth for Australia in 2022

- Nearly eight in ten commencements come from the top ten sending markets for the sector, with Colombia, Thailand, and Brazil driving overall growth

- The total number of ELICOS commencements has now recovered to 63% of pre-pandemic volumes

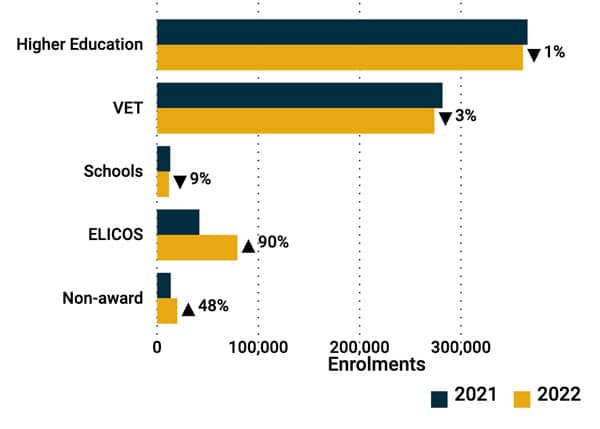

The year-end tally from Australia’s Department of Education indicates a total enrolment of 619,371 international students for 2022. This represents year-over-over growth of 8%, with most sectors holding flat or losing ground compared to 2021, including higher education (down -1%), VET (-3%), and the schools sector (-9%). This also reflects in part the limited growth of Australia’s top sending markets last year, notably China (-9%) and India (+1%), both of which have long been important drivers of both higher education and VET numbers.

In contrast, the ELICOS (English Language Intensive Courses for Overseas Students) sector grew by nearly 90% in 2022 on the strength of huge gains in commencements, visa lodgements, and visas granted.

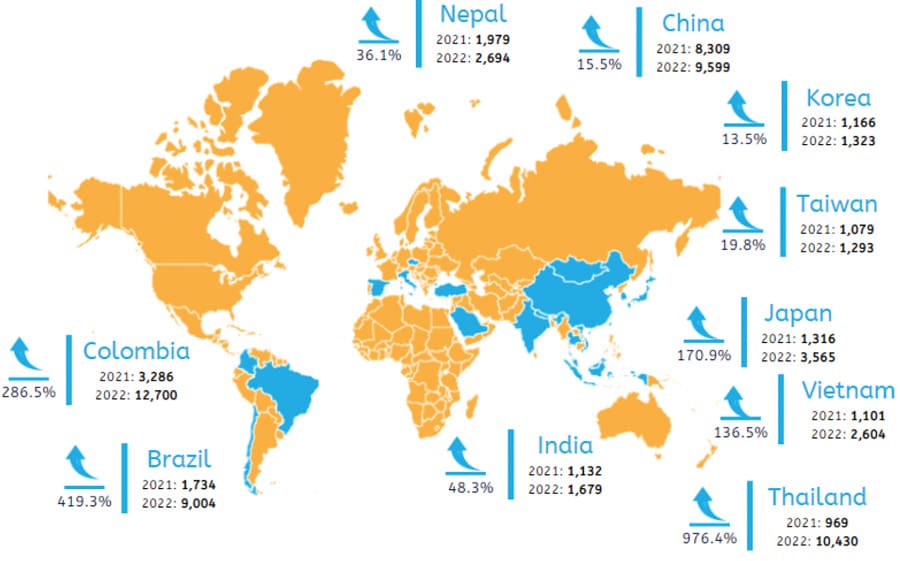

All told, ELICOS commencements increased by 155.4% year-over-year. But just as impressive is where that growth is coming from with Colombia, Thailand, and Brazil the biggest movers among the top sending markets.

Colombia was the leading source market for ELICOS in 2022, and finished the year with 12,700 commencements – accounting for nearly one in five of all commencing students and marking 287% growth from 2021.

Just over 10,400 new Thai students began their ELICOS studies in 2022, good enough to make Thailand the #2 sending market (with 14% of all commencements for the year), and representing a stunning 977% gain over the year before.

China finished up as the #3 sender for 2022 on the strength of its 9,599 commencements, but with a much more modest year-over-year growth of 16%.

The top five markets, which includes Brazil and Japan, accounted for six in ten of all ELICOS commencements. The top ten senders, as illustrated in the graphic below, provided roughly eight in ten of all commencing students for the year.

Reading the visa trends

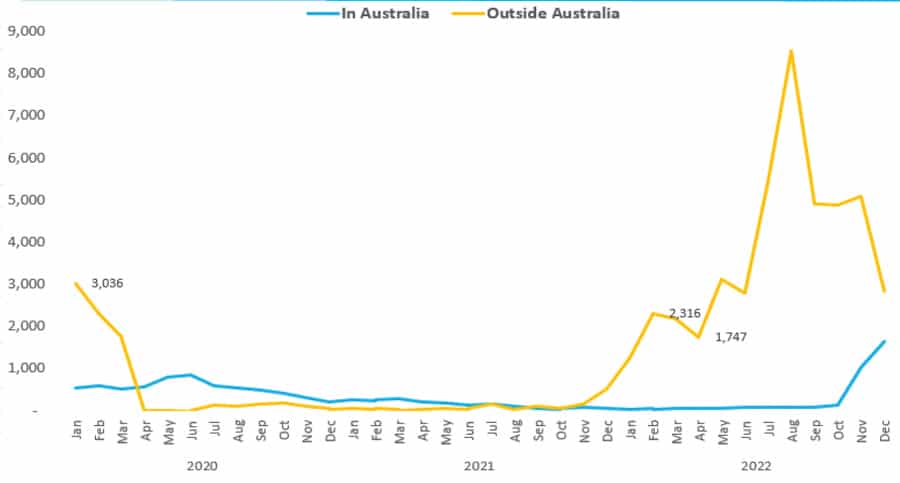

Department of Education data tells us that there were 79,362 enrolments in ELICOS programmes in 2022, compared to 41,850 the year prior. Those numbers reflect only students holding study visas, and we can see as well that ELICOS sector grants were over 13.5 times higher in 2022, with 45,323 more grants compared to 2021.

Visa lodgements for ELICOS study were roughly nine times higher year-over-year with 56,492 total applications filed.

As we see in the chart below, the bulk of that growth in visa grants occurred in the second half of 2022.

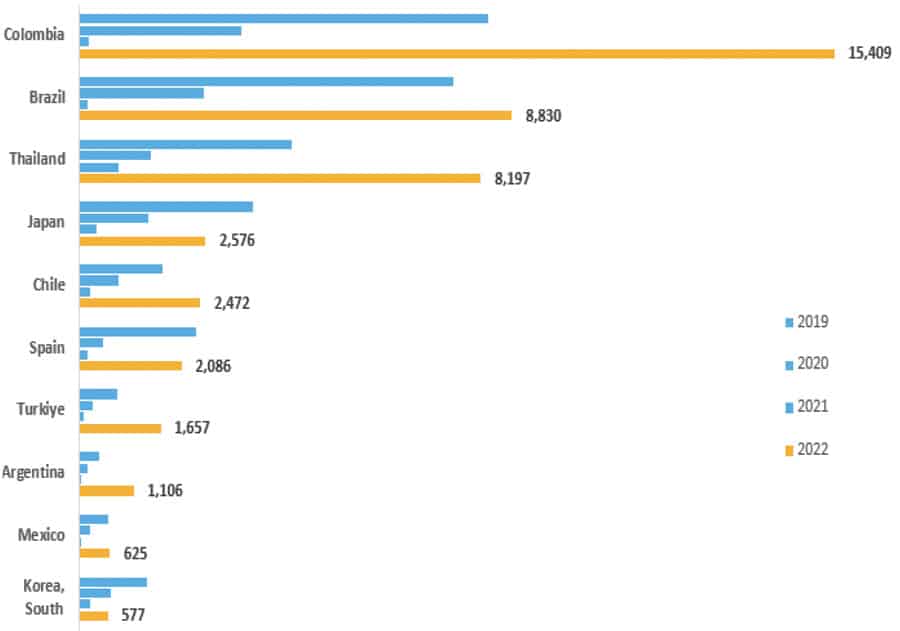

The mix of visas granted by sending market in 2022 is also interesting, especially when we remember that China was the #3 source market (in terms of commencements) for the year. It doesn't appear, however, in the following chart of the top ten markets in terms of ELICOS visa grants (China is #14 in that regard), suggesting that further shifts are ahead in the composition of ELICOS enrolment.

The bigger picture

With the dramatic growth for 2022, the total number of commencements has now recovered to 63% of pre-pandemic (2019) volumes. Needless to say. this is a very important and encouraging trend, not only for the sector, but for the recovery of foreign enrolment in Australia. Department of Education data indicates that nearly half (47%) of all student visa-holding ELICOS students go on to further study in the country.

The importance of those pathways, and the toll the pandemic has taken on international education in Australia, is vividly illustrated in a related report from English Australia. The study finds that the direct economic contribution of the sector declined from AUS$2.36 billion in 2019 to AUS$438 million in 2021, a drop of roughly AUS$1.9 billion (or -82%). It estimates as well that, given the large number of ELICOS students that progress to further study in Australia, the economic impact of those lost future enrolments was AUS$2.7 billion, for a total loss of AUS$4.6 billion.

Those numbers underscore the importance of the recovery in ELICOS commencements this year, not only in terms of total volume but also in the more diverse mix of sending markets we see taking shape through 2022.

For additional background, please see: