Demand for study abroad rising in China but students considering more destinations in 2024

- China’s border opened in 2023 after two years of COVID-related closure, and pent-up demand among Chinese families for study abroad seems to be spiking, fuelled in part by concerns over a slowing economy at home

- Asian and European destinations are picking up market share

- There are some positive signs for the Big 4 English-speaking destinations as well

The shape of Chinese outbound student mobility has been changing for years and is different again in 2024.

Over the past decade, the number of Chinese students studying abroad ballooned as more families moved into the middle class and could pay for foreign education. But as the Chinese economy reached new heights and as China moved into superpower status, Chinese students became more interested in staying home for higher education. A rapidly rising number of top-ranked Chinese universities and multinational employers was compelling – and especially helpful as the pandemic took hold and China closed its borders for two years. The border closure further diminished the flow of Chinese students abroad.

When the border opened in 2023, Chinese families began to send their children outside of the country again – but not always to traditionally preferred destinations of Australia, Canada, the UK, and the US. As we reported last year, Asian destinations such as Thailand saw significant increases in Chinese enrolments. Chinese parents became more focused on affordability as their economy stuttered to start again and more interested in having their children studying within the region. This intra-regional trend contributed to the challenges many admissions officers and student recruiters the US, Canada, and Australia faced last year in China.

One month or so into 2024, it looks like Chinese outbound is rising again – though perhaps not to pre-pandemic levels. Many agents and Chinese international education experts are noticing more demand from and potential in the Chinese market. They believe this is prompted in part by China’s troubled economy: exports are down, the youth unemployment rate is high, and real estate values are plummeting (causing a cash flow crisis for many households – as many as 7 in 10 Chinese families have lodged most of their assets in property). Anecdotal evidence and surveys suggest that Chinese students are:

- Growing more open to study abroad as they consider it a better option than attempting to break through bleak job prospects in China.

- Newly interested in the competitive edge a foreign degree could represent in a tight job market.

Affordability is a priority for many Chinese students and post-study work opportunities are also more compelling than in the past. David Weeks, co-founder and chief operating officer of the Beijing student recruitment firm Sunrise International, said in a November 2023 webinar:

“You can expect a bit of a reversal from this old idea that Chinese families are not price sensitive. Increasingly, you'll see that Chinese families will take a more balanced view of the quality of education, but also the value of that investment.”

Demand is up, but the market is more complex than ever

Mr Weeks believes that Chinese outbound will pick up this year. Sunshine International conducted surveys in 2023 of roughly 2,000 students and found that there was “a radical drop off in students delaying study overseas plans,” as reported in University World News. “The proportion of students who originally planned to stay inside China for university and instead pivot to study overseas, went up from 3% in 2021 to 15% in 2023.” You can read our 2023 article on for more evidence of this trend here.

Tapping into refreshed Chinese demand for study abroad will require a well-considered strategy, however. The market is more complex, and more destinations and institutions are competing in it. Many Chinese students remain interested in staying within Asia and others are as likely to choose Europe as North America, the UK, and Australia.

In addition, Chinese students are applying to many more institutions than in the past. The China Institute of College Admission Counseling agency conducted a survey last year of students in 144 high schools showing that less than a third of students applied to institutions in one country for the 2024 academic year, compared to 37% applying to two and 24% applying to three.

The appeal of Europe

We speak often of diversification as this applies to institutions broadening the nationalities they enrol in their programmes. But from the viewpoint of a student, diversification can mean widening their consideration set when it comes to destinations, institutions, and programmes. It appears that Chinese students are indeed diversifying their pool of study abroad options.

As reported in the South China Morning Post (SCMP), European countries such as Germany, Spain, Netherlands, and Ireland are becoming hot spots for Chinese students looking at study abroad.

A counsellor responsible for European programmes at a “well-known agency in China” (who asked SCMP to keep her name out of the article given that she had not been authorised to speak to the press), said:

“We have not yet finalised the statistics for 2023 of how many students went to European countries … But our preliminary estimate is that it will definitely exceed pre-pandemic levels – the peak in 2019. We attended an event organised by the Irish Department of Education this year, and the figures we obtained were that Ireland had issued over 1,000 more visas to Chinese students than before the pandemic.”

The SCMP article provides examples of accomplished Chinese graduates of German and French universities, and notes that Germany is popular for its reputation as a scientific and technologically advanced culture – not to mention no-to-low tuition and fees.

While there has been attrition in Chinese enrolment numbers in Australia, Canada, and the US just before and during the pandemic, the following European countries held onto – or increased – their Chinese numbers.

- Netherlands: 5,610 in 2022/23, (+6% from 2021/22)

- Spain: 12,525 in 2021/22 (+6% from 2019/20)

- Ireland: 5,110 in 2022 (+11% from 2021 and 7% from 2019)

France lost a bit of traction in China, with 25,600 enrolments 2022/23, down from 27,470 the year before.

Chinese outbound trends: Australia, Canada, UK, US

While Europe and Asia are becoming compelling destinations for more Chinese families, the Big 4 English-language destinations enrol the lion’s share of Chinese students abroad. Here’s what has happened in these destinations since China’s border opened in 2023:

- Canada has reported study permit data for almost all of 2023 and Chinese enrolments moved from 51,750 (whole of 2022) to 55,280 (up to November 2023), a 7% increase. The peak for Canada was 2019, when 84,155 Chinese students attended Canadian education institutions (34% higher than the number in 2023).

- The United States hosted 289,525 Chinese students in 2022/23 (-0.2% over 2021/22 but much better than the -8.6% decline recorded the previous year). Still, the 2022/23 total is 29% off the peak of 372,530 in 2019/20.

- The United Kingdom is the outlier of the Big 4: it has held on to its Chinese enrolments in recent years. There were 151,690 Chinese in UK universities in 2021/22, up from 143,820 in 2020/21, and up 42% from 2017/18. However, UCAS data suggests that this trend may be coming to an end; it recorded 4% fewer Chinese applications in 2023 than in 2022.

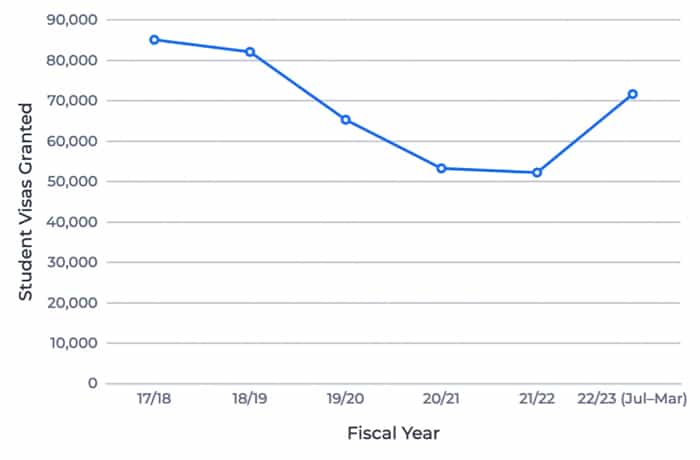

- Australia saw a 4% increase in Chinese student numbers from 2022 to the end of Q3 2023 (156,215 to 162,825 from January-October 2023), and ApplyBoard notes that “fiscal year 2022/23 set a record for the number of applications lodged for Chinese students during the months of January to March” – as depicted in the following chart. Fiscal year 2022/23 is “the first full year unaffected by Australia’s closed-border response to the pandemic since 2018/19.” The peak for Australia was 211,995 Chinese students in the country in 2019.

For additional information, please see: