“Steady recovery” underway for US English language training sector but visa issues persist

- A benchmark survey of the English-language programme sector in the US shows that recovery is underway but that a high rate of visa refusals is a significant challenge

- Top sending markets for US ELPs include Japan, France, China, Colombia, and Brazil, and enrolments are predominantly adult learners

- An estimated US$1 billion flows into the US economy from ELP students’ direct spending

A new study by EnglishUSA and BONARD based on a survey of 289 English language programme providers (ELPs) provides a comprehensive look at the state of the English-language training sector in the US.

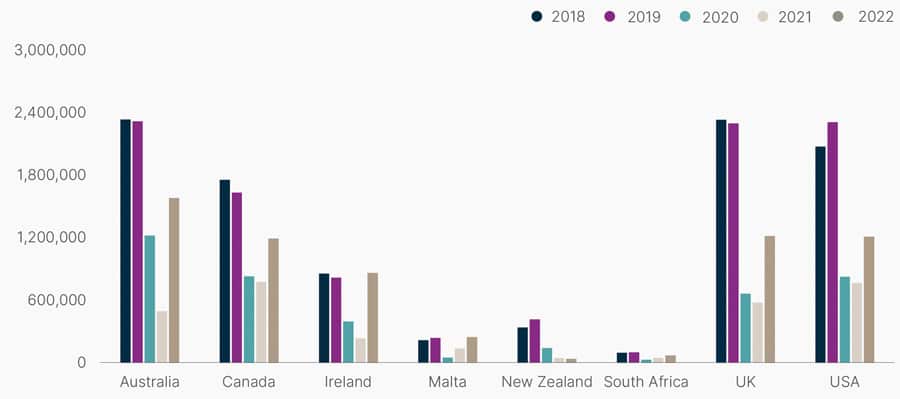

The US is now the third-largest destination for English-language study, in terms of numbers of students hosted, after Australia and the UK. As we see in the chart below, the total volume of ELP student weeks in the US was comparable to that of the UK and Canada, but still lagging behind the global leader, Australia. The reports adds, "According to the global data for 2022, it is evident that the majority of destinations saw a consistent resumption of student mobility. The global ELP sector recovered 65-70% of its 2019 levels."

The 2022 Annual Report on English Language Programs in the USA is the first of its kind and is intended to be a benchmark against which future iterations of the survey can be compared. It will complement the data collected by other established sources, such as IIE’s Open Doors surveys and SEVIS by the Numbers reports, by drilling down into enrolment details such as age groups, student sources, course types, visa types, and more.

There was robust participation in the EnglishUSA/BONARD study among US ELPs that have been clamouring for more specific data with which to understand their audience and refine their recruitment strategies. Most respondents (61%) were EnglishUSA members. Overall, EnglishUSA says there were 750 active ELPs operating in the country at the time of the survey.

Cheryl Delk-Le Good, EnglishUSA’s executive director, says that a steady recovery of ELP enrolments is underway, but that the pace of recovery is not consistent across the country – and is constrained to some degree by a high rate of visa refusals for English-language students applying to the US relative to those applying to other types of programmes.

The survey also highlights the huge contribution of the ELP sector to the US economy: an estimated US$1 billion, of which US$800 million is accounted for by the business of the 289 survey participants. On average, students spend US$1,060 per week on tuition and other expenditures and US$10,695 for their entire stay in the US.

The findings

The 289 responding programmes enrolled 70,580 students in 2022. Those students collectively studied for over 714,000 student weeks, with an average stay of 10.1 weeks. Most students in US ELPs are adults (84%), with the junior segment responsible for just 16% of enrolments. This is not surprising given the distance that students from the top three markets – Japan, France, and China – are travelling to attend US ELPs. The top five sending markets for 2022 are as follows:

- Japan (8,695 students)

- France (6,070 students)

- China (4,885 students)

- Colombia (4,020 students)

- Brazil (3,885 students)

Students are much more likely to book their programmes directly with an ELP (45%) than any other way, though agents send a significant proportion of students as well (25%). Fewer are likely to enrol on the basis of word of mouth (12%) or institutional agreements (10%).

Ms Delk-Le Good considers the agent channel to be “still underused and misunderstood in the US” and says “EnglishUSA is working on changing this perspective [to encourage] working with all types of partners.”

Visa issues persist

While visa processing times are improving and visa approvals are up over 2019, Ms Delk-Le Good said what “cannot be ignored is the high rate of denials to applicants applying for an English language programme.”

Most ELP students chose the F-1 visa route (62%). The next largest group was those who for various reasons did not need a visa (25%). Only 6% used the B-1 route.

Student visa denials were far and away the most cited challenge by survey respondents (67%), followed by “the lingering effects of COVID-19” (50%), and visa processing times (also 50%).

Ms Delk-Le Good echoed respondents’ frustration about high visa rejection rates, noting the role that the ELP sector plays in the overall international education industry in the US. The health of the sector – in the US and elsewhere – has a direct bearing on college and university enrolments given that it is often the first type of programme international students enrol in before going on to study at other levels. In a follow-up comment to ICEF Monitor, Ms Delk-Le Good added:

“Since the time of the data collection period, visa processing times have improved overall and members have not reported long visa appointment wait times for their students. Although there are still anecdotes of lower priority being given for English language students when requesting an expedited visa appointment.

[In addition,] members continue to report F-1 visa denials for bona fide students with strong credentials and there are still some countries for which our members report having higher numbers of denials than what should be considered typical.

EnglishUSA will continue to advocate to the Department of State Consular Affairs officers that attendance at English language programmes is not in itself a reason for refusing a student visa application. F-1-approved schools should be treated as equal.

The economic impact of our sector may appear small within international education as a whole, but our government leaders need to acknowledge that English language programmes are all accredited and meet the requirements for F-1 visa approval. Schools in turn follow the SEVP procedures and vet candidates to the best of their ability before issuing the F-1. There is no reason these students should be treated as any less serious about their studies or that these schools should be treated as any less rigorous.”

For additional background, please see: