Global ELT volumes dipped in 2024

- Global ELT enrolments in the top eight English language learning destinations declined in 2024, in large due to more restrictive visa settings and growing concerns around affordability

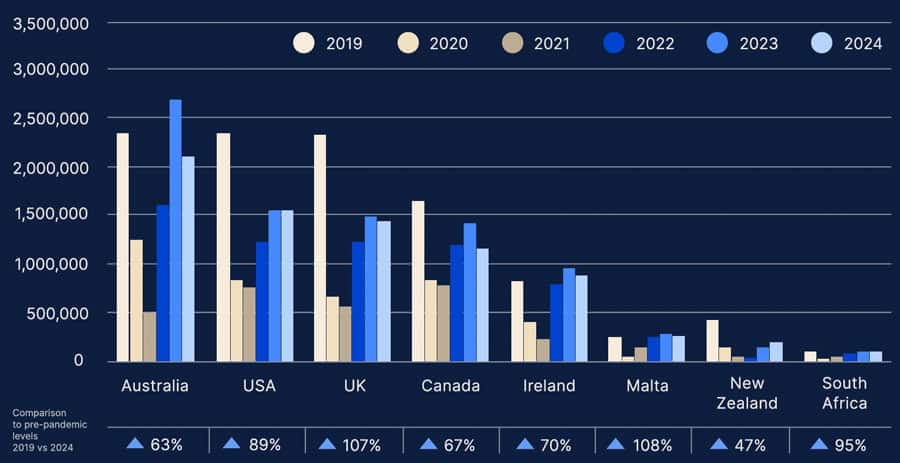

- Of the top eight destinations, only Ireland and Malta are currently trending above pre-pandemic volumes

Globally, the ELT sector gave back some hard-won, post-pandemic gains in 2024. An annual study of eight top English language learning destinations – Australia, Canada, Ireland, Malta, New Zealand, South Africa the UK, and the USA – finds that they collectively hosted one million language learners in 2024 for a total of 7.6 million weeks. This represents, however, a -10% decline in student weeks from 2023 levels, and a 6% drop in enrolments, across those eight destinations.

And it means, says BONARD's Global ELT Annual Report 2025, that the ELT sector was sitting at 73% of its pre-pandemic enrolment, and 75% of 2019's student weeks, for 2024.

As to why, the report points to the same headwinds that are buffeting student flows to major study destinations in 2024 and 2025, but also that students are finding alternative options for language study.

“The data shows two dominant forces reshaping student mobility: visa barriers and affordability,” said Sarah Verkinova, Head of International Education at BONARD Education. “This has pushed many students to explore alternative destinations such as Dubai and the Philippines, which together attracted more than 100,000 ELT learners in 2024.” Among the top eight destinations represented in the report, only Ireland and Malta are trending above their respective pre-COVID benchmarks. BONARD attributes that progress to Ireland and Malta's visa-friendly policies and work rights for language learners that helped, "attract students discouraged by stricter regulations, high course fees, and other expenses in other destinations."

The report adds that, while ELT volumes in the UK declined in 2024, the United Kingdom remains the most popular destination for English language study, with an estimated 38% market share. Part of that strength arises from the UK's dominant position in the junior market. Junior students accounted for 62% of total ELT enrolments in the UK in 2024, the most of any of the top eight destinations. Ireland and Malta – again, the only two destinations to reach above pre-pandemic levels in 2024 – also hosted significant numbers of junior students last year (55% and 50% of ELT enrolments respectively).

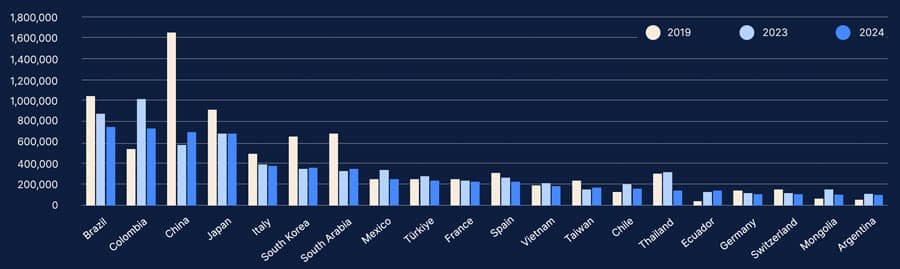

Softening source markets

The top ten sending markets for ELT accounted for nearly two-thirds (63%) of all student weeks in 2024. Brazil moved past Colombia to become the largest ELT market during the year. With the exception of Colombia, all of the top five senders have declined from pre-pandemic levels.

The outlook for this year

"In 2025, government interventions and economic conditions will continue to shape global ELT trends," says the report. "Policy shifts, visa regulations, and financial pressures are expected to influence both student decision-making and destination performance.

"Junior student mobility to the traditional 'Big Four' countries is projected to decline further. Concerns around safety and perceptions of a less welcoming environment are discouraging parents and students from choosing these study destinations…In summary, 2025 is likely to bring another year of decline for the eight major ELT study destinations. The same combination of factors will continue to weigh on the sector: immigration and visa policies in several countries, persistent visa and affordability barriers, and significant share of international students, particularly from China, choosing not to travel."

For additional background, please see: