Measuring the economic impact of foreign students in the UK and the country’s competitive position in international recruitment

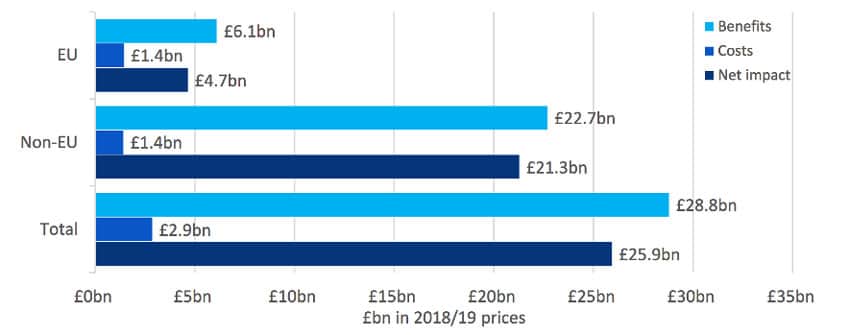

- International students commencing studies in 2018/19 contributed £25.9 billion to the UK when contributions and costs are analysed over the duration of these students’ programmes

- Non-EU students were found to be responsible for a greater proportion of net economic benefit to the UK than EU students

- A new report assesses the UK’s competition for international students and recommends strategies for “maintaining, regaining, or developing” specific sending markets

Two new fascinating reports released recently underline the importance of international students to the UK economy and what is at stake in terms of the UK’s ability to maintain market share relative to other leading study abroad destinations. The first is an analysis from London Economics commissioned by the Higher Education Policy Institute and Universities UK International, while the second is a report jointly produced by UUKi and IDP Connect.

The UK has a stated goal of hosting 600,000 international students by 2030, increased its international enrolments in 2019/20, and remains the #2 destination for students after only the US. At the same time, UK educators face growing competitive pressure as other destinations recruit students on the basis of affordability, post-study work rights, and assurances of safety and openness towards international students.

£25.9 billion to the UK economy in 2018/19

The London Economics analysis shows that a 2018/19 cohort of international students studying in the UK contributed a net economic benefit of £25.9 billion (US$35.9 billion) to the UK’s economy – up 19% from the last time a similar analysis was undertaken in 2015/16. The cohort comprised 272,920 first-year international students commencing their studies at UK universities in 2018/19, and the analysis looked at the total economic impact of this cohort on the UK economy over the entire duration of their studies.

In determining the net economic benefit, the analysis took into account:

- Students’ tuition fees and the indirect benefit of these fees – through universities’ spending on staff, goods, and services – to the economy;

- Students’ non-tuition spending (e.g., expenditure on living costs) and how this spending rippled through various sectors of the economy;

- The income associated with students’ families and friends visiting them while they were in the UK that flowed through multiple sectors of the economy.

According to the findings of the analysis, “every 14 EU students and every 10 non-EU students generate £1 million worth of net economic impact for the UK economy over the duration of their studies.”

Non-EU students spent more than EU students

Of the roughly 273,000 international first-year students who entered higher education in the UK in 2018/19, three-quarters (76%) were from outside the EU – a significant 20% increase over 2015/16. (For more on the strategic importance of non-EU students in the UK, please see this recent article.) The remaining 24% were from the EU.

A typical non-EU student contributed a net benefit of £109,000 to the economy compared with £94,000 for an EU student. The difference is largely attributable to non-EU students paying more in tuition in 2018/19 than EU students – a differential that will disappear now that EU students will pay the same tuition fees as non-EU students because of Brexit terms.

Extrapolating from one student to all first-year international students, non-EU students contributed vastly more income while costing the economy no more than EU students (see table below).

Looking at all new international students – EU and non-EU – commencing studies in 2018/19, these students contributed £25.9 billion versus £21.7 billion in 2015/16, largely due to a 17% increase in international students (especially non-EU students) in 2018/19 compared with 2015/16.

How competitive is the UK today?

The London Economics analysis commissioned by Universities UK underlines the importance of international students to the British economy, while a separate report produced jointly by UUKi and IDP Connect this fall shows that the UK’s competitive position is vulnerable because of stronger competition for students by other major destinations.

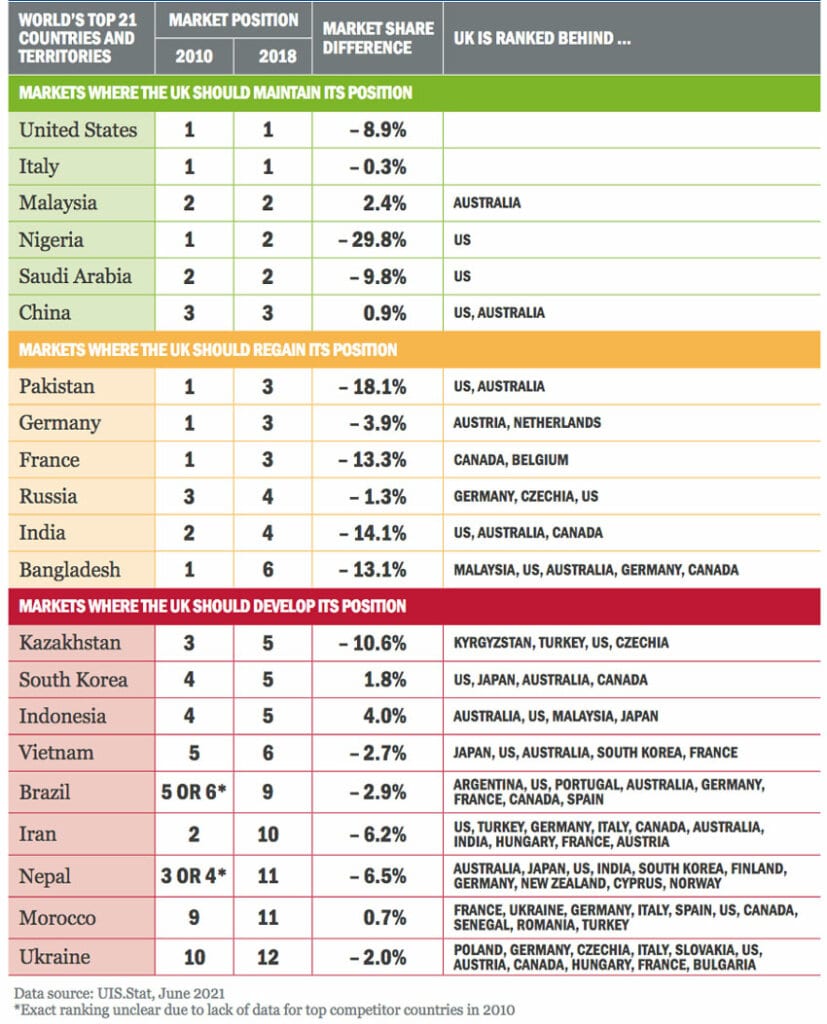

The UUKi/IDP Connect report assessed the UK’s position relative to Australia, Canada, China, France, Germany, Japan, Malaysia, New Zealand, and the US, and looked at the strategies employed by these other destinations to attract students. The report is intended to guide collaborative efforts by higher education institutions, the wider sector, and the UK government to reach a goal of 600,000 international students in 2030. For the 2019/20 academic year, international enrolments in the UK rose to 556,625.

A variety of research sources informed the report: quantitative data analyses of HESA and UNESCO data; secondary research; and qualitative interviews with prospective students, alumni, and agents from Brazil, India, Indonesia, Nigeria, Pakistan, Saudi Arabia, South Korea and Vietnam.

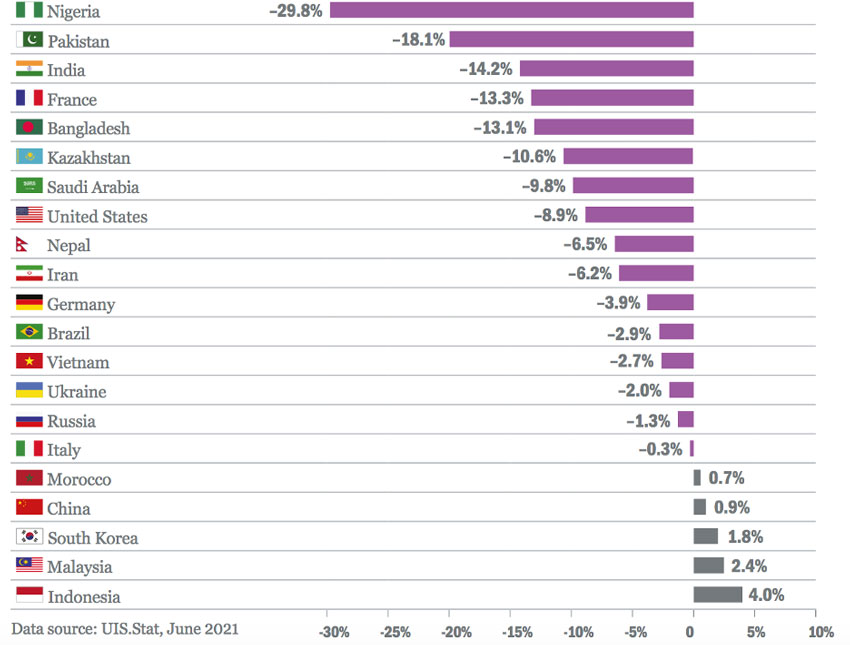

Declining share in major markets

The UK remained the world’s #2 destination for international students in 2018 by a narrow margin over Australia (though the pandemic will have easily widened that gap between the UK and Australia given the latter country’s extended border closure). Despite its popularity, however, the UK lost market share in 16 out of 21 top sending markets for international students between 2010 and 2018 according to research informing the report (see table below).

Quality of education key

The research found that while the UK remains a highly compelling choice for international students, particularly given its reputation for quality of education, there are some weaknesses in terms of the country’s ability to attract students compared with other destinations. These include:

- The UK being relatively expensive for international students;

- Students not being provided with enough information on regional options within the UK;

- Lack of a scholarship search tool in the Study UK campaign;

- Slightly more restrictive post-study work opportunities.

Markets with the most potential

Interestingly, the report assessed which markets are the most and least promising for UK educators. It found that the UK should maintain its position in Nigeria and Saudi Arabia (where it is currently second after the US); reclaim its position in India and Pakistan (where it is second and third); and build on its position in Brazil, Indonesia, South Korea, and Vietnam (where it is fourth or lower in terms of its share).

The report outlined four broad recommendations for improving the UK’s ability to attract international students:

- “Improve the promotion of the UK as a welcoming, diverse, and accessible study destination;

- Ensure the success of the Graduate Route;

- Reduce financial barriers for international students;

- Support the improvement of English-language ability” (specifically by supporting the recovery of the UK’s ELT sector, which has been badly battered in the pandemic).

What matters most in various sending markets?

The report’s qualitative research identified main push and pull factors in key sending markets around the world. For example, here are some of the drivers for students in specific countries:

- Nigeria: The availability of funding and post-study work opportunities;

- Saudi Arabia: Whether a country is perceived as welcoming and safe for international students;

- India: The availability of funding, university rankings, and post-study work opportunities;

- Pakistan: The availability of funding, the presence of family in a destination to reduce costs, and students' sense of being able to secure a favourable return on their education investment;

- Brazil: The opportunity to form international connections, funding, job opportunities during their degree, and culture and lifestyle;

- Indonesia: The chance to get international experience, funding, rankings, and lifestyle factors (e.g., accommodation and the presence of a “large Asian community”);

- South Korea: Affordability, rankings, and post-study work opportunities;

- Vietnam: Opportunities for permanent residency, safety, affordability, and presence of scholarships.

As we can see, the themes of affordability – and relatedly, scholarships, post-study work rights, and safety – coursed through the qualitative interviews with students, alumni, and agents. These findings informed the report’s recommendations to promote the Graduate Route more intensively and to create “more diverse and innovative funding opportunities,” particularly in Brazil, India, Nigeria, Pakistan, Indonesia and Vietnam, where there is more price-sensitivity and need for financial support.

In addition, the report highlights the importance of English-language learning opportunities for students in markets such as Indonesia, Brazil, and Vietnam and it recommends that the government:

- “Work with the British Council to develop a long-term strategic approach to market development through investment in English language education;

- Support the recovery of the UK-based English language sector, which has been severely affected by the Covid-19 pandemic.”

For months now, ELT providers in the UK have been frustrated at the lack of government support for their financial survival. They have been hit incredibly hard by the travel restrictions that have been part and parcel of the pandemic. The hope is to see a real recovery by late-2022. The UUKi/IDP Connect report highlights that the sector is not only crucial in and of itself to the UK economy, but is also an indispensable pipeline of students for higher education in the UK.

For additional background, please see: