UK ELT reports “devastating” 2020 results but recovery by late-2022 is still the target

- English language schools in the UK lost 84% of their enrolments in 2020 compared with 2019

- Programmes for juniors were especially hard-hit

- Many adults who were able to come to the UK for ELT last year stayed for longer

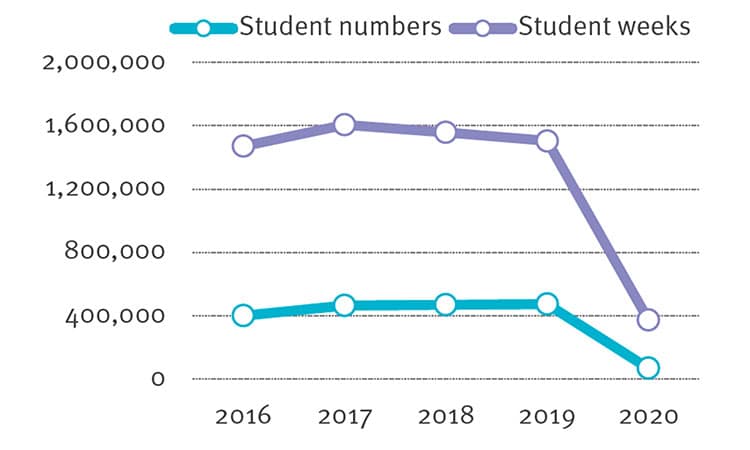

Student weeks were down by 71% and the number of students plummeted by 84% in English language schools in the UK in 2020, according to the latest data from BONARD for English UK. These figures are even more worrying than the ones included in an earlier analysis, and some schools have not been able to endure the downturn from the pandemic. English UK notes,

“As a result of Covid-19, at least 32 ELT member centres closed, a figure which translates to 8% of the English UK membership in 2019.”

Despite the numbers, Jodie Gray, Chief Executive of English UK, says that the target remains a full recovery by the end of 2022:

“Our ambitious target is to return to 2019 student volumes by the end of 2022, and exceed that in a second phase. We are launching a campaign to deliver clear messages on safety and quality to our key markets – and rigorous, granular statistics and analysis are critical to monitor progress and change direction if necessary.”

In this article we’ll focus on private sector ELT schools as they represent 87% of the association’s membership and account for 83% of all students and 71% of all student weeks.

The junior segment

The junior market has been hit especially hard over the course of the pandemic: students under the age of 18 represent only 23% of the overall ELT student population for 2020. As a point of comparison, younger students made up more than half (54%) of the overall market in 2019. They accounted for only 7% of student weeks last year, compared with 27% in 2019.

Schools move to blended instruction

It has been a turbulent time for many schools moving for the first time to the online mode of instruction. While more than half of students were taught face-to-face, 30% moved to a blended method (face-to-face followed by online or vice versa). One in five students learned totally online, “either within (4%) or outside (10%) the UK.”

As Ms Gray says, the ability of English UK schools to adapt to online delivery so rapidly is admirable:

“[The] numbers of students enrolling on blended courses tell a story of resourcefulness, resilience and innovation: vital cornerstones of rebuilding.”

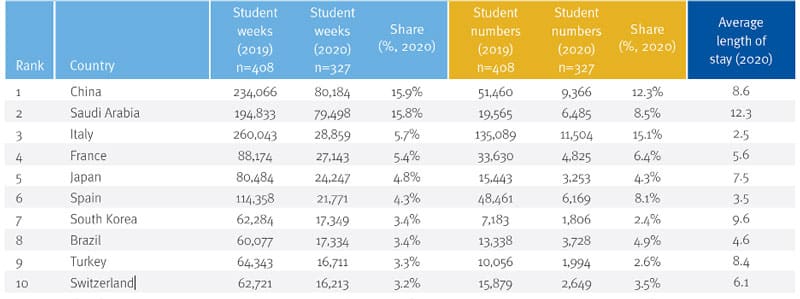

Big drops from major source markets

The following table shows both top sending markets and their contribution during the pandemic compared with 2019. Some of the worst declines came from Italy (82% fewer student weeks) and in general there were far fewer students coming in from Western Europe than normal, which correlates with the steep declines in the junior market. EU juniors typically come to the UK especially in the summer for camps, and that was made almost impossible in last year for most.

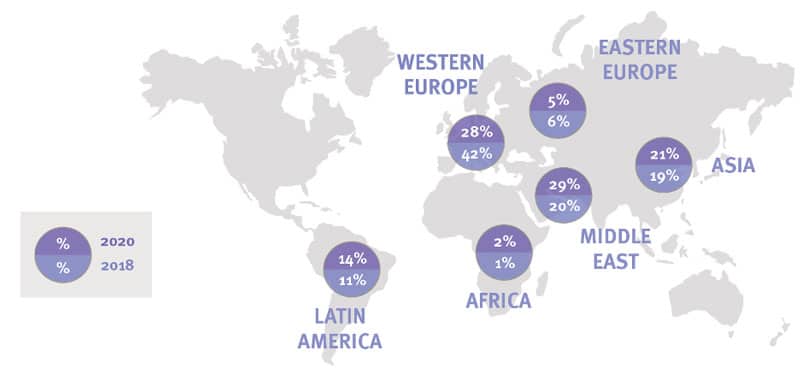

As we see in the following illustration, Western Europe was the region with the largest decline for 2020.

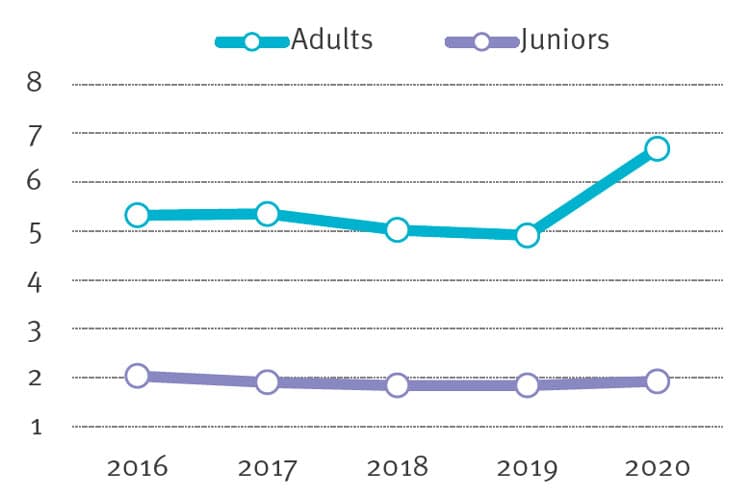

Longer stays

Average stays increased for English-language study in the UK in 2020. English UK notes,

“Except for Colombia and Chile, all top nationalities experienced an increase in the average length of stay between 2019 and 2020. The shorter-stay market was most affected in 2020 as students who were willing to travel opted for longer stays.”

Almost all students who opted for longer stays would have been adults with more flexibility in their year than school-aged students. English UK reports, “In 2020, the length of stay averaged out at 6.7 weeks for adults (up from 4.9 in 2019), and 1.9 weeks for juniors (up from 1.8 in 2019).”

Of the research, Patrik Pavlacic, Head of Research at BONARD, says the findings highlight the need for extraordinary support for the UK’s ELT sector.

“The data contained in this report is important for two main reasons. First, it documents the devastating impact of COVID-19 on the English language teaching sector in the UK and, hence, stresses the importance of cashflow and development schemes to support business operations. Second, it will be key to identifying the most efficient ways of rebuilding a stream of international students opting for the UK as their English study destination.”

For additional background, please see: