How diverse is the international student population in leading study abroad destinations?

- We explore data showing how diversified the foreign enrolment was in Australia, Canada, the UK, and the US in 2023 versus 2019

- The analysis covers Top 2, Top 5, and Top 10 student source countries

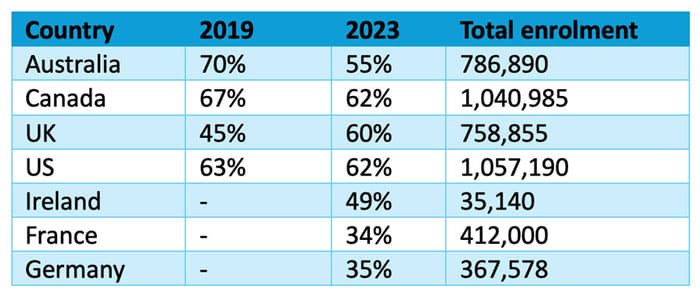

The last time we looked in on the distribution of nationalities in four top study destinations, we reported that in 2019 – i.e., just before the pandemic – Australia (70%) and Canada (67%) were the most reliant on their Top 5 student source countries, the UK was the least (45%), and the US (63%) held the middle ground.

What has happened in the years since? How do other destinations compare? We look at recent foreign enrolment figures to find out.

Australia: Top 5 markets in 2023

- China: 166,420

- India: 126,490

- Nepal: 62,380

- Colombia: 39,725

- Philippines: 35,590

Of the 786,890 international students enrolled across education sectors in Australia in 2023, just over half (55%) were from Top 5 sending countries. This is a marked decrease from Australia’s 70% reliance in 2019. Australian institutions are clearly focusing on expanding recruitment campaigns across a longer list of source markets.

Canada: Top 5 Markets in 2023

- India: 427,085

- China: 101,150

- Philippines: 48,870

- Nigeria: 45,965

- France: 26,980

The total international student population in Canada across sectors in 2023 was 1,040,985. The share of Top 5 sending countries was 62% – down from 67% in 2019. This reflects a strong and much-needed effort among Canadian institutions to diversify, especially beyond India and China.

UK: Top 5 markets in 2022/23

- India: 173,190

- China: 154,260

- Nigeria: 72,355

- Pakistan: 34,690

- US: 22,540

Students from the UK’s Top 5 sending markets accounted for 60% of the 758,855 international students enrolled in UK universities in 2022/23 – up significantly from 45% in 2019. Some of this increased concentration is attributable to a surge in students from India and Nigeria applying to and enrolling in UK universities.

US: Top 5 markets in 2023

- China: 289,525

- India: 268,925

- South Korea: 43,845

- Canada: 27,875

- Vietnam: 21,900

There were 1,057,190 international students in US colleges and universities in 2022/23. Students from the Top 5 sending markets accounted for 62% of the total international student population – essentially stable since 2019 (63%).

Other destinations are less dependent on the Top 5

As you can see in the table below, less than half of foreign students in higher education in Ireland, France, and Germany are from those destinations’ Top 5 markets. In France and Germany, the Top 5 markets represent only 34% and 35%, respectively, of all international students.

About 7 in 10 students in the “Big Four” are from Top 10 markets

Drilling further into the data, we see more consistency across Australia, Canada, the UK, and the US regarding the proportion of students from Top 10 markets. In this exercise, the UK emerges as the least reliant on Top 10 countries (68%) based on 2022/23 data, but only by a small margin. In Canada, 72% of international students were from the Top 10 sending countries in 2023, while in the US and Australia, the proportions were 70% and 71% in 2023, respectively.

And what of China and India?

Chinese and Indian students are integral to the viability of international education sectors across leading destinations. In 2023, more than half of international students in Canada and the US were from India or China, and Canada is particularly reliant on Indian students (41%).

- Australia: China (21%) + India (16%) = 37%

- Canada: India (41%) + China (10%) = 51%

- UK: India (23%) + China (20%) = 43%

- US: China (27%) + India (25%) = 52%

Diversification under pressure

The most recent international education strategies published by the Australian and Canadian governments identify diversification of student source markets as a top goal. As the data profiled in this article show, Australian and Canadian institutions made significant progress from 2019 to 2023 towards that goal, supported by welcoming immigration policies.

Time will tell whether educators in those countries, as well as the UK, can continue to distribute their foreign enrolment across an expanded list of countries given new rules affecting their recruitment activities.

Earlier this year, it became clear that some Australian institutions were adjusting their recruitment targets because:

- Certain student source countries are associated with a high rate of visa refusal.

- Institutions face penalties if they extend too many offers of admission to students who are then deemed to be unsuitable by immigration officials.

Several Australian institutions rescinded offers of admission to students they believed would be refused a visa, while others limited the list of countries from which students could apply.

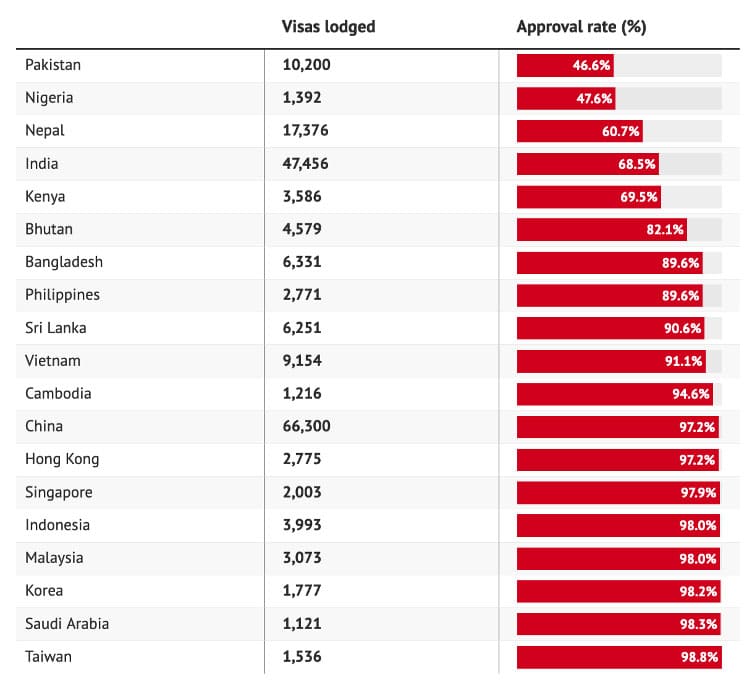

In 2024, some of the emerging markets that contributed the most to diversity in Australia and Canada (e.g., Nigeria, Nepal, Pakistan) are the ones most challenged by new rules in 2024. For example, the following screen shot from the Sydney Morning Herald shows that countries experiencing the lowest visa approval rates up till April 2024 include Pakistan, India, and Nepal – all Top 10 markets for Australian educators.

In Canada, the average study permit approval rate for international students fell from 55% in 2022 to 50% between January and April 2024. It dropped to 32% for Ghanaian students (12 percentage points lower than in 2023) and to 16% for Nigerian students (16 percentage points lower). Still, University World News reports that IRCC data for the first half of 2024 indicate that:

“Students from Ghana will be the largest contingent after India: 3,329 study permits have already been issued. Students from Nigeria will likely be the second largest contingent after India as 3,028 permits have already been issued. Chinese students will likely make up the third largest contingent after India while the students from the Philippines are likely to be the fourth largest contingent.”

If this prediction holds true, this could lead to a significant reshaping of Canada’s international student population. In 2023, for example, Ghana was Canada’s 20th top student source country.

For additional background, please see:

- Join the ICEF Monitor Global Summit (23 September 2024, London). A landmark one-day summit bringing together the industry's senior leaders, policy makers, and experts, all focused on shaping the future of the international education sector.

- “Recent policy changes slowing student interest in the UK, Canada, and Australia”

- “What is the cost of policy intended to reduce international student flows?”