Recent policy changes slowing student interest in the UK, Canada, and Australia

- Research continues to indicate that immigration policy changes in the UK, Canada, and Australia are slowing international student demand for these destinations

- Meanwhile, the US, Germany, Italy, and Austria are attracting growing interest from prospective students

Studyportals has shared new research on LinkedIn showing that many prospective international students are setting their sights on destinations other than Australia, Canada, and the UK due to immigration policies in those countries that make it less possible and/or attractive to study there.

The Studyportals research appears in an article entitled “Winners & Losers: An update on how domestic policies in the UK, Canada, and Australia have impacted student search behaviour,” and it is based on surveys that aggregate weekly pageview data across all Studyportals websites throughout 2024. This data highlights how several destinations are faring in terms of student interest since the policy changes took effect in Australia, Canada, and the UK.

The article drills down to regional-level data for each destination and looks at student demand by country of origin, offering real-time insights into how students in key markets are responding to policy changes.

Trendlines paint a vivid picture

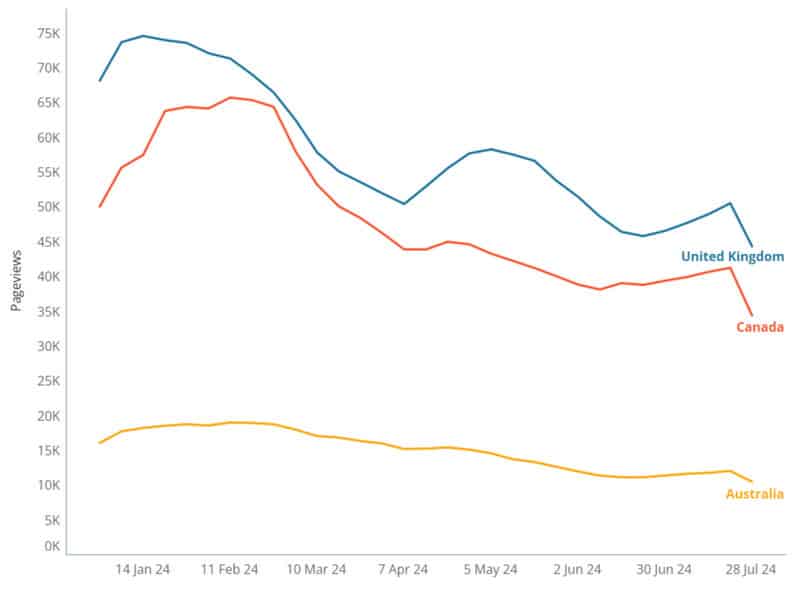

According to the research, demand from prospective students for on-campus bachelor or master programmes offered in Canada and the UK was rising in January 2024, but then began to nosedive in February, especially for Canada. Declines accelerated in March 2024 then stabilised briefly, but the overall trend over February-July 2024 was downward.

Australia’s popularity over this period was much lower than the UK’s or Canada’s, but the trendline was less jagged. As the figure below illustrates, compared to the first week of 2024, the UK, Australia, and Canada respectively saw drops of 25.8%, 25.1%, and 17.6% by 21 July 2024.

Will students reconsider the UK given the new Labour government?

While the graphic illustrates a marked loss of student interest in these destinations over the year, the article also notes that the UK has experienced a very recent uptick in demand, which Studyportals suggests may be due to optimism over the result of the UK elections.

The previous administration, under Rishi Sunak, was responsible for the removal of most dependants’ rights to accompany international students to the UK. Mr Sunak also actively contemplated a restriction of the Graduate Route, which provides two-to-three years of work rights for international students. There is now hope among international education stakeholders in the UK and overseas students that the new Labour administration may adopt a less restrictive stance. Speaking with Indian Express, Professor Manuel Barcia, Dean of Global Engagement, University of Leeds, said that:

“Based on the signals made by the incoming government prior to the election, we can reasonably speculate that the new government will work closely with universities in an effort to rectify years of neglect under previous administrations. The new Education Secretary, Bridget Phillipson, is already on record saying this much.”

Regional insights

The year-over-year change in international student demand also reveals key findings at the regional level for each destination. In the UK, institutions based in England saw only a slight decline in student demand in the past 12 months (July 2023 to June 2024) compared to the previous 12 months (July 2022 to June 2023). Meanwhile, institutions in Scotland and Wales saw pageview increases during the same period.

Elsewhere, key subnational regions in Canada and Australia registered significant drops in the volume of international students checking them out on Studyportals. In Canada, the provinces of Saskatchewan, British Columbia, and Quebec each experienced large declines, while the states of South Australia, Western Australian, and Victoria also attracted less interest. Only Alberta in Canada and New South Wales and the Northern Territory in Australia saw any significant uptick in pageviews.

Shifting demand by origin country

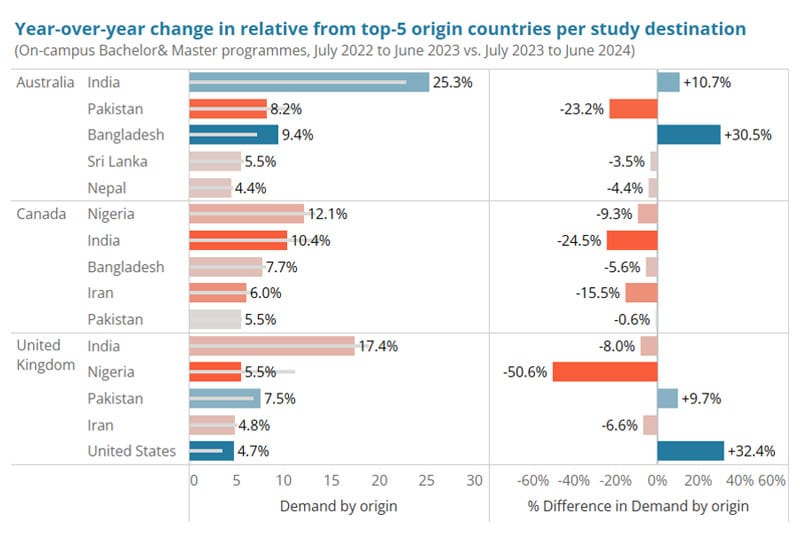

Look closely at the data, and you’ll see variations in how demand for the UK, Canada, and Australia has shifted by source country. Canadian institutions, for example, are coping with a consistent decline in demand from top-five student markets, most notably from India (-24.5%) and Iran (-15.5%).

The story is similar for the UK, though the data offers a couple of bright spots. Nigerian demand has dropped significantly, falling by about half. At the same time, pageviews are up for the United States (32.4%) and Pakistan (9.7%).

In Australia, institutions are seeing less interest than last year from students in Pakistan and (less dramatically) from students in Sri Lanka and Nepal. On the other hand, there has been a surge in demand from Bangladesh (30.5%) and to a lesser extent, India (10.7%).

Students are exploring other destinations

As increasing numbers of prospective students turn away from Australia, Canada, and the UK, which destinations are gaining share of interest?

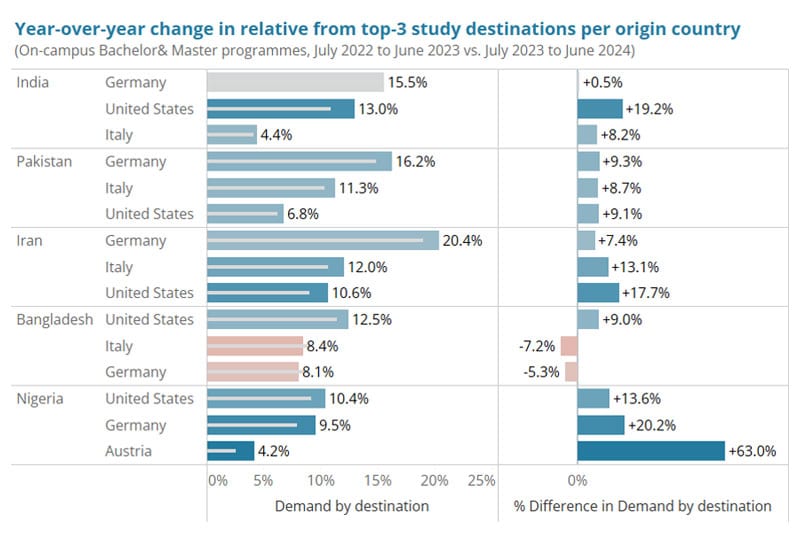

The data reveals a few interesting trends. On-campus bachelor and master’s US programmes attracted an increasing volume of pageviews from each origin country in the past 12 months. In Europe, Italy and Germany are gaining traction, as the figure below makes clear.

It is important, however, to look at the granular data when considering trendlines. While Bangladeshi students also consider Italy and Germany, the data notes a drop in pageviews over the past 12 months compared to the previous 12 months. The United States saw a notable rise in demand from Indian students. In the case of Nigeria, Austrian institutions offer an appealing European alternative. Germany and the United States also saw increased interest from Nigerian students during this period.

Key takeaways

The Studyportals data suggests that immigration policies in Australia, Canada, and the UK are reshaping international student mobility in 2024 and leading into 2025. The UK may be in the midst of a modest recovery in student demand due to recent political changes, but that’s not the story in Canada and Australia, as both countries continue to experience pronounced declines in popularity.

At the same time, the US – and European countries such as Italy and Germany – have emerged as fresh alternatives for students from key markets in South Asia, Iran, and Nigeria.

A significant reduction in Nigerian and Indian students choosing Canada or the UK will be difficult for many institutions in those countries to adjust to. Consider that:

- Indian students composed more than 40% of Canada’s international student population in 2023, and Nigerian students accounted for 5%. If we add Iran (2%) – another declining market for Canada according to the Studyportals data – those three countries represented almost half of Canada’s international student population in 2023.

- Indian students made up 23% of all international students in the UK in 2022/23, and Nigerian students were 10% of the total. This means that a third of students in UK universities were either Nigerian or Indian in the 2022/23 academic year.

Canadian institutions may be particularly worried given that (1) they are more heavily reliant than UK universities on India and (2) demand from other top markets is also falling. The UK is at least seeing increases over 2024 from the US and Pakistan, its 4th and 5th largest student markets.

Overall, the research makes it abundantly clear that policy changes can quickly erode a destination’s competitive edge, and it suggests that students quickly respond by researching alternative destinations with more welcoming policies.

For additional background, please see:

- “UK reports record foreign enrolment for 2022/23”

- “ICEF Podcast: Europe’s unique and diverse array of attractive study destinations”

- “Pulse survey indicates early impact of new financial requirements for Australia study visas”

- “International students contributed 31 billion to Canadian economy in 2022”

Most Recent

-

US: Student visa issuances fell by -36% in summer 2025; OPT uncertainty among factors affecting international student demand Read More

-

Canada and India deepen educational ties; India repositions as an equal player in international education Read More

-

Inbound, outbound, and transnational: the landscape for international education in China continues to evolve Read More