Australian border closures cost ELICOS sector AUS$1.2 billion in 2020

- A newly released impact study commissioned by English Australia concludes that the continuing closures of Australia’s borders led to a direct loss of AUS$1.2 billion for the ELICOS sector in 2020.

- Considering the corresponding decline in students who would have otherwise gone on to further study in Australia, the total economic loss is estimated at AUS$2.7 billion for the year.

A newly released impact study commissioned by English Australia concludes that the continuing closures of Australia's borders led to a direct loss of AUS$1.2 billion for the ELICOS sector in 2020.

Prepared by industry research specialist Bonard, Economic Impact of COVID-19 on the ELICOS Sector in Australia also found that enrolment in Australian ELICOS programmes (English Language Intensive Courses for Overseas Students) fell by -47% between 2019 and 2020, both in terms of student numbers and student weeks. Related data from the Australian government indicates that ELICOS commencements are down nearly -62% again this year compared to 2020 (an overall decline of -71% since 2019) and that overall enrolments are down -63% from 2020 to 2021, and -69% overall from 2019 levels.

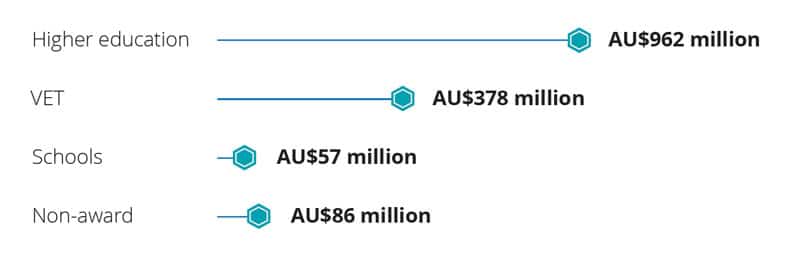

The Bonard study meanwhile, estimates the total impact in terms of lost economic contribution at AUS$2.7 billion for 2020 alone, including the direct loss of AUS$1.2 billion in spending on tuition fees and living costs by ELICOS students, and a further AUS$1.5 billion in lost spending by students who would have otherwise gone on to further study in Australia last year after their language programmes. "According to data from the Department of Education, Skills and Employment (DESE), 47% of ELICOS students enrolled on a student visa progress to another international education sector in Australia," notes the study.

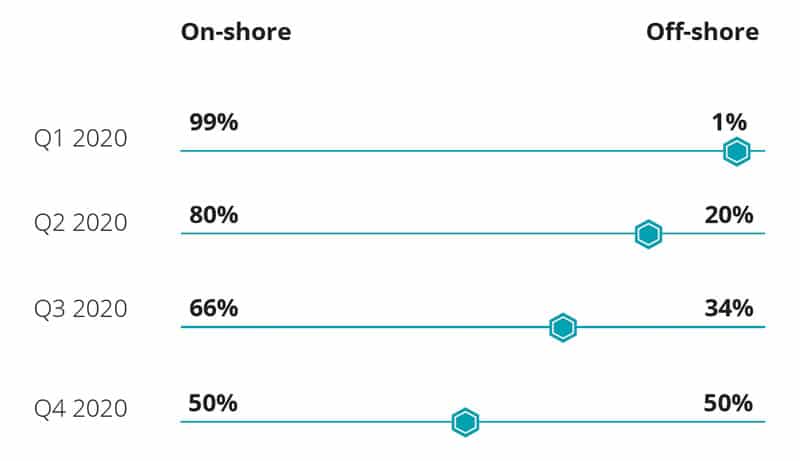

The report also explains that the economic cost would have been even greater had ELICOS providers not shifted quickly to deliver online programmes to offshore students. Before COVID, there were very few students following ELICOS course online. But, as the following chart illustrates, fully half of all enrolled ELICOS students were following their courses remotely by the end of 2020.

Even so, nearly three out of every four employees in the ELICOS sector were impacted by the crisis, and more than a third (35%) lost their jobs in 2020. At the time of the report's publication in August 2021, Bonard estimates that one in five ELICOS providers are still "hibernating" or inactive, adding that, "The number of businesses at risk of ceasing their operations is anticipated to grow as Australia's borders

remain closed."

The report concludes with an appeal to government for additional supports and policy measures targeted on a sector-by-sector basis, and stresses that, "Clear guidance as to when the borders will open is deemed critical for international students, parents and other stakeholders such as education agencies. Without this, recovery will be a difficult road for Australia as industry sentiment points to a growing interest in other English language travel (ELT) destinations such as Canada, the UK, and the USA."

For additional background, please see: