New report describes shifting Nigerian demand for study abroad

- Nigeria remains one of the most important student sending markets in the world, and its students are increasingly considering a wider array of destinations

- A new report from the Carnegie Endowment for Peace explores why the UK is losing share of Nigerian students to other countries including Canada, and it suggests that scholarships may be an underused element of UK educators’ recruitment strategies

With its large youth demographics and expanding middle class, Nigeria has become one of the most sought-after markets for student recruiters in major destination countries including Australia, Canada, China, Ireland, the US, and the UK. Along with Ghana, Nigeria’s outbound student mobility greatly exceeds that of other African markets. But it is not always the easiest market to recruit from, not the least because of volatility in the country’s economy. Suzanne Rowse, director of the British Boarding Schools Network, offers a concise characterisation of the challenge of recruiting in Nigeria: “It’s a market of extremes, it is either very tough, or buoyant.”

And yet Nigeria remains a promising market with great demand for study abroad from millions of young students who can’t find places in quality higher education institutions in their home country.

The UK’s recently updated International Education Strategy – released in a post-Brexit context in which non-EU markets are ever-more important for British educators – lists Nigeria as a priority recruitment market. But increasingly, the UK will be competing with Canada and other countries for Nigerian students, and the number of Nigerian students in UK schools and universities has been declining over the past several years. A new Carnegie Endowment for Peace report looks into possible reasons for the declining trend, and suggests that affordability should not be overlooked as a driver of demand for study abroad among Nigerian students.

A complex market

Nigeria is attempting to decrease its reliance on oil revenues, but oil still makes up 80% of exports and fluctuations in this sector continue to dominate the overall health of the national economy. Coupled with the effects of the pandemic, Nigeria entered a recession in 2020 but the World Bank expects it to return to marginal growth in 2021.

The Carnegie report notes that outbound student mobility from Nigeria varies “significantly year-to-year depending on macroeconomic trends, monetary policies, the ease and speed of visa application processes, and the availability of post-study residency permits.”

Over the past few years, some Nigerian students have serious challenges in their ability to study abroad. They’ve had to deal with restrictive foreign exchange policies imposed by their government in 2016 and at that time, many scholarship students found themselves unable to access promised funds.

Then, of course, there was (and remains) the pandemic, which has affected Nigerian students’ dreams of studying abroad just as it has interrupted the plans of millions of their peers in other developing countries.

Drive to study abroad is strong

Whatever challenges they face, nearly 100,000 Nigerian students were enrolled abroad in 2020. Where they chose to study – and why – is a significant question for recruiters in countries that command significant share of the Nigerian market. In 2020, we reported that along with popular regional hubs South Africa and Ghana the top destinations were:

- The US, with 15,980 students in early 2019

- Malaysia, with roughly 13,000 in 2019

- Canada, with 11,985 in 2019

- The UK, with 10,540 in 2017/18

The UK is losing share

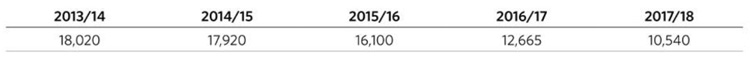

Overall Nigerian enrolment in UK universities has fallen from 18,020 in 2013/14 to 10,540 in 2017/18 – a 41% decrease – and the latest HESA numbers indicate that the trend continued through 2019/20 as well.

Despite those declining numbers, Carnegie notes that Nigeria remains a top source market for the UK, in sixth place after Malaysia, Hong Kong, the United States, India, and China.

However, it is a market from which further declines could pose a significant issue for UK educators – many of which rely significantly on Nigerian post-graduate enrolments – because Nigeria is predicted to be the most important sender of postgraduate students in the world soon. The British Council determined in 2015 that Nigeria’s number of outbound postgraduate students will grow the fastest in the world through 2025, followed by India (with a projected annual average growth of 7.5%), Indonesia (7.2%), Pakistan (6.4%), and Saudi Arabia (5.2%).

Carnegie notes as well that while numerous factors are affecting declining UK enrolments, a noteworthy problem is that few universities are offering scholarships to Nigerian students – unlike universities in Canada and the US (and China, where providing scholarships for African students is a major recruiting strategy).

The foundation goes so far as to say that “broadly speaking, UK universities see Nigerian students – and indeed international students generally – as a revenue centre,” and may not be taking into account the fact that “the decrease may also be a sign that UK universities are no longer affordable for most middle-class Nigerian families.”

Carnegie highlights an exception to the broad trend, however, in Coventry University and others that attract the highest numbers of Nigerian students because they “attract more Nigerian applicants by combining scholarships with effective marketing, tailored course offerings, and competitive fees.”

Affordability is a major draw for Nigerian students and along with a welcoming policy environment, it’s a key reason Canada has now surpassed the UK in its numbers of Nigerians enrolled in Canadian universities. Carnegie elaborates:

“Nigerian families are attracted to [Canadian universities’] more affordable tuition fees as well as the country’s less-onerous visa process and clearer pathways to postgraduate work and residency. In 2020, the Canadian government sought to make the country even more competitive by introducing the Nigeria Student Express scheme, aimed at improving student visa processing times and introducing a specialized system for verifying the financial status of prospective applicants. Nigerian applicants also see Canada as a safer environment for people of colour—one that is less xenophobic than the United States and the United Kingdom and thus a more attractive destination. For these reasons, the number of Nigerian students attending Canadian institutions increased from 2,825 in 2009 to 11,985 in 2019.”

Along with Canada, the US, Ireland, and Australia are all seeing Nigerian student numbers increase in recent years.

UK strategy emphasises diversification

Nigerian student numbers aside, the UK university sector posted enrolment gains in 2020 thanks to students coming from non-EU markets. Non-EU enrolments exceeded 400,000 for the first time ever in 2019/20 to reach 408,825. This represents year-over-year growth of nearly 17% in non-EU numbers and compares to essentially flat volumes of EU students (+.83% year-over-year).

This welcome news comes with a caveat of sorts if we look at the data from a lens of which countries the growth is coming from: China and India were the overwhelming contributors to it. These countries remain incredibly important but educators the world over are increasingly aware that there is no guarantee that these markets will remain stable senders of students. China in particular is likely to send fewer students in the years to come as a result of demographic changes and increasing domestic quality and capacity.

With a growing number of leading destinations competing on the basis of affordability and visa policies, and in a post-Brexit environment where EU enrolments are projected to decline further, the UK’s bid to increase share will be bolstered by its increasingly welcoming posture to international students. And it may well be influenced by the growing reality that international students – including Nigerians – have more affordable, quality options when choosing where to study than ever before.

For additional background, please see: