China emerging as a major destination for African students

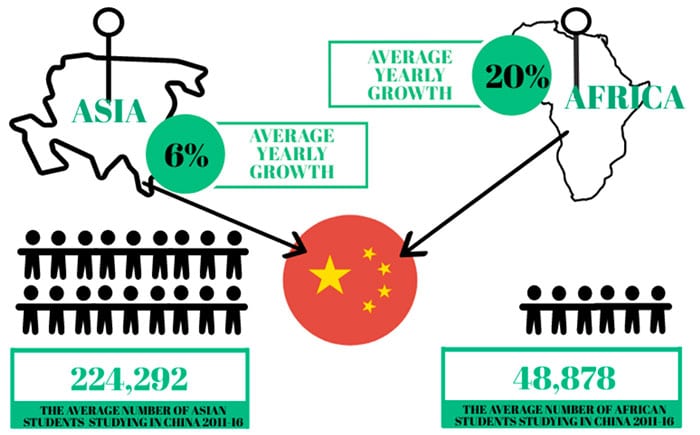

- Asian students remain the most populous in China, but African markets are growing more quickly

- The rate of growth of African students going to China for study abroad grew by 258% between 2011 and 2017, compared with a growth rate of 30% for the US and declines of -2% for France and -24% for the UK

In less than a decade, China has moved from being the least popular study abroad destination for African students to the most popular for a growing number of sending markets, though France remains the preference for Africa’s francophone students.

International development consultancy Development Reimagined used data from China’s Ministry of Foreign Affairs and from the Center for Strategic International Studies in the US “to forecast 2021 [student mobility] trends that would have been occurring if there was no COVID 19.” The consultancy’s analysis covered actual and projected student flows from 24 African markets to China, France, the UK, and the US.

The effect of COVID on international student mobility remains to be seen, of course. Historical growth trends are important but will be balanced by policies, COVID rates, vaccination rollouts, and travel and visa restrictions in source and destination countries, all of which remain exceptionally dynamic in 2021 and will likely be an important influence on longer-term trends as well.

China the fastest-growing destination

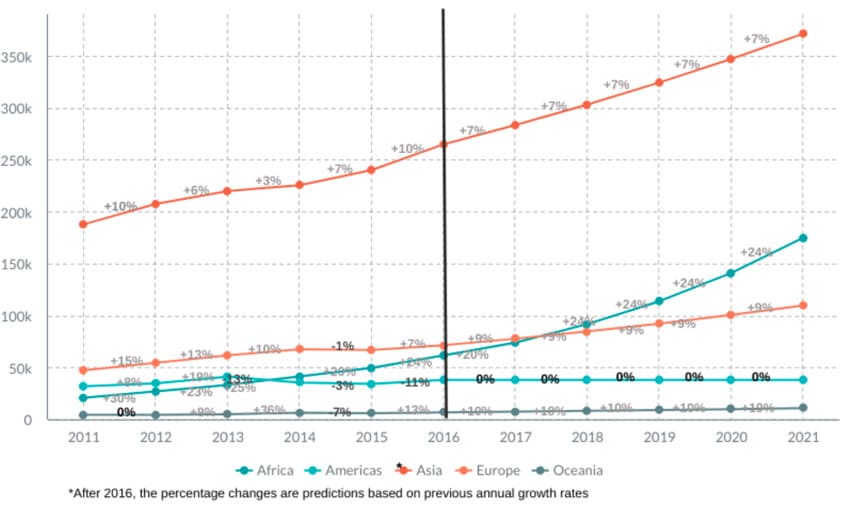

Development Reimagined reports that China hosted 74,011 students from 24 African countries in 2017 thanks to overall growth of 258% from 2011–2017.

By contrast, France hosted 112,217 of these students (i.e., from the 24 African countries) in 2017 – still the largest total enrolment, but one that declined by -2% overall between 2011 and 2017. The US hosted 46,737, an increase of 30%, and the UK hosted 27,775, a decrease of -24%.

While the 30% growth rate in the US seems impressive, it is nothing compared to what’s been happening in China: the number of African students going to China grew at a pace nearly nine times that of the US growth rate between 2011 and 2017.

Asian students are also going to China in record numbers, with proximity a major factor. In absolute terms, and as we see in the graphic below, there were many more Asian than African students in China as of 2017. But even so, African enrolments grew nearly three times faster than enrolments from other Asian markets between 2011 and 2017.

What about 2021?

Based on 2011–2017 trends – and imagining that there was no COVID – Development Reimagined predicts that Asian students will still be the major source of students for China in 2021. However, total student numbers from the top African sending markets are growing quickly and are projected to start closing that gap.

Which are the most important country markets in Africa?

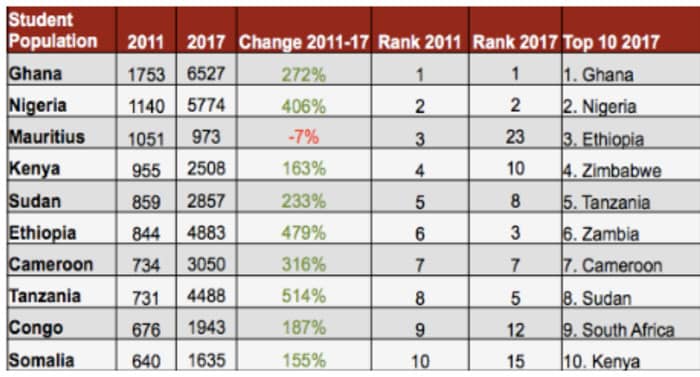

China’s top ten African markets (with the exception of Mauritius) have all been growing rapidly, as illustrated in the table below. Ghana was the #1 market in 2017, but Nigeria and Tanzania were growing the most quickly.

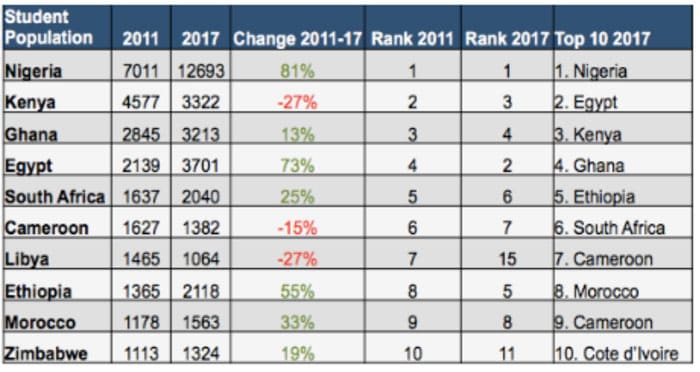

By contrast, as you can see in the following table, many of France’s top African markets were sending fewer students in 2017. Only Morocco and Cote d’Ivoire were still growing at that time, though new, separate data show that Algeria grew by 39% from 2014 to 2019, that Senegal grew by 55% in that time period, and that Tunisia grew by 13%, suggesting that French institutions have intensified their recruiting in these markets in the past couple of years.

France remains the most popular destination for most francophone African students with the exception of Congolese students, who in 2017 began to prefer China.

Meanwhile, US educators had made significant inroads as of 2017 in Nigeria, Egypt, and Ethiopia. They may have been losing Kenyan students to China, however, with a -27% fall-off in this market compared with China’s 163% increase (see China table above). Development Reimagined also found a growing preference for China (over the US) among Ethiopians, Ghanaians, South Africans, and Zimbabweans.

As for the UK, it remains a top destination for South African students but is facing particular pressure when it comes to the important Nigerian market. Development Reimagined notes that Nigerians’ preference for the UK began to wane in 2016 as more Nigerians began to choose the US and China. By the 2017/18 academic year, Carnegie Endowment for Peace data show that the number of Nigerian students in UK universities had fallen to 10,540 – a 41% decrease from 2013/14.

By 2022, China is predicted to host more Nigerians than either the UK or the US.

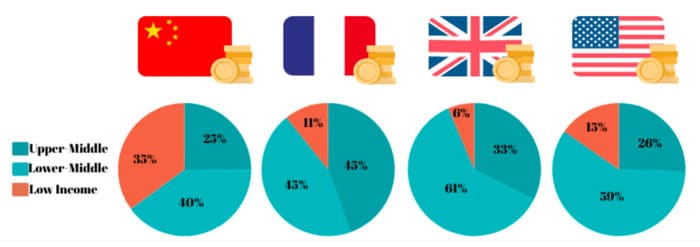

Income factors

Development Reimagined’s analysis finds that China is particularly welcoming to African students from lower-income African countries. France’s large proportion of students from upper-middle income countries is mostly explained by the large numbers of French-speaking African students who come from Algeria and Gabon (upper-middle income countries). Overall, the largest number of internationally mobile students from Africa live in lower-middle income countries.

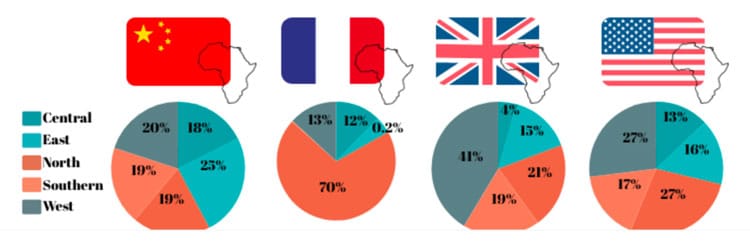

Geographical considerations

As shown in the pie charts below, France has significant market share in North Africa, the region that sends the most African students abroad, and where French is the dominant language. The UK is well established in West Africa. US and Chinese educators, meanwhile, are recruiting from a more diverse set of countries than France or the UK.

Soft power and recruitment

Educators’ ability to recruit students from foreign markets is dependent not only on their programmes, their reputation, and their tuition costs, but also on their governments’ diplomatic ties with other governments. Development Reimagined notes that China’s diplomatic efforts underpin Chinese educators’ recruitment successes in Africa:

“We’ve seen a gradual increase in the number of African government officials and business leaders with exposure and ties to China. Notable examples are Former President of Ethiopia from 2013–2018, Mulatu Teshome Wirtu, who studied at BCLU and Peking University; Joseph Kabila, former President of DRC from 2010–2019 who studied for 6 months at China’s National Defence University; and the former Zimbabwean President Robert Mugabe’s daughter, Bona Mugabe, who graduated from Hong Kong University.

A study by Chinese Professor Li Anshan found that by 2005, 8 former recipients of Chinese Government scholarships were holding ministerial positions in their home countries, 8 were serving as Ambassadors or consuls to China and 6 were working as secretaries or advisors to their president.

This is important because as Africa’s relationship with China becomes more interconnected, it is essential to have Government ministers and civil servants that understand how to work with and ultimately negotiate with China ….

In the future, and again if these trends are able to continue post-COVID, we can expect stronger bridges with China to be built by the rising numbers of future African leaders studying here.”

For additional background, please see: