Despite rising rejection rates, US student visa issuances now exceed pre-COVID levels

- The number of F-1 study visas issued by the US last year exceeded the total number of F-1s in 2019

- India is driving overall growth along with several other key Asian markets and there is strong growth from Europe, Africa, and Latin America as well

- The strong performance comes in spite of rising rejection rates for F-1 applicants

- The US denied 35% of all F-1 applications in 2022, and more than half of all applicants from Africa in particular

The US State Department is reporting that the total number of F-1 student visas issued in fiscal year 2022 reached both a record high and surpassed pre-pandemic levels for the first time.

The US issued a total of 411,131 F-1 visas in FY2022. This represents a nearly 15% year-over-year increase from FY2021, and a roughly 13% gain over the FY2019 total.

The US government's fiscal year runs from 1 October to 30 September, and the State Department is reporting that for year-to-date FY2023, as of 1 August, more than 393,000 F-1 visas have been issued. In other words, for the first ten months of the current fiscal year, the US has nearly exceeded the total F-1 volume from the previous year.

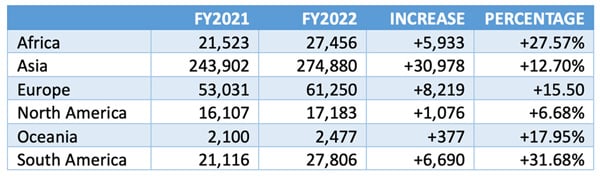

As we see in the following table, just over two-thirds of those visas were issued to students from Asia; that region continues to pace overall growth in foreign enrolment in the US.

Much of the overall increase from Africa was powered by Ghana (3,331 visas issued in FY2022, +94% year-over-year) and Nigeria (7,547 visas; +20%).

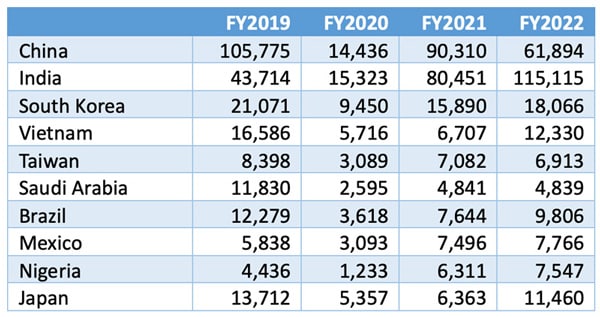

India is the major growth story overall and the leading market for Asia as well (115,115 visas issued in FY2022; +43% year-over-year). Other notable gainers among Asian markets include Bangladesh (7,754 visas; +86%); Japan (11,460 visas; +80%); Nepal (6,175 visas; +92%); and Vietnam (12,330 visas; +84%). Those gains from other regional markets helped to offset a notable decline in visas issued to Chinese students, where total volumes fell sharply from 90,310 in 2021 to 61,894 last year (-31%).

Led by France and Germany, European markets mainly saw more modest increases across the board that helped to boost the total number of F-1s issued to students from the region in FY2022. Meanwhile, Brazil (9,806 F-1s issued; +28%) and Colombia (7,038; +58%) were the big drivers of Latin American growth last year.

The additional table below provides a closer look at recent-year patterns for the top ten sending markets for the US, as reported by the Institute of International Education's (IIE) Open Doors survey. We again see a steady decline in visas issued to Chinese students from FY2019 onward, set against an even greater increase in inbound Indian students. Most other top ten senders are approaching – or have already reached – pre-pandemic F-1 visa levels.

The other 35%

That strong growth into 2023 comes amid reports of rising rejection rates for F-1 applicants. As we reported recently, the US State Department rejected roughly 35% of all F-1 applications in FY2022.

US visa data also reveals significant variations in rejection rates by global region. More than half (54%) of African students were denied F-1 visas in 2022, compared with a 9% rejection rate for European students. Asian students fared better than African students, but the 36% visa rejection rate they have encountered is still much higher than the rejection rate for European students.

For additional background, please see:

- ICEF Miami, December 2023: Get the latest on US market trends through a comprehensive seminar programme and partner with pre-screened student recruitment agents from across the world

- "More than half of African applicants fail to get a visa to study in Canada or the US"

- "US reports a significant spike in student visa refusals for 2022"

Most Recent

-

British Council says student recruitment to UK higher education will get a boost this year from South Asia and the “Trump effect” Read More

-

New Zealand expands post-study work opportunities for international students Read More

-

As Iran retaliates across the Middle East, schools close, students worry, and institutions reassess transnational education Read More